Get the free OREGON ADMINISTRATIVE RULE PUBLIC EMPLOYEES RETIREMENT BOARD CHAPTER 459 DIVISION 05...

Show details

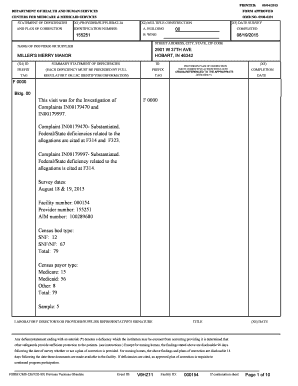

This document outlines the rules and regulations governing the deferred compensation loan program for public employees, including loan eligibility, application processes, repayment terms, and tax

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign oregon administrative rule public

Edit your oregon administrative rule public form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your oregon administrative rule public form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing oregon administrative rule public online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit oregon administrative rule public. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out oregon administrative rule public

How to fill out OREGON ADMINISTRATIVE RULE PUBLIC EMPLOYEES RETIREMENT BOARD CHAPTER 459 DIVISION 050 – DEFERRED COMPENSATION

01

Obtain the OREGON ADMINISTRATIVE RULE PUBLIC EMPLOYEES RETIREMENT BOARD CHAPTER 459 DIVISION 050 – DEFERRED COMPENSATION document.

02

Review the eligibility criteria outlined in the document to ensure compliance.

03

Complete the necessary application form included in the document.

04

Provide all required personal information, including Social Security number, employment details, and contact information.

05

Select your desired deferral amount and investment options as per your financial plans.

06

Submit the completed application form along with any additional required documentation to the appropriate administrative office.

07

Keep a copy of your submission for your records.

08

Confirm receipt of your application and check the status of your deferred compensation plan.

09

Monitor your account regularly and make adjustments as needed according to your retirement goals.

Who needs OREGON ADMINISTRATIVE RULE PUBLIC EMPLOYEES RETIREMENT BOARD CHAPTER 459 DIVISION 050 – DEFERRED COMPENSATION?

01

Public employees in Oregon who are looking to save for retirement through deferred compensation plans.

02

Employees seeking tax-deferred benefits to enhance their retirement savings.

03

Individuals who want to take advantage of employer-sponsored retirement savings plans.

Fill

form

: Try Risk Free

People Also Ask about

What is vested deferred compensation?

“Vesting” in a retirement plan means ownership. This means that each employee will vest, or own, a certain percentage of their account in the plan each year. An employee who is 100% vested in his or her account balance owns 100% of it and the employer cannot forfeit, or take it back, for any reason.

Is deferred compensation considered retirement?

There are many forms of deferred compensation, including retirement plans, pension plans, and stock-option plans. There are qualified and non-qualified deferred compensation plans.

How is deferred compensation classified?

Deferred compensation can be structured as either qualified or non-qualified under federal regulations. Some deferred compensation is made available only to top employees, such as executives.

What is the downside of deferred compensation?

The Risks Of Deferred Compensation Plans As I mentioned before, most plans do not allow the participant to access the money early. If you switch jobs you might lose the entire account or you might have to take all of the money in a lump sum, which would trigger a big tax bill.

Is deferred compensation the same as retirement?

Deferred compensation plans offer an additional choice for employees in retirement planning and are often used to supplement participation in a 401(k) plan. Deferred compensation is simply a plan in which an employee delays accepting part of their compensation until a specified future date.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is OREGON ADMINISTRATIVE RULE PUBLIC EMPLOYEES RETIREMENT BOARD CHAPTER 459 DIVISION 050 – DEFERRED COMPENSATION?

OREGON ADMINISTRATIVE RULE PUBLIC EMPLOYEES RETIREMENT BOARD CHAPTER 459 DIVISION 050 – DEFERRED COMPENSATION outlines the regulations and guidelines for deferred compensation plans available to public employees in Oregon.

Who is required to file OREGON ADMINISTRATIVE RULE PUBLIC EMPLOYEES RETIREMENT BOARD CHAPTER 459 DIVISION 050 – DEFERRED COMPENSATION?

Public employees who participate in the deferred compensation plans are required to comply with the filings as mandated by Chapter 459 Division 050.

How to fill out OREGON ADMINISTRATIVE RULE PUBLIC EMPLOYEES RETIREMENT BOARD CHAPTER 459 DIVISION 050 – DEFERRED COMPENSATION?

To fill out the document, public employees must provide personal information, participation details in the deferred compensation plan, and any required signatures as indicated in the form instructions.

What is the purpose of OREGON ADMINISTRATIVE RULE PUBLIC EMPLOYEES RETIREMENT BOARD CHAPTER 459 DIVISION 050 – DEFERRED COMPENSATION?

The purpose is to establish a formal framework for deferred compensation plans which allow public employees to save for retirement while deferring a portion of their income.

What information must be reported on OREGON ADMINISTRATIVE RULE PUBLIC EMPLOYEES RETIREMENT BOARD CHAPTER 459 DIVISION 050 – DEFERRED COMPENSATION?

Participants must report their salary deferral amounts, contributions to the deferred compensation plan, and any changes in personal information or employment status.

Fill out your oregon administrative rule public online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Oregon Administrative Rule Public is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.