WI HT-110 2010 free printable template

Show details

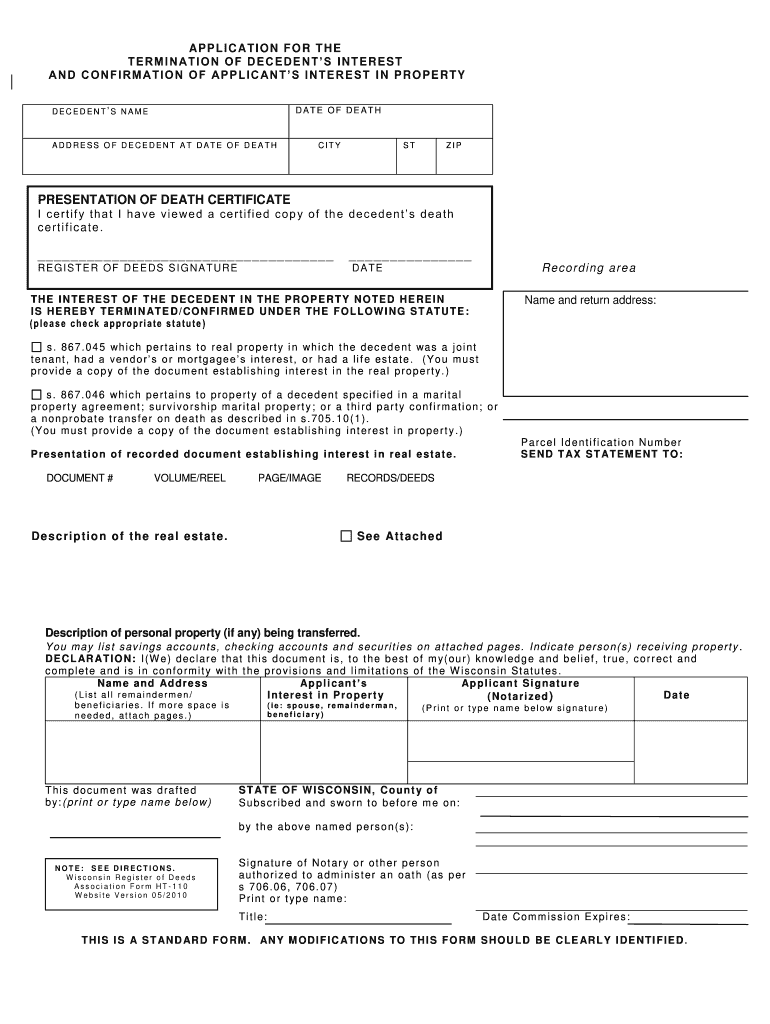

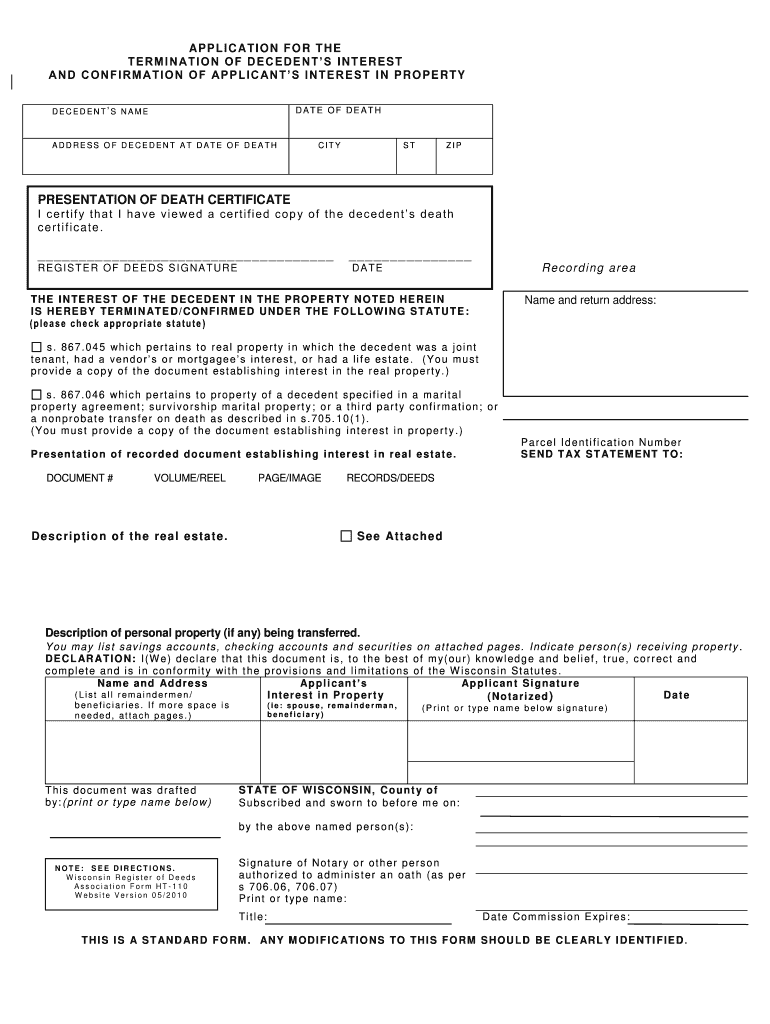

N a m e a n d Ad d r e s s Ap p l i c a n t s Ap p l i c a n t S i g n a t u r e List all remaindermen/ Interest in Property Date Notarized beneficiaries. If more space is needed attach pages. T h i s d o c u m e n t wa s d r a f t e d by print or type name below ie spouse remainderman beneficiary P ri nt or type nam e bel ow si gnature S T AT E O F W I S C O N S I N C o u n t y o f S u b s c r i b e d a n d s wo r n t o b e f o r e m e o n by t...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WI HT-110

Edit your WI HT-110 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WI HT-110 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit WI HT-110 online

To use our professional PDF editor, follow these steps:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit WI HT-110. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WI HT-110 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WI HT-110

How to fill out WI HT-110

01

Begin by downloading the WI HT-110 form from the official Wisconsin Department of Revenue website.

02

Fill in your name, address, and contact information at the top of the form.

03

Provide your Social Security number or Tax ID number in the designated field.

04

Complete the sections related to your income and deductions accurately.

05

Ensure that all entries match your supporting documents, such as pay stubs or W-2s.

06

Calculate your total tax owed or refund due based on the instructions provided.

07

Review the form for any errors or missing information before submission.

08

Sign and date the form at the bottom.

09

Submit the completed form by mail or electronically according to the instructions.

Who needs WI HT-110?

01

Individuals filing personal income taxes in Wisconsin.

02

People claiming specific tax credits or deductions.

03

Residents who owe state taxes or seek refunds.

Fill

form

: Try Risk Free

People Also Ask about

What are the advantages of a transfer on death deed in Wisconsin?

When a property owner who has recorded a Wisconsin TOD deed dies, the property interest automatically passes to the TOD beneficiary, with no need for probate. The beneficiary receives the property subject to any existing liens or mortgages.

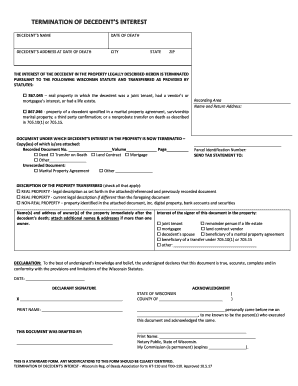

What is HT-110 form Wisconsin?

