UK HMRC IHT30 2014 free printable template

Get, Create, Make and Sign UK HMRC IHT30

How to edit UK HMRC IHT30 online

Uncompromising security for your PDF editing and eSignature needs

UK HMRC IHT30 Form Versions

How to fill out UK HMRC IHT30

How to fill out UK HMRC IHT30

Who needs UK HMRC IHT30?

Instructions and Help about UK HMRC IHT30

Thank you for stopping by to view this video on completing a school withdrawal clearance letter a school throw clearance letter is a document that can be requested from you when you have previously attended other institutions that may have requested aid on your behalf such as grants and federal student loans and is very likely to be required if you have been enrolled at a different institution fairly recently the school withdrawal clearance letter will allow the educational funding department at Herding University to determine exactly how much 8 had been dispersed to you at your previous institution so that we will be able to award you're remaining financial aid eligibility if this document is requested from you, you will have received an email from the educational funding Department with the school withdrawal clearance letter attached the document itself is fairly easy for you to fill out the part that may take some work will be contacting the financial aid department at your previous institution to ensure that they complete this document for you first locate the email with the attached school withdrawal clearance letter that had been sent to you and open the attachment here's what the document looks like you will need to print sign and date the top portion for student name and signature here please note that this step must include a physically into signature on the document electronic signatures of any kind cannot be accepted next contact your previous institutions financial aid office ask them what steps you need to take in order for them to fill out the school withdrawal clearance letter for you, they will most likely want you to either fax or email the document to their offices so that they can complete the rest of the form for you our contact information is on the bottom of the form here instructing the financial aid staff at your previous institution where to send the document once it has been completed we do recommend that you follow up with your previous institution on a regular basis to ensure that their staff complete the school withdrawal clearance letter for you in a timely manner in the event that you have a difficult time getting your previous institution to complete the school withdrawal clearance letter and feel you may need assistance please fax or email your signed school withdrawal clearance letter to our offices along with the phone and fax number of your previous institutions financial aid department and our offices will attempt to contact your previous school on your behalf please note that your previous institution may require you to fill out additional forms authorizing our offices to speak to your prior institution on your behalf before they would complete this form for you once the school withdrawal clearance letter has been completed by your previous institution it will simply need to be submitted to our offices for review we would like to thank you for viewing this video please feel free to contact our offices with...

People Also Ask about

What is an sc2?

Can I print a SC2 form?

What is the purpose of a self certification form?

What is the purpose of the SC2 form?

Can I download a self certification form PDF?

Where can I download a SC2 form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the UK HMRC IHT30 electronically in Chrome?

How do I fill out the UK HMRC IHT30 form on my smartphone?

How do I edit UK HMRC IHT30 on an iOS device?

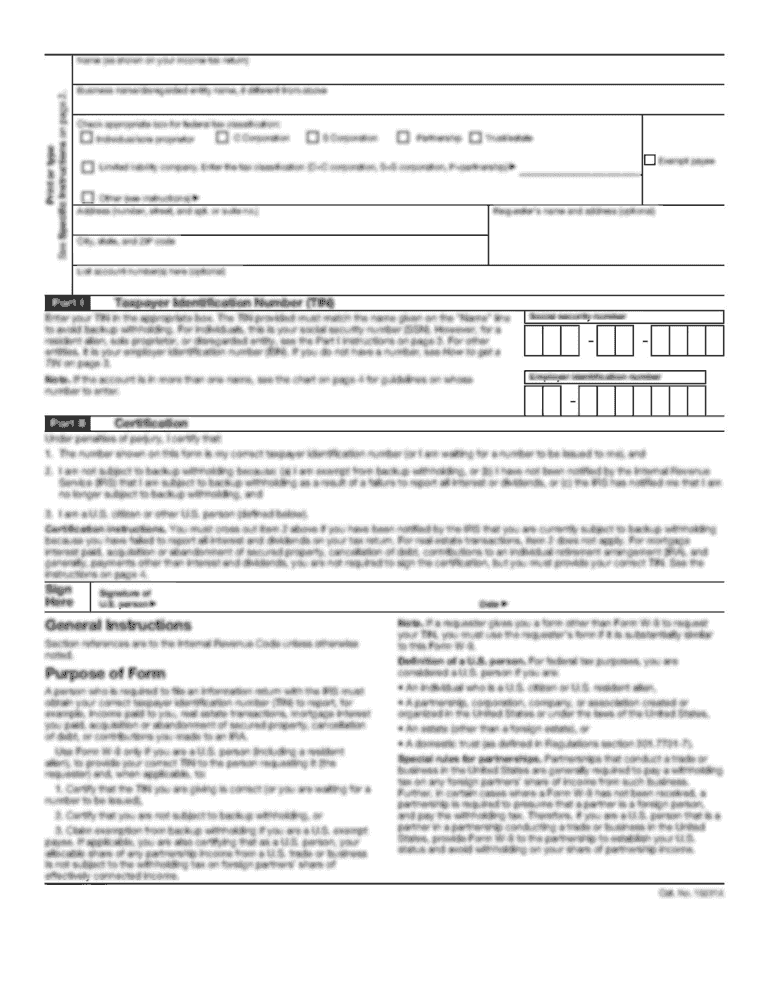

What is UK HMRC IHT30?

Who is required to file UK HMRC IHT30?

How to fill out UK HMRC IHT30?

What is the purpose of UK HMRC IHT30?

What information must be reported on UK HMRC IHT30?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.