Toronto F002074A 2003-2025 free printable template

Show details

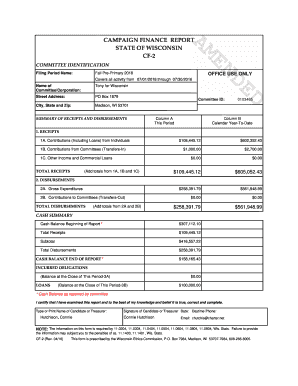

Application for Finance Revenue Services Vacant Unit Rebate Application Deadline The application filing deadline for each taxation year is the last day of February of the following year. 1990 c M. 45 s. 442. 5 O. Reg. 325/01. The information is used to determine eligibility for a property tax rebate for property owners of vacant commercial and industrial units. Questions about this collection can be directed to the Supervisor Assessment and Appeals Unit 5100 Yonge Street M2N 5V7 Telephone...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign toronto vacant form

Edit your toronto vacant rebate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ca toronto vacant rebate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing vacant home tax toronto declaration online pdf download online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit canada toronto vacant rebate form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out vacant home tax toronto declaration form pdf download

How to fill out Toronto F002074A

01

Gather all necessary personal information, including your full name, date of birth, and contact details.

02

Read the instructions carefully to understand what sections need to be completed.

03

Fill out the identification section with accurate information.

04

Complete any financial sections by providing details about your income and expenses.

05

If applicable, provide information regarding dependents or other relevant circumstances.

06

Double-check all entries for accuracy and completeness.

07

Sign and date the form at the designated area.

08

Review any additional documentation that needs to accompany the form and attach it.

09

Submit the form to the appropriate authority by mail or in person.

Who needs Toronto F002074A?

01

Individuals applying for specific permits or licenses in the City of Toronto.

02

Residents seeking financial or social assistance from the municipal government.

03

Anyone who has been instructed to complete Form F002074A as part of a regulatory process.

Video instructions and help with filling out and completing vacant home tax toronto declaration online pdf

Instructions and Help about toronto f002074a vacant rebate

Fill

toronto f002074a vacant form

: Try Risk Free

People Also Ask about toronto f002074a vacant pdf

How do I get around vacancy tax?

Vacancy tax can be avoided if the owner allows for the occupation of the property, either by themself or a tenant, for at least six months per year.

What is the city of Toronto vacancy rebate program?

The purpose of the Vacancy Rebate Program is to provide property tax relief through rebates to owners of vacant commercial and industrial buildings.

What is vacant unit tax in Toronto?

A Vacant Home Tax of one per cent of the Current Value Assessment (CVA) will be imposed on all Toronto residences that are declared, deemed or determined vacant for more than six months during the previous year.

How much is the vacancy tax in Ontario?

The Vacant Home Tax is 1% of the Current Value Assessment (CVA) and applies to Toronto homes declared, deemed, or found vacant for over 6 months in the previous year. The tax is based on the property's occupancy status in the previous year.

How do I avoid B.C. vacancy tax?

Generally, an owner is exempt from the tax if the home is their principal residence. Exemptions for individuals and corporations are also available for circumstances such as major home renovations and life events such as divorce, hospitalization, or extended absence.

How can I avoid vacancy tax?

Vacancy tax can be avoided if the owner allows for the occupation of the property, either by themself or a tenant, for at least six months per year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute toronto vacant unit printable online?

pdfFiller has made it simple to fill out and eSign toronto vacant rebate print. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I make changes in application vacant rebate blank?

With pdfFiller, the editing process is straightforward. Open your vacant home tax form pdf in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How can I fill out toronto vacant unit blank on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your toronto vacant rebate online from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is Toronto F002074A?

Toronto F002074A is a specific form used for reporting certain tax information related to businesses operating in Toronto.

Who is required to file Toronto F002074A?

Businesses that operate in Toronto and meet specific revenue thresholds or other criteria are required to file Toronto F002074A.

How to fill out Toronto F002074A?

To fill out Toronto F002074A, businesses should carefully read the form instructions, provide accurate financial data, and ensure all sections of the form are completed as required.

What is the purpose of Toronto F002074A?

The purpose of Toronto F002074A is to gather relevant tax information from businesses to ensure compliance with local tax regulations and to facilitate proper tax assessment.

What information must be reported on Toronto F002074A?

Toronto F002074A requires businesses to report financial data including revenue, expenses, and other relevant financial metrics necessary for tax assessment.

Fill out your Toronto F002074A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Toronto Application Vacant Download is not the form you're looking for?Search for another form here.

Keywords relevant to toronto vacant rebate printable

Related to toronto application vacant unit

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.