You must file a real estate transfer return at a Register of Deeds office when terminating a life estate or joint tenancy interest with a Termination of Decedent's Property Interest Form (HT-110). Filing this form meets the definition of a conveyance under state law (sec. 77.21, Wis. Stats.)

How do you terminate a decedent's interest in Wisconsin?

To terminate the decedent's interest in the property and to complete the distribution, file a form HT-110 under Wis. Stat. 867.045, with the register of deeds for the county where the property is located.

Who pays real estate transfer tax in Wisconsin?

CURRENT LAW The Wisconsin real estate transfer fee (RETF) is imposed upon the grantor (seller) of real estate at a rate of $3.00 per $1,000 of value.

What are the disadvantages of a transfer on death deed?

TOD/POD disadvantages: these accounts pass directly to the beneficiary and do not go through probate, if the executor does not have enough probate assets to pay the debts of the estate, creditors are entitled to claim some non- probate assets, including TOD accounts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit WI HT-110 from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your WI HT-110 into a dynamic fillable form that you can manage and eSign from anywhere.

Can I create an electronic signature for signing my WI HT-110 in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your WI HT-110 and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I edit WI HT-110 on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign WI HT-110. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is WI HT-110?

WI HT-110 is a form used for reporting certain tax information related to tax withholding in the state of Wisconsin.

Who is required to file WI HT-110?

Employers who have withheld Wisconsin income tax from employees are required to file WI HT-110.

How to fill out WI HT-110?

To fill out WI HT-110, obtain the form from the Wisconsin Department of Revenue website, provide the required information regarding wages and tax withheld, and submit it according to the filing instructions.

What is the purpose of WI HT-110?

The purpose of WI HT-110 is to report the amount of state income tax withheld from employee wages and ensure compliance with Wisconsin tax laws.

What information must be reported on WI HT-110?

Information that must be reported on WI HT-110 includes the employer's identification details, total wages paid, total Wisconsin income tax withheld, and other relevant payroll information.

Fill out your WI HT-110 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WI HT-110 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.