Get the free Application and Verification Form for Residential Energy Tax Credit Certification

Show details

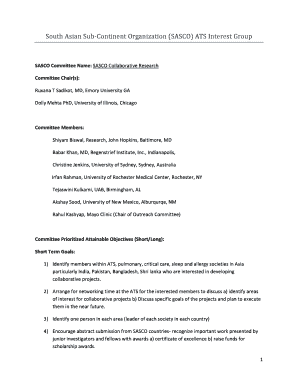

This document outlines the application process and requirements for claiming the Oregon Residential Energy Tax Credit for qualifying wind electric systems.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application and verification form

Edit your application and verification form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application and verification form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application and verification form online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit application and verification form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application and verification form

How to fill out Application and Verification Form for Residential Energy Tax Credit Certification

01

Obtain the Application and Verification Form for Residential Energy Tax Credit Certification from the official website or local tax office.

02

Fill in your personal information including name, address, and contact details at the top of the form.

03

Indicate the type of energy improvements you made to your residence (e.g., solar panels, insulation, energy-efficient windows).

04

Provide details about the contractor who performed the improvements, including their name, license number, and contact information.

05

Complete the section regarding the costs associated with the improvements, including receipts or invoices where applicable.

06

Review the eligibility requirements to ensure that all criteria for the tax credit are met.

07

Sign and date the form at the bottom, affirming that the information provided is accurate.

08

Submit the completed form to the appropriate tax authority, either electronically or by mailing it to the designated address.

Who needs Application and Verification Form for Residential Energy Tax Credit Certification?

01

Homeowners who have made eligible energy-efficient improvements to their residences and wish to claim a tax credit.

02

Individuals seeking financial incentives for installing renewable energy sources in their homes, such as solar or wind energy systems.

Fill

form

: Try Risk Free

People Also Ask about

How does IRS verify energy credits?

Manufacturer Certifications They prove that your solar panels, inverters, and other components meet specific performance and quality standards. The IRS uses these certifications to verify that your system is legit and eligible for the tax credit. It's like showing a hall pass to the taxman.

How does IRS verify energy tax credit?

Manufacturer Certifications They prove that your solar panels, inverters, and other components meet specific performance and quality standards. The IRS uses these certifications to verify that your system is legit and eligible for the tax credit. It's like showing a hall pass to the taxman.

What form is used for residential energy credit?

Use Form 5695 to figure and take your residential energy credits. The residential energy credits are: The residential clean energy credit, and. The energy efficient home improvement credit.

Where do I get my 5695 form?

The IRS has released Form 5695 for 2024, and it is now available to download on its website as a PDF. You can also access the form through tax preparation software, including TurboTax and H&R Block.

Do you need receipts for energy tax credit?

Use the Form 5695 instructions to enter qualified expenses, calculate the credit amount, and transfer it to your tax return. Keep records of receipts and manufacturer certifications in case the IRS requests verification.

Does the IRS audit tax credits?

We're auditing your tax return and need information from you to verify the credit you claimed. We may be holding your refund for the following credits: Earned Income Tax Credit (EITC), Child Tax Credit (CTC)/Additional Child Tax Credit (ACTC), Premium Tax Credit (PTC) and the American Opportunity Tax Credit (AOTC).

What disqualifies you from a solar tax credit?

You must own the system: To use the tax credit, you must purchase the solar panels with cash or a loan. You will not get the tax credit if your solar panels are installed through a solar lease or a power purchase agreement (PPA) because you are not the owner of the system. You must have taxable income.

Who qualifies for residential clean energy credit?

Qualified expenses include the costs of new clean energy property including: Solar electric panels. Solar water heaters. Wind turbines. Geothermal heat pumps. Fuel cells. Battery storage technology (beginning in 2023)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Application and Verification Form for Residential Energy Tax Credit Certification?

The Application and Verification Form for Residential Energy Tax Credit Certification is a document used by taxpayers to claim tax credits for energy-efficient improvements made to their residential properties, ensuring compliance with specific energy standards.

Who is required to file Application and Verification Form for Residential Energy Tax Credit Certification?

Taxpayers who have made qualifying energy-efficient improvements to their homes and wish to claim a tax credit for those improvements are required to file this form.

How to fill out Application and Verification Form for Residential Energy Tax Credit Certification?

To fill out the form, taxpayers need to provide personal information, details of the improvements made, and supporting documents that verify the energy efficiency and compliance with relevant standards.

What is the purpose of Application and Verification Form for Residential Energy Tax Credit Certification?

The purpose of the form is to certify that the residential energy improvements meet federal energy efficiency requirements, allowing taxpayers to receive appropriate tax credits.

What information must be reported on Application and Verification Form for Residential Energy Tax Credit Certification?

The form must report personal identification information, details of the energy improvements, the costs associated with the improvements, and any documentation required to demonstrate compliance with energy efficiency standards.

Fill out your application and verification form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application And Verification Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

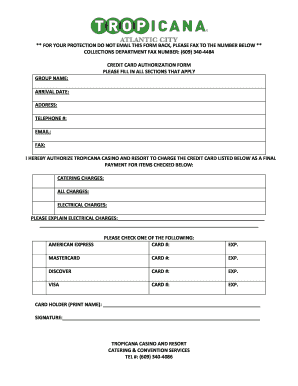

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.