Get the free Limited liability partnership strike off, dissolution and restoration - companieshou...

Show details

This guide provides information on the process of striking off, dissolving, and restoring a Limited Liability Partnership (LLP) under the Companies Act 2006 in the UK, including relevant procedures,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign limited liability partnership strike

Edit your limited liability partnership strike form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your limited liability partnership strike form via URL. You can also download, print, or export forms to your preferred cloud storage service.

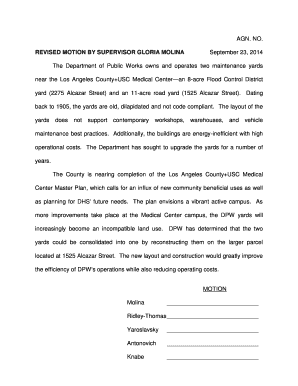

Editing limited liability partnership strike online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit limited liability partnership strike. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

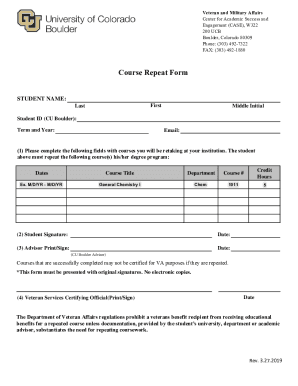

How to fill out limited liability partnership strike

How to fill out Limited liability partnership strike off, dissolution and restoration

01

Gather required documents including the LLP's certificate of incorporation and relevant financial records.

02

Verify that all LLP tax returns and obligations are up to date.

03

Complete the application for strike off by filling out the necessary forms, such as form LL DS01.

04

Submit the application to the relevant government authority, ensuring all fees are paid.

05

Inform all members and stakeholders of the decision to strike off the LLP.

06

Wait for confirmation of strike off from the regulatory body.

07

If restoration is needed, complete the applicable restoration forms and submit them to the registry.

08

Pay any outstanding fees associated with the restoration process.

Who needs Limited liability partnership strike off, dissolution and restoration?

01

Businesses wishing to cease operations and remove their LLP from the register.

02

Limited Liability Partnerships that haven't traded for a significant period.

03

LLPs needing to address their financial responsibilities before closure.

04

Partners seeking to legally dissolve and restore the LLP after unintentional strike off.

Fill

form

: Try Risk Free

People Also Ask about

What is the strike off condition for LLP?

To strike off an LLP, an application has to be made in Form 24 to the MCA. Before making use of it, the LLP have to clean all pending dues, record past due returns, and settle any liabilities. Once the software is authorized, the LLP's name is removed from the official sign-up, and the LLP ceases to exist.

What are the consequences of a compulsory strike off?

Company ceases to exist – the main consequence of compulsory strike off is that, once the company has been dissolved, it will cease to exist as a 'legal person' and is therefore unable to trade or carry out any of the legal functions of a company.

How long does a proposal to strike off take?

The duration of an active proposal to strike off varies, but a minimum of two months. This begins from the date the DS01 form is submitted and accepted by Companies House. During this period, Companies House will send out various notifications and warnings.

What is the timeline for strike off?

Procedure for Striking Off a Company by RoC Notice from RoC: The RoC will send a formal notice (E-form STK-1) to the company, indicating its intention to strike off the company's name from the Register. The company is given 30 days to respond with any valid objections or supporting documents.

How long does strike off take?

How long does it take to strike a company off? Once the original DS01 form has been received at Companies House, it takes around 5 working days for the application to be accepted. It then takes a further 3-4 months for the company to be completely struck off the company register.

How long does it take to strike off?

You'll get a letter from Companies House to let you know if you've filled in the form correctly. If you have, your request for the company to be struck off will be published as a notice in The Gazette. If nobody objects, the company will be struck off the register once the 2 months mentioned in the notice has passed.

What happens when an LLP is dissolved?

Before a company or limited liability partnership (LLP) is dissolved, its members should ensure that assets owned are transferred out of the company or LLP's ownership. If this is not done, assets owned at the date of dissolution will pass into the ownership of the Crown.

How long does strike off action take?

A notice is posted on the Published Notices website. This advises the public that the company will be deregistered in 2 months' time. After 2 months have passed, ASIC deregisters the company and issues a confirmation notice to the directors and/or Liquidator. The company ceases to exist at this point.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Limited liability partnership strike off, dissolution and restoration?

Limited liability partnership (LLP) strike off refers to the process of removing an LLP from the register of companies, essentially dissolving it. Dissolution is the formal end of the LLP's existence, while restoration involves bringing a struck off LLP back into existence.

Who is required to file Limited liability partnership strike off, dissolution and restoration?

The designated members of the LLP or a liquidator are typically required to file for strike off, dissolution, and restoration. This filing is necessary to ensure compliance with legal requirements and to officially process the LLP's status change.

How to fill out Limited liability partnership strike off, dissolution and restoration?

To fill out the application for LLP strike off, dissolution, and restoration, you must complete the relevant forms provided by the registering authority, ensuring that you include all required information such as LLP details, member signatures, and any supporting documentation.

What is the purpose of Limited liability partnership strike off, dissolution and restoration?

The purpose of LLP strike off is to formally dissolve an LLP that is no longer trading or required. Dissolution serves to clear the register and alleviate unnecessary administrative burdens, while restoration allows previously struck off LLPs to reinstate their status if needed.

What information must be reported on Limited liability partnership strike off, dissolution and restoration?

Information that must be reported includes the LLP's registration number, names of the designated members, reasons for the strike off, and any relevant financial details. It is also necessary to provide a statement confirming that the LLP has no outstanding liabilities.

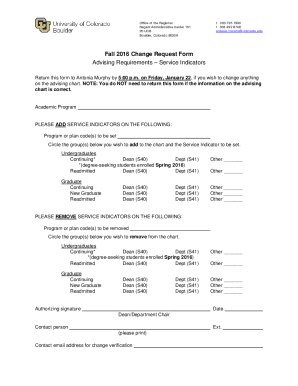

Fill out your limited liability partnership strike online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Limited Liability Partnership Strike is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.