Get the free Application of a Client for an Extract from the Central Credit Register

Show details

This document outlines the procedure and requirements for a client to request an extract from the Central Credit Register maintained by the Czech National Bank, detailing the claims and financial

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application of a client

Edit your application of a client form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

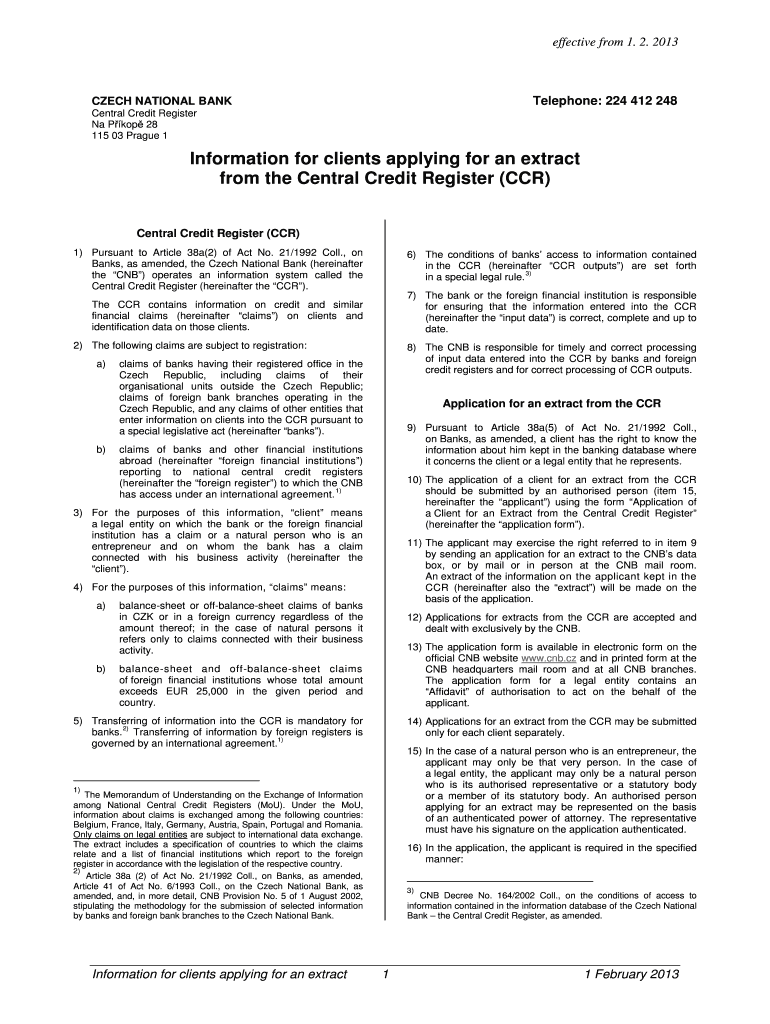

Share your form instantly

Email, fax, or share your application of a client form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application of a client online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit application of a client. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

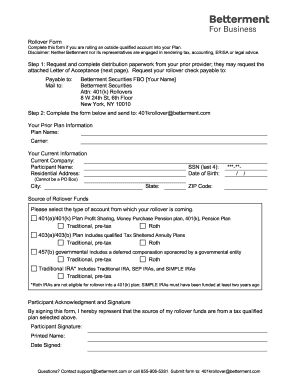

How to fill out application of a client

How to fill out Application of a Client for an Extract from the Central Credit Register

01

Gather necessary documents: Ensure you have all required personal identification and financial documents.

02

Obtain the application form: Download or collect the 'Application of a Client for an Extract from the Central Credit Register' form from the official website or local office.

03

Fill out personal information: Enter your full name, address, date of birth, and any other requested personal details accurately.

04

Specify the reason for the request: Indicate why you are seeking the credit extract (e.g., loan application, financial review).

05

Include identification details: Enter your identification number (such as a national ID or social security number) as required.

06

Review the application: Check for any errors or missing information before submission.

07

Submit the application: Send the completed form along with any required documentation to the designated authority, either online or in person.

08

Pay any applicable fees: Be prepared to pay any fees associated with obtaining the credit extract, if applicable.

09

Wait for processing: Allow time for the application to be reviewed and processed, and check for confirmation of receipt if applicable.

Who needs Application of a Client for an Extract from the Central Credit Register?

01

Individuals applying for loans or mortgages who want to assess their credit situation.

02

People checking their credit history for accuracy or discrepancies.

03

Financial institutions requiring credit information for loan approvals or assessments.

04

Consumers wanting to understand their credit standing before making significant financial decisions.

