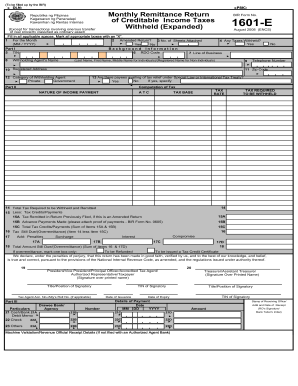

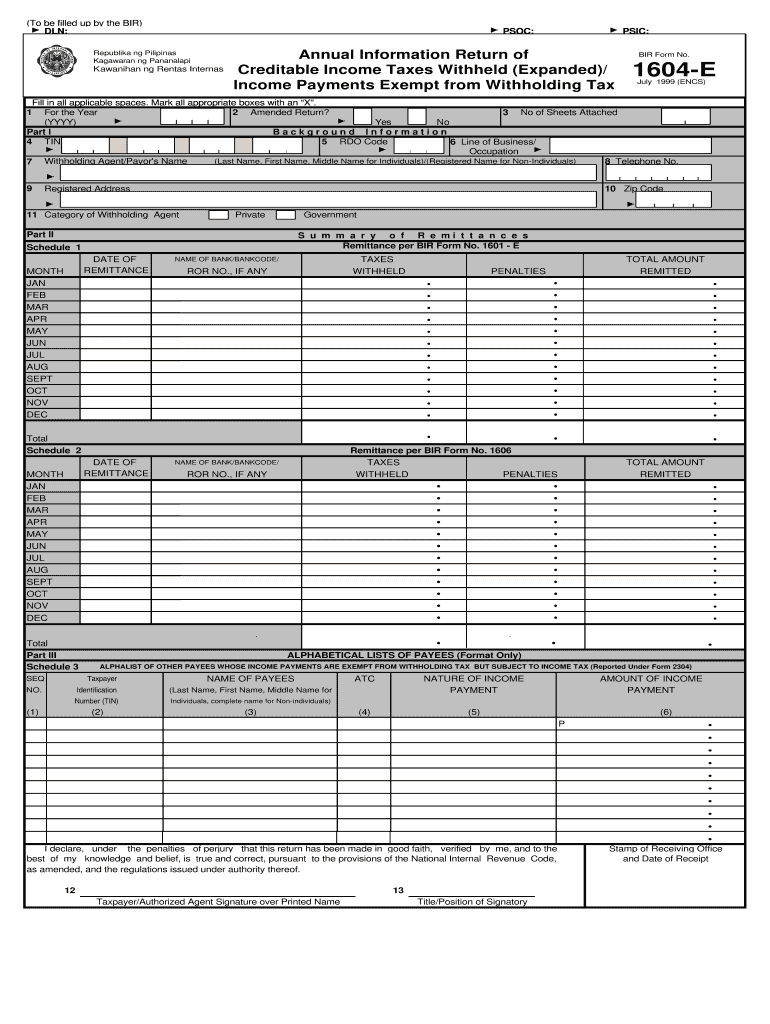

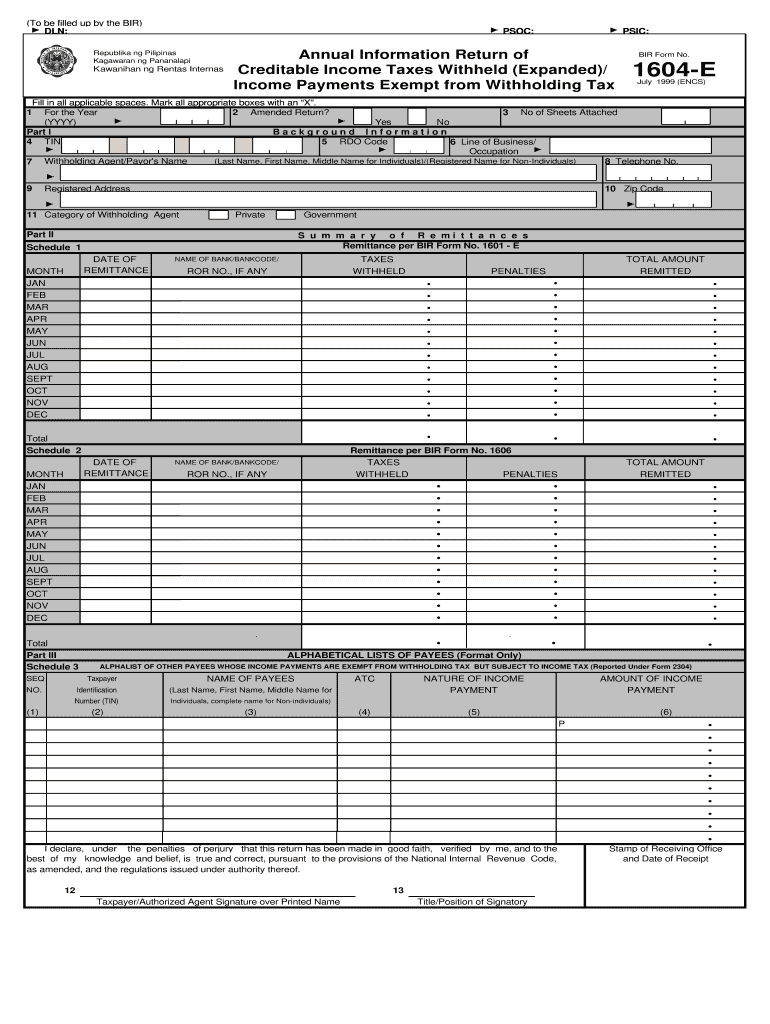

PH BIR 1604-E 1999 free printable template

Show details

(To be filled up by the BIR) DAN: Republican NG Filipinas Catamaran NG Pananalapi PSO: SIC: BIR Form No. Hawaiian NG Rental Internal Annual Information Return of Creditable Income Taxes Withheld (Expanded)/

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PH BIR 1604-E

Edit your PH BIR 1604-E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PH BIR 1604-E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit PH BIR 1604-E online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit PH BIR 1604-E. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PH BIR 1604-E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PH BIR 1604-E

How to fill out PH BIR 1604-E

01

Obtain the PH BIR Form 1604-E from the BIR website or local BIR office.

02

Fill out the taxpayer identification information, including your name, TIN, address, and contact details.

03

Indicate the applicable tax year and the period covered by the return.

04

Enter the total income earned from employees for the period.

05

Calculate the withholding tax based on the applicable tax rates and enter the total amount withheld.

06

If applicable, provide additional information regarding exemptions, adjustments, or other relevant details.

07

Sign and date the form to certify that all information provided is true and correct.

08

Submit the completed form to the appropriate BIR office, along with any required attachments such as payment evidence.

Who needs PH BIR 1604-E?

01

Employers who are required to report and remit withholding taxes on compensation paid to their employees.

02

Taxpayers who need to comply with the Philippines' tax regulations concerning employee income.

Instructions and Help about PH BIR 1604-E

Fill

form

: Try Risk Free

People Also Ask about

