Get the free Instructions to CPA Certificate and PA License Applicants

Show details

This document outlines the application process and requirements for CPA and PA license applicants in Oregon, including experience requirements, employment records, ethics examinations, and associated

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign instructions to cpa certificate

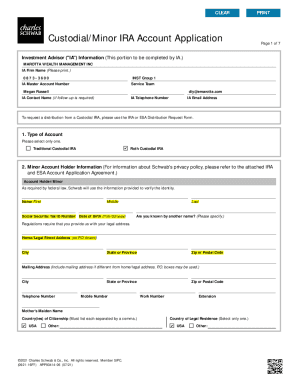

Edit your instructions to cpa certificate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your instructions to cpa certificate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit instructions to cpa certificate online

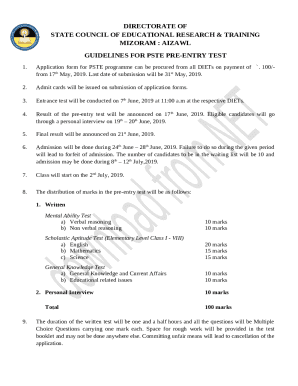

To use the professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit instructions to cpa certificate. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out instructions to cpa certificate

How to fill out Instructions to CPA Certificate and PA License Applicants

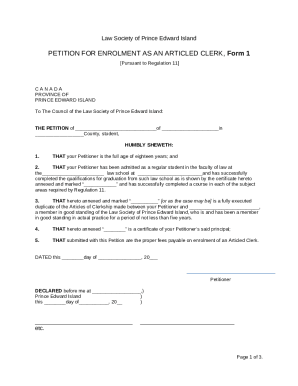

01

Obtain the Instructions to CPA Certificate and PA License Applicants document from the relevant state board of accountancy.

02

Review the eligibility requirements for receiving the CPA Certificate and PA License.

03

Gather required documentation, including transcripts, proof of work experience, and identification.

04

Fill out the application form carefully, ensuring that all fields are completed accurately.

05

Attach required documents in the specified order as outlined in the instructions.

06

Pay the application fee through the specified payment method.

07

Double-check all information for accuracy before submission.

08

Submit the completed application and documents to the designated address provided in the instructions.

Who needs Instructions to CPA Certificate and PA License Applicants?

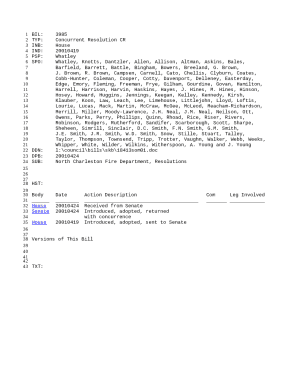

01

Individuals seeking to obtain a CPA Certificate in Pennsylvania.

02

Accountants aiming to become licensed in Pennsylvania.

03

Students or recent graduates of accounting programs.

04

Professionals transitioning from other states who wish to practice in Pennsylvania.

Fill

form

: Try Risk Free

People Also Ask about

What do you need to become a CPA in PA?

You need 150 semester credits with at least 24 credits in accounting and business, 12 additional accounting credits, a bachelor's degree, and 1,600 hours of professional accounting experience. You must also possess passing scores on every section of the Uniform CPA Examination.

Can you become a CPA without taking the CPA exam?

Mark Rigotti is correct, you cannot become a CPA without completing the education requirements first. The academic training is critical.

What are the requirements to get a CPA license in PA?

What are the requirements to get a CPA license in PA? Pennsylvania CPA license requirements include 1,600 hours of experience and 150 post-secondary credits. At least 24 credits must cover topics like accounting, business, or economics. Another 12 must focus on auditing, tax, or accounting.

What is the fastest way to get a CPA?

Focus on your education and join the Pros. Pursuing a degree in Commerce or Business (with a major in accounting) is your quickest route to earning a professional accounting designation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Instructions to CPA Certificate and PA License Applicants?

Instructions to CPA Certificate and PA License Applicants are guidelines provided by the licensing authority that outline the steps and requirements necessary for obtaining a CPA certificate and PA (Public Accountant) license.

Who is required to file Instructions to CPA Certificate and PA License Applicants?

Individuals seeking to obtain a CPA certificate and PA license must file the Instructions to CPA Certificate and PA License Applicants as part of their application process.

How to fill out Instructions to CPA Certificate and PA License Applicants?

To fill out Instructions to CPA Certificate and PA License Applicants, applicants must carefully read the instructions, complete required forms with accurate information, attach necessary documents, and submit the application by the specified deadlines.

What is the purpose of Instructions to CPA Certificate and PA License Applicants?

The purpose of Instructions to CPA Certificate and PA License Applicants is to ensure that applicants understand the requirements and processes involved in obtaining certification and licensure, thereby facilitating a smooth application experience.

What information must be reported on Instructions to CPA Certificate and PA License Applicants?

Applicants must report personal and educational information, work experience, references, and any criminal history or disciplinary actions when filling out the Instructions to CPA Certificate and PA License Applicants.

Fill out your instructions to cpa certificate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Instructions To Cpa Certificate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.