UK HMRC IHT30 2006 free printable template

Show details

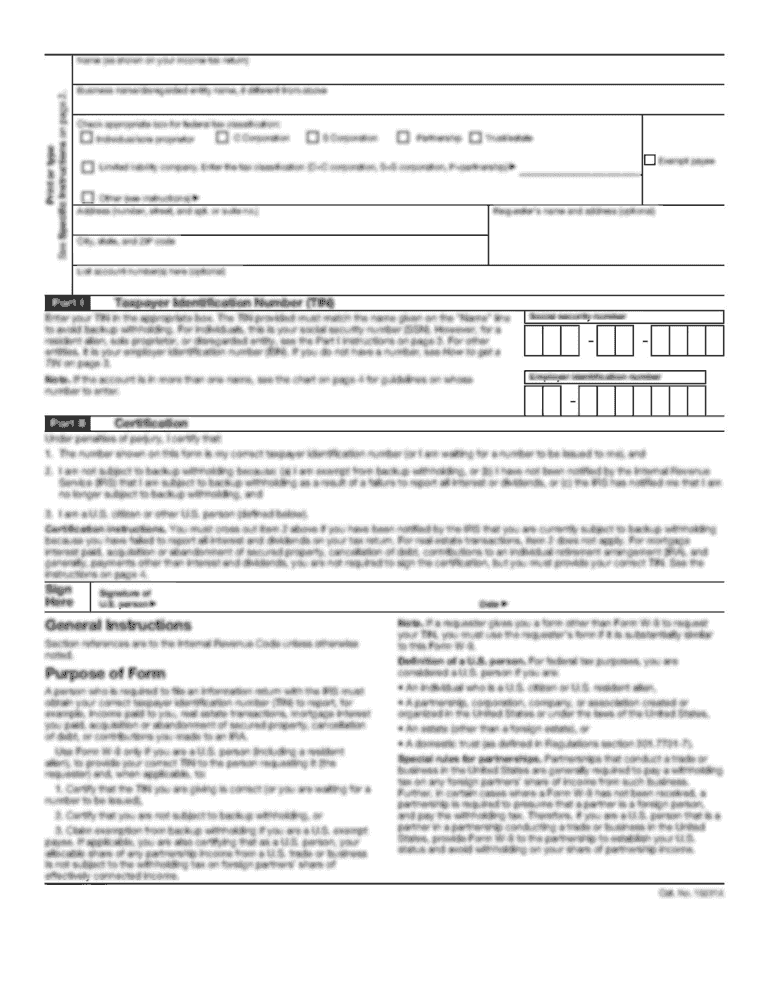

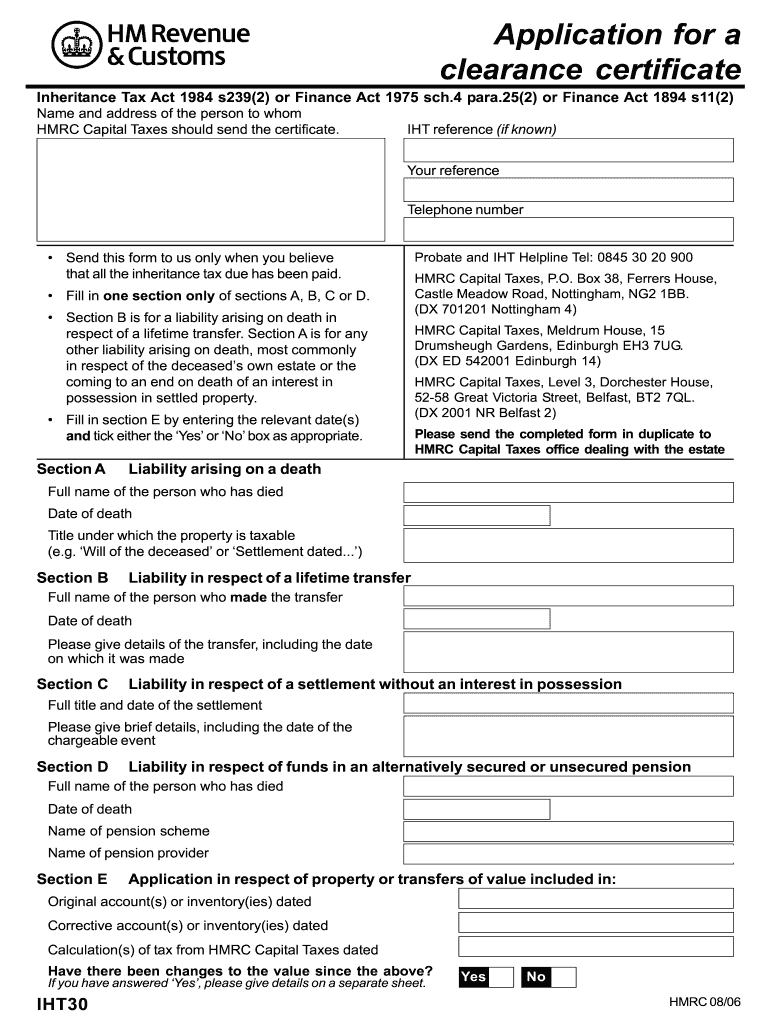

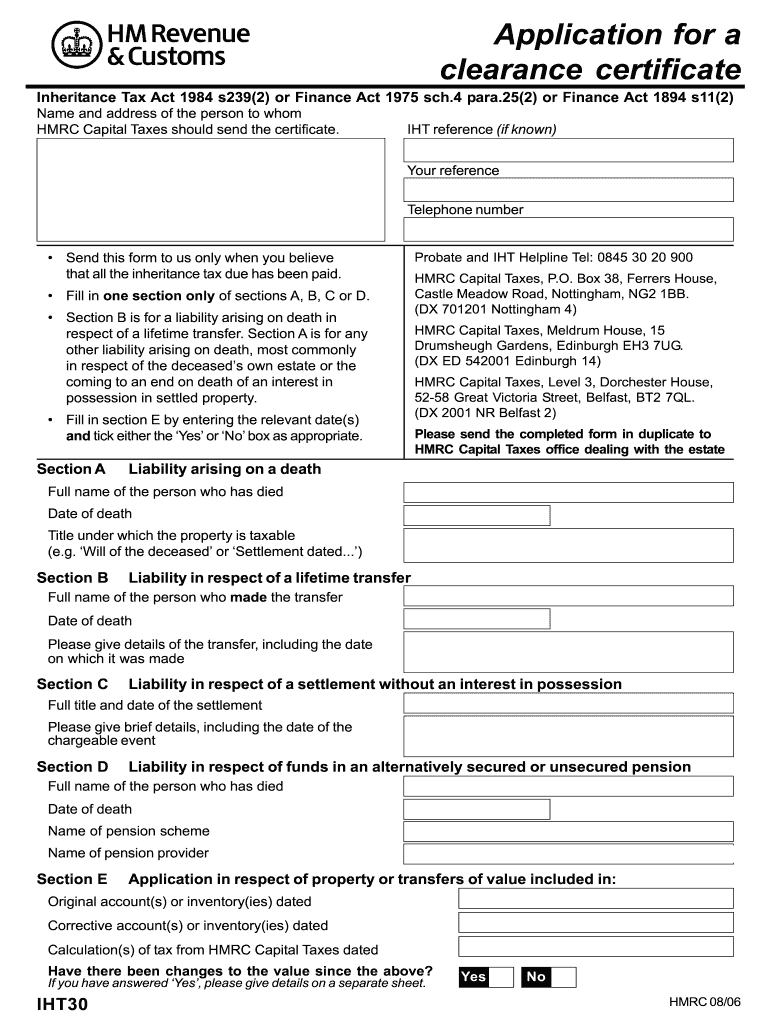

Application for a clearance certificate

Inheritance Tax Act 1984 s239(2) or Finance Act 1975 sch.4 para.25(2) or Finance Act 1894 s11(2)

Name and address of the person to whom HMRC Capital Taxes should

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UK HMRC IHT30

Edit your UK HMRC IHT30 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UK HMRC IHT30 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing UK HMRC IHT30 online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit UK HMRC IHT30. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK HMRC IHT30 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UK HMRC IHT30

How to fill out UK HMRC IHT30

01

Gather necessary documents including the deceased's will and financial statements.

02

Obtain and complete the UK HMRC IHT30 form, available on the HMRC website.

03

Fill out the personal details of the deceased, including name, address, and date of death.

04

Provide details of the estate, including all assets and liabilities, and their valuations.

05

Calculate the total value of the estate and the Inheritance Tax (IHT) due, if applicable.

06

Sign and date the form, confirming that the information provided is correct.

07

Submit the completed IHT30 form to HMRC, along with any required supporting documents.

Who needs UK HMRC IHT30?

01

Anyone who is responsible for administering the estate of a deceased person in the UK must fill out the IHT30 if they believe inheritance tax may be owed.

02

Executors or administrators of estates where the total value exceeds the tax-free threshold, or where assets include certain types of property.

Fill

form

: Try Risk Free

People Also Ask about

How do you write player clearance?

I declare that the applicant has been accepted as a member of the _ Club. I acknowledge that our club has provided the player's current club with a “Letter of Intent”. Also, to my knowledge, the player is financial to his/her current club and Association.

What are clearances in football?

A goal clearance is awarded when the whole of the ball passes over the goal line, either on the ground or in the air, having last touched a player of the attacking team, and a goal is not scored in ance with Law 10.

