ND NDPC Form 12 2003 free printable template

Show details

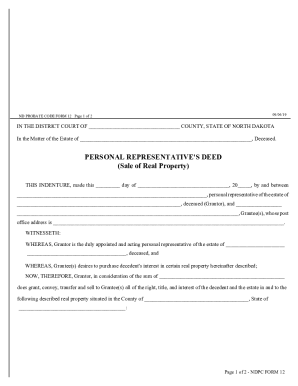

ND PROBATE CODE FORM 12-Page 1 11/03/03 IN THE DISTRICT COURT OF COUNTY, STATE OF NORTH DAKOTA In the Matter of the Estate of, Deceased. PERSONAL REPRESENTATIVE'S DEED (Sale of Real Property) THIS

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ND NDPC Form 12

Edit your ND NDPC Form 12 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ND NDPC Form 12 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ND NDPC Form 12 online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ND NDPC Form 12. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

ND NDPC Form 12 Form Versions

Version

Form Popularity

Fillable & printabley

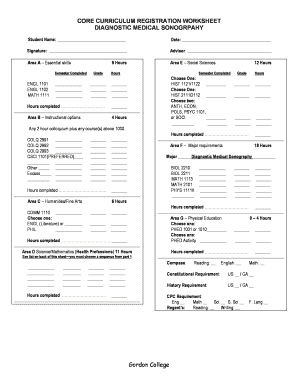

How to fill out ND NDPC Form 12

How to fill out ND NDPC Form 12

01

Obtain the ND NDPC Form 12 from the appropriate regulatory body or official website.

02

Read the instructions carefully to understand the requirements for filling out the form.

03

Fill in your personal details, including name, address, and contact information in the designated fields.

04

Provide any required identification numbers, such as Social Security number or tax ID.

05

Complete the sections that pertain to your specific application or purpose for filing the form.

06

Review all entries for accuracy and completeness before submitting the form.

07

Sign and date the form where indicated.

08

Submit the form either electronically or via postal mail based on the instructions provided.

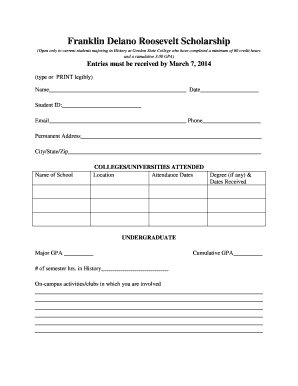

Who needs ND NDPC Form 12?

01

Individuals or businesses applying for a specific permit or license as required by the ND regulatory body.

02

Those who need to report changes or updates to previously submitted applications.

03

Anyone obligated to meet compliance standards set by ND regulations.

Fill

form

: Try Risk Free

People Also Ask about

How do you appoint a personal representative in Colorado?

By Petition to the Court (Formal Proceeding). The Probate Judge, Magistrate or Registrar may appoint a Personal Representative and determine Heirs after notice to all Interested Persons and after hearing on any objections. If you need assistance with legal decisions, you should contact an attorney.

How do I transfer a deed after death in Colorado?

After a property owner's death, a TOD beneficiary confirms the transfer of title in the same manner as a joint tenant. The beneficiary records a certified copy of the owner's death certificate and a supplementary affidavit with the land records of the county where the property is located.

What is a personal representative in probate Colorado?

A personal representative has a fiduciary duty to the estate, devisees, heirs, and other interested parties ,including creditors. A personal representative's specific duties included: 1. To act impartial in regards to all parties to the estate.

How do I quickly deed a house in Colorado?

To file a Colorado quitclaim deed form, you must bring your signed and notarized quitclaim deed to the county clerk where the property is located. Make sure that you bring any required fees as well. Create a Colorado Quit Claim Deed in minutes with our professional document builder.

How do I get a letter of administration in Colorado?

If you are curious about your role as PR or need to obtain Letters Testamentary, call (720) 513-2299 to set up a consult with a probate attorney. The probate court will then issue Letters of Administration if someone passes without a will or Letters Testamentary if someone passes with a will.

What is a personal representative's deed Colorado?

A Personal Representative's deed, or PR deed, is a tool used to transfer title of real estate out of an estate. It is very similar to a quitclaim deed, only the person transferring the ownership of the property is the executor of an estate instead of the actual owner.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute ND NDPC Form 12 online?

With pdfFiller, you may easily complete and sign ND NDPC Form 12 online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit ND NDPC Form 12 in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your ND NDPC Form 12, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I complete ND NDPC Form 12 on an Android device?

On Android, use the pdfFiller mobile app to finish your ND NDPC Form 12. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is ND NDPC Form 12?

ND NDPC Form 12 is a specific form related to the reporting of non-deposit taking (ND) and non-banking financial companies (NBFCs) in India, typically used for compliance with regulatory requirements.

Who is required to file ND NDPC Form 12?

Non-deposit taking non-banking financial companies (NBFCs) in India that meet specific criteria set by the Reserve Bank of India are required to file ND NDPC Form 12.

How to fill out ND NDPC Form 12?

To fill out ND NDPC Form 12, companies must provide detailed financial data and other requisite information as per the guidelines issued by the Reserve Bank of India, ensuring accuracy and timely submission.

What is the purpose of ND NDPC Form 12?

The purpose of ND NDPC Form 12 is to ensure transparency and compliance within the financial sector, enabling regulatory authorities to monitor the activities of non-deposit taking NBFCs.

What information must be reported on ND NDPC Form 12?

Information that must be reported on ND NDPC Form 12 includes financial statements, balance sheets, details of assets and liabilities, and any other pertinent data as required by the regulatory framework.

Fill out your ND NDPC Form 12 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ND NDPC Form 12 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.