Get the free Federal Economic Recovery Implementation Weekly Report

Show details

This report outlines the financial status and updates regarding various federal and state programs and grants aimed at assisting low-income families, healthcare services, and community projects in

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign federal economic recovery implementation

Edit your federal economic recovery implementation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your federal economic recovery implementation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit federal economic recovery implementation online

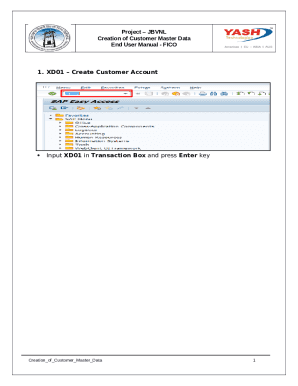

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit federal economic recovery implementation. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out federal economic recovery implementation

How to fill out Federal Economic Recovery Implementation Weekly Report

01

Obtain the Weekly Report form from the official website or your project manager.

02

Fill in the report header with your organization's information, including name, address, and contact details.

03

Indicate the reporting week date range in the designated section.

04

Provide details on project activities conducted during the week, including milestones achieved.

05

Report on financial expenditures and any adjustments made to the budget.

06

Include any challenges faced during the week and proposed solutions.

07

Review the report for accuracy and completeness before submission.

08

Submit the report by the required deadline to the appropriate authority.

Who needs Federal Economic Recovery Implementation Weekly Report?

01

Organizations and entities receiving federal economic recovery funds。

02

Project managers overseeing economic recovery initiatives.

03

Stakeholders monitoring the progress of economic recovery projects.

04

Government agencies requiring accountability and transparency in fund usage.

Fill

form

: Try Risk Free

People Also Ask about

How do I know if I'm getting a stimulus check?

You can use the IRS portal Get My Payment to check the status of the stimulus payment. Verify yourself and the tax return prior to seeing the schedule of the payment. This portal is very hard to use because it will put out wrong error messages when there are too many users to drop users.

Who qualifies for the 6000 stimulus check?

The new Covid relief package follows similar guidelines as the March CARES Act in distributing stimulus checks. This is who qualifies for the full stimulus check: Individuals earning up to $75,000 (or $112,500 as head of household) Married couples filing jointly earning up to $150,000.

Do I qualify for the IRS stimulus check?

The stimulus amount is dependent on your adjusted gross income. In order to qualify for the full $1,400, the taxpayers' annual income must not have been more than $75,000 for single filers or $150,000 for married couples filing jointly.

Why did I get $1400 from the IRS today?

Between 2021 and 2021, the federal government issued three Economic Impact Payments to help cushion the financial impact of the Covid-19 pandemic. The third and final stimulus check went out in the spring of 2021, providing up to $1,400 for individual filers and $2,800 for married couples filing jointly.

How to apply for the $6000 stimulus check?

How to Apply for the $6,000 Stimulus Check? Eligible recipients do not need to take any action to receive the FTB $6,000 stimulus check if they've already filed their taxes. However, if you haven't filed your 2020 tax return yet, you must do so by the applicable deadline to receive the payment.

Who qualifies for the recent stimulus check?

The stimulus amount is dependent on your adjusted gross income. In order to qualify for the full $1,400, the taxpayers' annual income must not have been more than $75,000 for single filers or $150,000 for married couples filing jointly.

Who qualifies for economic stimulus payment?

Normally, a taxpayer will qualify for the full amount of Economic Impact Payment if they have AGI of up to $75,000 for singles and married persons filing a separate return, up to $112,500 for heads of household, and up to $150,000 for married couples filing joint returns and surviving spouses.

Is the IRS sending automatic stimulus checks to taxpayers who missed the recovery rebate credit?

Back in December, the IRS announced they'll be issuing automatic payments to eligible individuals who did not claim the Recovery Rebate Credit on their 2021 tax returns. Here's what to know about the stimulus checks.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Federal Economic Recovery Implementation Weekly Report?

The Federal Economic Recovery Implementation Weekly Report is a document that provides updates on the progress and effectiveness of federal economic recovery efforts. It includes data and insights related to the implementation of recovery programs and initiatives.

Who is required to file Federal Economic Recovery Implementation Weekly Report?

Entities and organizations that receive federal funds for economic recovery initiatives are typically required to file the Federal Economic Recovery Implementation Weekly Report. This may include state and local governments, non-profits, and private contractors involved in recovery projects.

How to fill out Federal Economic Recovery Implementation Weekly Report?

To fill out the Federal Economic Recovery Implementation Weekly Report, individuals or organizations must gather relevant data on expenditures, program progress, and outcomes. The report should include specific fields as outlined by the federal agency, detailing financial disbursements, project status updates, and any challenges faced.

What is the purpose of Federal Economic Recovery Implementation Weekly Report?

The purpose of the Federal Economic Recovery Implementation Weekly Report is to ensure transparency and accountability in the use of federal funds allocated for economic recovery. It allows federal agencies to monitor the progress of recovery efforts and assess their impact on economic conditions.

What information must be reported on Federal Economic Recovery Implementation Weekly Report?

The information that must be reported includes the amount of federal funds received, the purposes for which funds were used, progress on recovery projects, employment generated or retained, and any obstacles encountered in the implementation of recovery programs.

Fill out your federal economic recovery implementation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Federal Economic Recovery Implementation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.