What is a clearance in football?

A goal clearance is awarded when the whole of the ball passes over the goal line, either on the ground or in the air, having last touched a player of the attacking team, and a goal is not scored in ance with Law 10.

How do I get international clearance from FA?

A player cannot themselves obtain international clearance; the club with which they intend to register in England must submit a completed international clearance request form to The FA, along with a copy of the player's passport (photo page) or national identity card.

How do I write a letter of clearance for football?

I declare that the applicant has been accepted as a member of the _ Club. I acknowledge that our club has provided the player's current club with a “Letter of Intent”. Also, to my knowledge, the player is financial to his/her current club and Association.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute UK HMRC IHT30 online?

Completing and signing UK HMRC IHT30 online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

Can I create an electronic signature for signing my UK HMRC IHT30 in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your UK HMRC IHT30 directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How can I edit UK HMRC IHT30 on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing UK HMRC IHT30 right away.

What is UK HMRC IHT30?

UK HMRC IHT30 is a form used to report and claim relief on inheritance tax for certain types of property.

Who is required to file UK HMRC IHT30?

Individuals or representatives who are claiming agricultural or business property relief on an inheritance tax return must file UK HMRC IHT30.

How to fill out UK HMRC IHT30?

To fill out UK HMRC IHT30, follow the instructions provided on the form, entering details about the estate, property, and any relief being claimed.

What is the purpose of UK HMRC IHT30?

The purpose of UK HMRC IHT30 is to allow taxpayers to claim exemptions or relief from inheritance tax on eligible properties.

What information must be reported on UK HMRC IHT30?

The information that must be reported on UK HMRC IHT30 includes details of the property in question, its value, and the specific relief being sought.

Fill out your UK HMRC IHT30 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK HMRC iht30 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.