Get the free Application For Authority to Organize and Operate a Credit Union

Show details

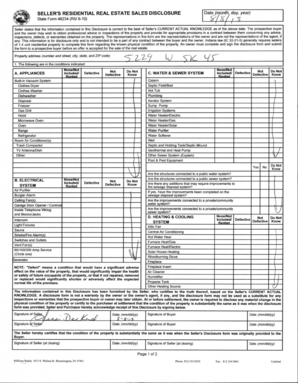

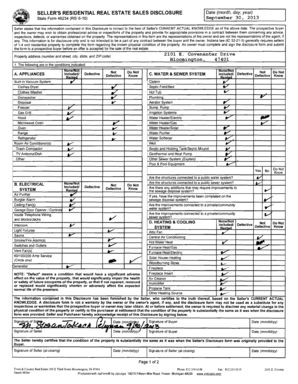

This document is an application form for establishing a proposed credit union in Florida, seeking authority to organize and operate under the regulations of the Office of Financial Regulation.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for authority to

Edit your application for authority to form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for authority to form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application for authority to online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit application for authority to. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for authority to

How to fill out Application For Authority to Organize and Operate a Credit Union

01

Obtain the Application For Authority to Organize and Operate a Credit Union form from the appropriate regulatory body.

02

Fill in the basic information about the proposed credit union, including its name and address.

03

Provide a detailed business plan outlining the purpose and goals of the credit union.

04

List the proposed board of directors and their qualifications.

05

Include financial projections for the first three to five years of operation.

06

Detail the membership criteria and the services the credit union plans to offer.

07

Attach any required supporting documents, such as bylaws and policies.

08

Review the application for completeness and accuracy.

09

Submit the application along with any required fees to the regulatory authority.

10

Follow up with the regulatory body to address any questions or requests for additional information.

Who needs Application For Authority to Organize and Operate a Credit Union?

01

Individuals or groups aiming to establish a new credit union.

02

Organizations seeking to form a cooperative financial institution for a specific community or demographic.

03

Existing financial entities that want to convert to a credit union structure.

Fill

form

: Try Risk Free

People Also Ask about

What is the organizational structure of a credit union?

Members exercise democratic control: one member, one vote, regardless of shares owned. Shares provide primary funding for the lending and investment activities of the credit union. The credit union is governed by a board of directors elected by and from the credit union's membership.

Who owns and controls a credit union?

Credit unions are owned and controlled by the people, or members, who use their services. Your vote counts. A volunteer board of directors is elected by members to manage a credit union.

What is required to open a credit union?

How Do I Start A Credit Union? Credit unions need a charter — a license to operate — from either the National Credit Union Administration or a state credit union regulator. The federal government and state governments have different chartering rules and requirements.

How do you organize a credit union?

14 Steps To Start a Credit Union: Choose the Name for Your Credit Union. Develop Your Credit Union Business Plan. Choose the Legal Structure for Your Credit Union. Secure Startup Funding for Your Credit Union (If Needed) Secure a Location for Your Business. Register Your Credit Union with the IRS.

Who runs the credit union?

Each credit union is an autonomous organisation and manages its own affairs.

Who typically owns a credit union?

Credit unions are owned and controlled by the people, or members, who use their services. Your vote counts. A volunteer board of directors is elected by members to manage a credit union.

Who are credit unions controlled by?

Credit unions are owned and controlled by their members.

Does the government have any control over credit unions?

DFPI licenses and regulates state-chartered credit unions and executes California laws relating to credit unions or the credit union business.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Application For Authority to Organize and Operate a Credit Union?

The Application For Authority to Organize and Operate a Credit Union is a formal request submitted to regulatory bodies by individuals or groups seeking to establish a new credit union.

Who is required to file Application For Authority to Organize and Operate a Credit Union?

Individuals or groups looking to establish a new credit union are required to file this application.

How to fill out Application For Authority to Organize and Operate a Credit Union?

To fill out the application, applicants must provide detailed information about the proposed credit union's structure, membership criteria, business plan, and financial projections, among other requirements.

What is the purpose of Application For Authority to Organize and Operate a Credit Union?

The purpose of the application is to ensure that the proposed credit union meets all regulatory requirements and is capable of operating safely and effectively within the financial system.

What information must be reported on Application For Authority to Organize and Operate a Credit Union?

The application must report information including the proposed credit union's name, location, organizational structure, proposed field of membership, governing policies, and financial viability.

Fill out your application for authority to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Authority To is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.