Get the free APPLICATION FOR EMPLOYER NUMBER

Show details

This document is an application to determine the status of an employer for the purpose of registration and compliance with Tennessee's unemployment insurance requirements.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for employer number

Edit your application for employer number form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for employer number form via URL. You can also download, print, or export forms to your preferred cloud storage service.

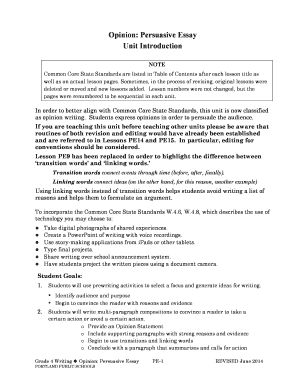

Editing application for employer number online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit application for employer number. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for employer number

How to fill out APPLICATION FOR EMPLOYER NUMBER

01

Obtain the APPLICATION FOR EMPLOYER NUMBER form from the relevant government website or agency.

02

Fill in your business details, including the legal name and address of the business.

03

Provide the business structure information, such as whether it's a sole proprietorship, partnership, corporation, etc.

04

Enter your tax identification number, if applicable.

05

Include contact details for the business owner or authorized representative.

06

Ensure all information is correct and complete to avoid delays.

07

Submit the completed form as per the instructions provided, either online or via mail.

08

Keep a copy of the submitted application for your records.

Who needs APPLICATION FOR EMPLOYER NUMBER?

01

Any business entity that intends to hire employees and needs to fulfill tax and reporting obligations.

02

Sole proprietors who are planning to hire workers.

03

Partnerships, corporations, or other organizations that require an employer number for tax purposes.

Fill

form

: Try Risk Free

People Also Ask about

How do I get my employer's ID number?

0:04 0:58 Yet you can find your EIN on last year's W2 if you still work for the same employer. You can alsoMoreYet you can find your EIN on last year's W2 if you still work for the same employer. You can also reach out to the department that that handles your company's payroll.

How do I find my employer license number?

Find a previously filed tax return for your existing entity (if you have filed a return) for which you have your lost or misplaced EIN. Your previously filed return should be notated with your EIN. Ask the IRS to search for your EIN by calling the Business & Specialty Tax Line at 800-829-4933.

Is employer ID the same as SSN?

An EIN is like an SSN for your business. For those simply operating sole proprietorships, they can use their SSN with the IRS for tax purposes and to open a business bank account. If you form an LLC, want to hire employees or would like to establish business credit, though, you'll need to obtain an EIN.

How to fill out an application for EIN?

How to apply for an EIN Visit the IRS website. Declare your business entity's legal and tax structure. Provide information about the members if your business operates as an LLC. Explain your reason for requesting an EIN. Identify the responsible party. Supply a physical address and phone number for your business.

How do I find my employer identification number without my W-2?

If you have not yet received a W-2 form from your employer or can't find a copy of a form that you previously submitted, you can reach out to your company's accountant. No one is obligated to provide the EIN, but you're more likely to receive it since you work for the company.

What do I put for employer number?

Once you have registered your business with the Employment Development Department (EDD), you will be issued an eight-digit employer payroll tax account number (example: 000-0000-0), also known as a State Employer Identification Number(SEIN) or State ID number.

How to fill out application for Employer Identification Number?

How to apply for an EIN Visit the IRS website. Declare your business entity's legal and tax structure. Provide information about the members if your business operates as an LLC. Explain your reason for requesting an EIN. Identify the responsible party. Supply a physical address and phone number for your business.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APPLICATION FOR EMPLOYER NUMBER?

The Application for Employer Number is a form used by businesses to obtain a unique identification number required for tax purposes and to manage different payroll and employment responsibilities.

Who is required to file APPLICATION FOR EMPLOYER NUMBER?

Any business or organization that hires employees or operates as a partnership, corporation, or limited liability company (LLC) is required to file an Application for Employer Number.

How to fill out APPLICATION FOR EMPLOYER NUMBER?

To fill out the Application for Employer Number, one must provide business details such as the legal name, trade name (if any), business address, type of business entity, and responsible party information. The form should be completed accurately and submitted to the relevant tax authority.

What is the purpose of APPLICATION FOR EMPLOYER NUMBER?

The purpose of the Application for Employer Number is to assign a unique identifier to businesses for tax reporting, enabling them to handle payroll and employment taxes properly.

What information must be reported on APPLICATION FOR EMPLOYER NUMBER?

The information that must be reported includes the business's legal name, trading name, address, structure of the business, contact information, and the Social Security Number or Employer Identification Number of the responsible party.

Fill out your application for employer number online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Employer Number is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.