Get the free Oregon Accounting Manual

Show details

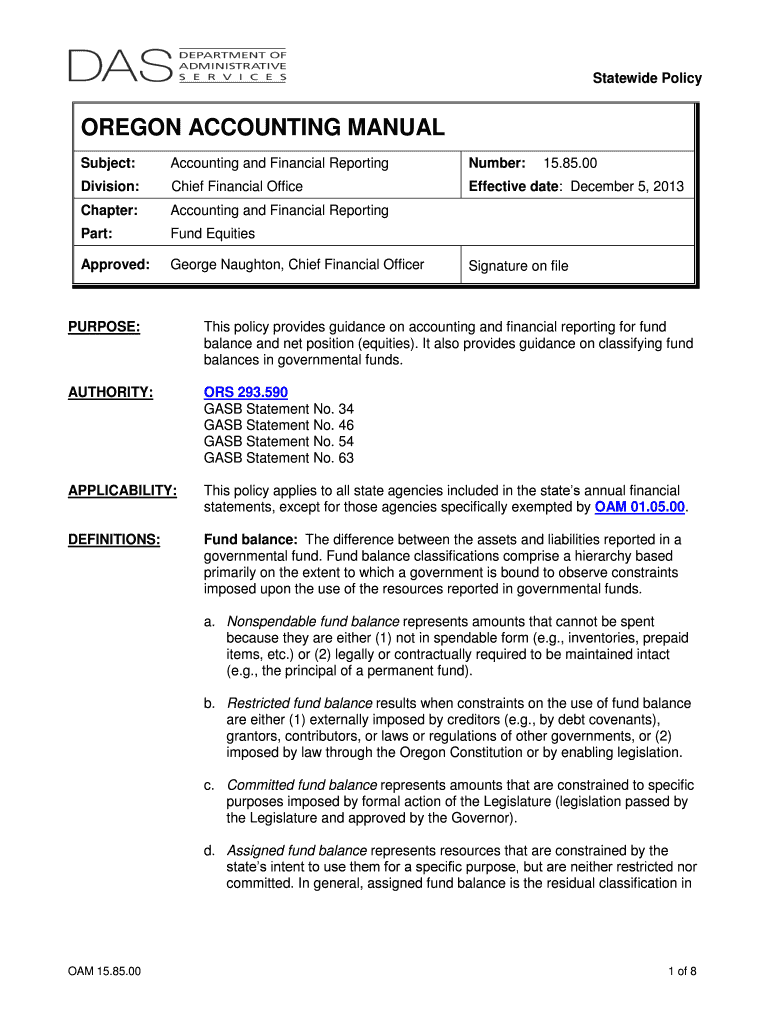

This document outlines the guidelines on accounting and financial reporting for fund balance and net position within governmental funds, including definitions and classifications of fund balances

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign oregon accounting manual

Edit your oregon accounting manual form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your oregon accounting manual form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing oregon accounting manual online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit oregon accounting manual. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out oregon accounting manual

How to fill out Oregon Accounting Manual

01

Obtain a copy of the Oregon Accounting Manual from the official state website.

02

Review the introduction section to understand the purpose and scope of the manual.

03

Follow the structured guidelines provided for various accounting procedures.

04

Fill in the necessary forms and tables as per the instructions in the manual.

05

Ensure that you comply with the specific accounting policies outlined for your department or agency.

06

If applicable, document any exceptions or unique circumstances as directed in the manual.

07

Regularly check for updates or revisions to ensure compliance with the latest standards.

Who needs Oregon Accounting Manual?

01

State agencies and departments in Oregon that handle public funds.

02

Accounting professionals working within the Oregon state government.

03

Employees responsible for financial reporting and budgeting in state agencies.

04

Auditors reviewing financial practices and compliance within Oregon agencies.

Fill

form

: Try Risk Free

People Also Ask about

What are the advantages of accounting manuals?

Accounting manuals enhance transparency by clearly outlining how financial data is handled for every aspect of accounting operations, which makes it easier for auditors to verify the accuracy and completeness of financial transactions and financial statements.

What are the benefits of accounting manual?

An accounting manual serves as a comprehensive guide for new employees, helping them quickly understand the organization's accounting practices and policies. This ensures there is 100% clarity on how transactions should be accounted for within the accounting department.

What is the meaning of accounting manual?

An accounting manual is a comprehensive document that outlines a company's accounting policies and procedures. It serves as a guide for employees in the accounting department to ensure consistency and accuracy in financial reporting.

How to prepare an accounting manual?

Components of an Accounting Manual Introduction. Organization Overview and Responsibilities. Chart of accounts. A list of core accounting processes and the interaction of the organization's accounting sub-processes. A list of the organization's accounting policies. The accounting resources required.

What is a key benefit of using manual accounting systems for small businesses?

Low Cost: Minimal initial investment is required compared to computerized systems. Simplicity: Easy to understand and operate, especially for small businesses with straightforward financial activities. Full Control: Provides a tangible, hands-on approach to managing finances, which some business owners prefer.

What is the purpose of an accounting manual?

An accounting manual contains the accounting policies and procedures of a company. Developed internally, the accounting manual contains company-specific accounting information for the firm to follow. The accounting manual works as a guideline for accounting personnel and as a training manual for new employees.

What is the government accounting manual?

The Government Accounting Manual (GAM) is prescribed by the COA to serve as guide to the accountants, budget officers, cashiers, accountable officers, and other finance personnel in recording and reporting government financial transactions.

What are the benefits of manuals?

Empowering Users with Knowledge: A well-structured user manual serves as a guide, providing step-by-step instructions and explanations that enable users to make the most of the product's features. User manuals can add to a positive user experience by providing clear and precise instructions for using a new product.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Oregon Accounting Manual?

The Oregon Accounting Manual is a comprehensive guide that outlines the accounting procedures and financial reporting standards for state agencies in Oregon, ensuring consistency and transparency in financial management.

Who is required to file Oregon Accounting Manual?

All state agencies and organizations that receive state funds or are involved in state financial transactions are required to adhere to the guidelines set forth in the Oregon Accounting Manual.

How to fill out Oregon Accounting Manual?

Filling out the Oregon Accounting Manual involves following the prescribed formats for financial reporting, ensuring that all financial data is accurately reported per the guidelines and submitting required documentation to the appropriate state authorities.

What is the purpose of Oregon Accounting Manual?

The purpose of the Oregon Accounting Manual is to provide clear and consistent accounting guidelines to enhance accountability, improve financial reporting, and ensure that financial operations comply with state laws and regulations.

What information must be reported on Oregon Accounting Manual?

The Oregon Accounting Manual requires reporting of various financial information including budgets, expenditures, revenue, assets, liabilities, and any other relevant financial data necessary for transparent reporting and accountability.

Fill out your oregon accounting manual online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Oregon Accounting Manual is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.