Fill

form

: Try Risk Free

People Also Ask about

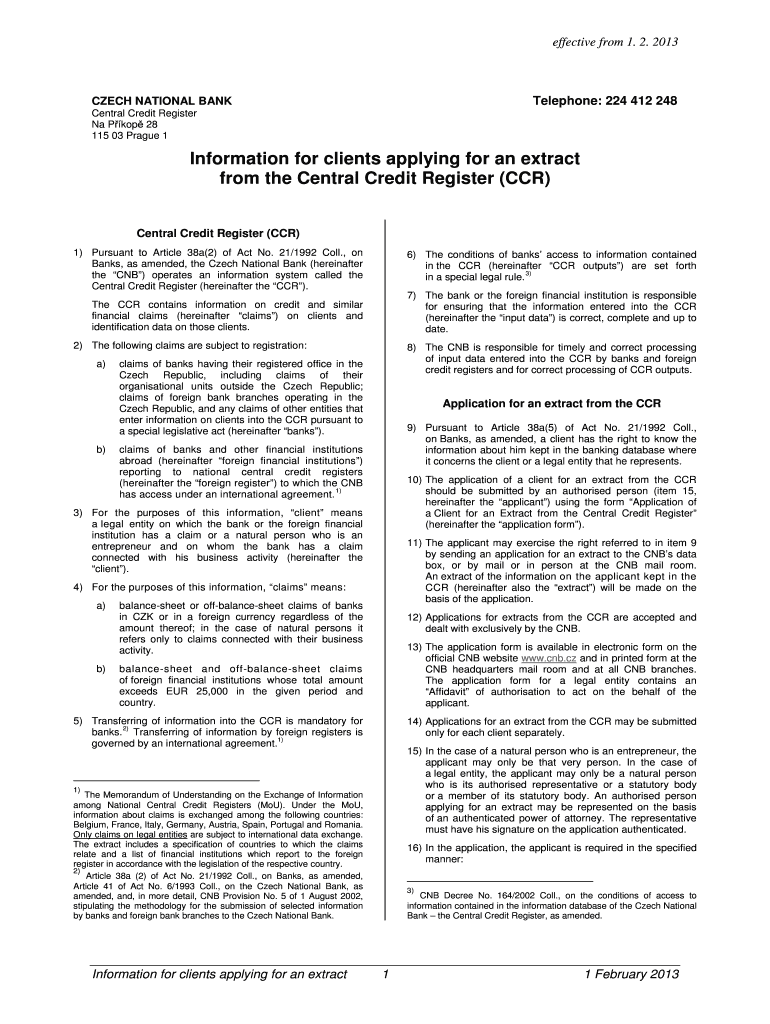

What is a central credit register?

The Central Credit Register (the Register) is a centralised system that collects and securely stores information about loans. It is managed by the Central Bank of Ireland under the Credit Reporting Act 2013. The Register collects information on loans of €500 or more including: Credit cards. Overdrafts.

What does not appear on the central credit register?

A credit report is created only from the information that is submitted by each Credit Information Provider. The Central Credit Register does not have access to any supporting documentation relating to any loan, such as loan application forms or terms and conditions.

Who is CIC on my credit report?

Understanding how CIC credit appears on credit reports is crucial for anyone looking to manage their financial health. CIC, or Credit Information Company, plays a vital role in collecting and maintaining credit data, which can significantly impact credit scores and lending decisions.

What is the purpose of the central credit register?

The Central Credit Register supports the Central Bank's obligations and functions, including consumer protection, supervising the financial sector and ensuring financial stability.

What shows up on CCR?

Credit data held on the Central Credit Register includes the loan type, such as mortgage, credit card, overdraft, personal loan, business loan, HP, PCP etc; the amount borrowed and the amount outstanding.

Why is Central credit calling me?

Why does Central Credit Audit keep calling me? Central Credit Audit is likely trying to recover a debt, which is why they keep reaching out. The worst thing you can do is ignore them. You do not want to have the situation be escalated to another collection agency or to have them seek legal action for the debt.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Application of a Client for an Extract from the Central Credit Register?

It is a formal request made by an individual or entity to obtain a report detailing their credit history and financial standing as recorded in the Central Credit Register.

Who is required to file Application of a Client for an Extract from the Central Credit Register?

Individuals or businesses that wish to check their credit history or verify their credit standing with financial institutions are required to file this application.

How to fill out Application of a Client for an Extract from the Central Credit Register?

The application must be filled out with personal identification details, contact information, and any relevant information requested by the Central Credit Register, following the specific guidelines provided by the registering authority.

What is the purpose of Application of a Client for an Extract from the Central Credit Register?

The purpose is to allow clients to access their credit information, enabling them to understand their credit situation, check for inaccuracies, and prepare for potential credit applications.

What information must be reported on Application of a Client for an Extract from the Central Credit Register?

The application must report the applicant's full name, identification number, address, date of birth, and any additional information required to verify identity and access the credit data.

Fill out your application of a client online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application Of A Client is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.