Get the free Charitable Trust Registration Form - txdps state tx

Show details

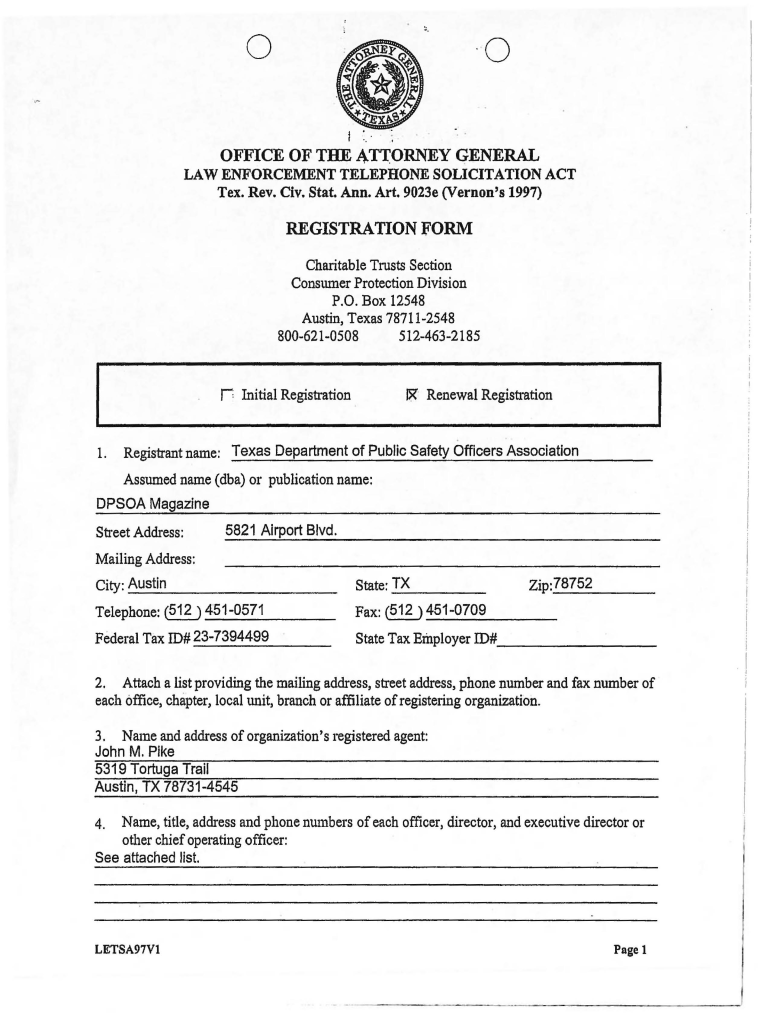

This document serves as a registration form for charitable organizations operating in Texas, detailing the organization's information, officers, purpose, and fundraising activities.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign charitable trust registration form

Edit your charitable trust registration form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your charitable trust registration form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing charitable trust registration form online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit charitable trust registration form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out charitable trust registration form

How to fill out Charitable Trust Registration Form

01

Obtain the Charitable Trust Registration Form from the relevant regulatory authority or their website.

02

Read the instructions carefully to ensure you understand the requirements.

03

Provide the name of the charitable trust and its primary purpose.

04

Fill in the contact details of the trust's principal officers, including names, addresses, and phone numbers.

05

Detail the trust's financial information, including sources of funding and financial projections.

06

Include the trust's governing documents, such as the trust deed.

07

Specify the area or community the trust aims to serve.

08

Review all the information for accuracy and completeness.

09

Sign and date the form where required.

10

Submit the completed form along with any necessary attachments to the designated authority.

Who needs Charitable Trust Registration Form?

01

Any individual or organization intending to operate as a charitable trust must complete the Charitable Trust Registration Form.

02

Trustees of charitable organizations looking to receive tax-exempt status may also need this registration.

03

Organizations raising funds for charitable purposes must register to comply with local regulations.

Fill

form

: Try Risk Free

People Also Ask about

What is a CRI 400 form in NJ?

Charity Registration Extension Form CRI-400 (Requesting an Extension of Time to File the Renewal Registration Statement and Financial Report for Charitable Organizations). For requesting an extension of time to file a charity renewal registration statement and financial report for charitable organizations only.

Does a charitable trust file 1041 or 990?

A fiduciary must file Form 1041 for a domestic estate or trust that meets specific income or beneficiary requirements. The form is filed by nonexempt charitable and split-interest trusts and five additional types of entities.

What is the form for charitable trust?

Form 10B is to be furnished by a charitable or religious trust or institution that has been registered u/s 12A or who has submitted an application for registration by filing Form 10A. Form 10B is an audit report which is provided by a CA upon nomination by the taxpayer.

What is the difference between 990 and 990pf?

The primary difference between Form 990 and Form 990-PF is that Form 990 is required for tax-exempt organizations in general (such as public charities) while Form 990-PF is required specifically for private foundations.

What are the disadvantages of a charitable trust?

Cons: Irrevocable. Fixed income does not protect against inflation. All remaining funds must be distributed to a charitable organization, or multiple, of a donors' choosing at the end of the CRTs term. Not the best choice if you would rather leave the money to your family.

What is the IRS form for a charitable trust?

About Form 1041-A, U.S. Information Return Trust Accumulation of Charitable Amounts | Internal Revenue Service.

What is the IRS form for charitable trust?

About Form 1041-A, U.S. Information Return Trust Accumulation of Charitable Amounts | Internal Revenue Service.

Do all trusts have to file a 1041?

At a glance: Not all trusts and estates must file Form 1041 — only those with income-producing assets or nonresident alien beneficiaries.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Charitable Trust Registration Form?

The Charitable Trust Registration Form is a legal document required for the registration of a charitable trust, outlining its purposes, governance structure, and operational guidelines.

Who is required to file Charitable Trust Registration Form?

Organizations or individuals intending to establish a charitable trust must file the Charitable Trust Registration Form with the appropriate governmental authority to ensure compliance with legal requirements.

How to fill out Charitable Trust Registration Form?

To fill out the Charitable Trust Registration Form, provide accurate details about the trust's name, purpose, trustee information, and financial structures, and ensure all sections are completed as per the guidelines provided by the registration authority.

What is the purpose of Charitable Trust Registration Form?

The purpose of the Charitable Trust Registration Form is to legally recognize and govern charitable trusts, ensuring transparency, accountability, and adherence to regulations in charitable activities.

What information must be reported on Charitable Trust Registration Form?

The Charitable Trust Registration Form typically requires information such as the trust's name, objectives, details of trustees and beneficiaries, funding sources, and a declaration of compliance with applicable laws.

Fill out your charitable trust registration form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Charitable Trust Registration Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.