Get the free CANADA TAX REFUND APPLICATION FORM

Show details

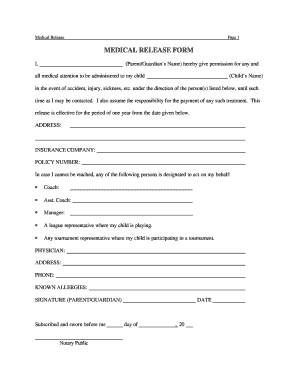

This document is used for applying for a tax refund in Canada, requiring personal and employment information from applicants, as well as authorizations for a representative to manage the tax return

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign canada tax refund application

Edit your canada tax refund application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your canada tax refund application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing canada tax refund application online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit canada tax refund application. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out canada tax refund application

How to fill out CANADA TAX REFUND APPLICATION FORM

01

Obtain the Canada Tax Refund Application Form from the Canada Revenue Agency (CRA) website or your local CRA office.

02

Gather all necessary documents such as your T4 slips, receipts, and any other income information.

03

Fill in your personal information including your name, address, and Social Insurance Number (SIN).

04

Declare all sources of income earned during the tax year, ensuring accuracy.

05

Claim any deductions and credits that you qualify for, such as medical expenses or charitable donations.

06

Review the completed form for any errors or missing information.

07

Sign and date the form.

08

Submit the application via mail or electronically through the CRA's online services.

Who needs CANADA TAX REFUND APPLICATION FORM?

01

Individuals who have overpaid taxes and are eligible for a refund.

02

Residents of Canada who have filed their tax returns and are seeking to claim a refund.

03

Anyone who has submitted a tax return and expects a refund due to tax credits or deductions.

Fill

form

: Try Risk Free

People Also Ask about

How to get a $10,000 tax refund in Canada?

Line 31270 – Home buyers' amount. You can claim up to $10,000 for the purchase of a qualifying home in 2024 if you meet both of the following conditions: You (or your spouse or common-law partner) acquired a qualifying home.

How do I get a tax return form in Canada?

You can also order a package by calling the CRA at 1-855-330-3305 (non-residents can call 1-613-940-8495). Your Social Insurance Number (SIN) will be required. It can take up to 10 business days for publications and forms to arrive by mail.

Can you get Canadian tax forms at the post office?

You can also request a paper copy of this package from the CRA online, at post offices and other government buildings. If you do decide to use tax software or a tax preparation service, you can often file electronically with the CRA.

Can Americans get tax back from Canada?

Visitors to Canada Use this form if you are a non-resident visitor to Canada who paid goods and services tax / harmonized sales tax (GST/HST) on eligible short-term accommodation or goods. Except for Quebec sales tax (TVQ), as explained below, sales taxes from other provinces are not eligible for this refund.

What is the Canadian tax return form called?

Most Common CRA Tax Forms and Schedules T1 GeneralIncome Tax and Benefit Return T101 Slip Statement of Resource Expenses T2202 Slip Tuition and Enrolment Certificate T3 Slip Statement of Trust Income Allocations and Designations T4 Slip Statement of Remuneration Paid137 more rows

How do I request a tax return form?

Use Form 4506 to request a copy of your tax return.

Where can I get a Canadian tax return form?

You can also order a package by calling the CRA at 1-855-330-3305 (non-residents can call 1-613-940-8495). Your Social Insurance Number (SIN) will be required. It can take up to 10 business days for publications and forms to arrive by mail.

How do I get my tax return in Canada?

If the CRA owes you a tax refund, it will be sent to you automatically after you file taxes. The CRA does not give you a tax refund if your refund is less than $2, you owe an amount (taxes or debt) to the (federal, provincial, or territorial) government, or if a wage garnishment law applies to you.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CANADA TAX REFUND APPLICATION FORM?

The Canada Tax Refund Application Form is a document that individuals and businesses use to request a refund of overpaid taxes from the Canada Revenue Agency (CRA).

Who is required to file CANADA TAX REFUND APPLICATION FORM?

Individuals and businesses who have overpaid their taxes or are eligible for refunds based on tax credits or deductions are required to file the Canada Tax Refund Application Form.

How to fill out CANADA TAX REFUND APPLICATION FORM?

To fill out the Canada Tax Refund Application Form, you must provide your personal and financial information, including your social insurance number, income details, and the reason for the refund. Complete all sections of the form accurately and attach any necessary documentation.

What is the purpose of CANADA TAX REFUND APPLICATION FORM?

The purpose of the Canada Tax Refund Application Form is to officially request a refund for any excess taxes paid or to claim eligible tax credits and deductions.

What information must be reported on CANADA TAX REFUND APPLICATION FORM?

The information that must be reported on the Canada Tax Refund Application Form includes your personal information (name, address, social insurance number), income details for the tax year, tax payments made, and any relevant tax credits or deductions that apply.

Fill out your canada tax refund application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada Tax Refund Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.