What is the deadline for 1601eq?

The quarterly withholding tax remittance return shall be filed and the tax paid/remitted not later than the last day of the month following the close of the quarter during which withholding was made.

How do I file an annual alphalist of payees?

There's three (4) ways to file the BIR Form 1604E: Electronic Filing Payment System (eFPS) Electronic BIR Form (eBIR Form) – for non-efps. Manual Filing of BIR — kindly check with your RDO if they still accept manual filing of BIR Form 1604E. MPM Accounting Software.

What is the purpose of the expanded withholding tax?

Through the so-called expanded withholding tax or EWT, the government can collect certain income tax payments ahead of the quarterly and yearly due dates — this tax is specifically deducted on the income of the payee on a monthly basis.

Why would you increase tax withholding?

Getting a second job is the most common reason for needing to adjust your W-4. Do this whether you moonlight, have a home business or get another full-time job. Any time your income goes up, your tax liability will likely go up too, requiring a new W-4.

What is the meaning of expanded withholding tax?

Expanded - is a kind of withholding tax which is prescribed on certain income payments and is creditable against the income tax due of the payee for the taxable quarter/year in which the particular income was earned.

What is the alphalist of payees?

QAP files, or also known as Quarterly Alphalist of Payees is a file that contains all the names of payees included both in your 1601-EQ/1601-FQ report.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find PH BIR 1604-E?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the PH BIR 1604-E in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

Can I edit PH BIR 1604-E on an iOS device?

You certainly can. You can quickly edit, distribute, and sign PH BIR 1604-E on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How do I fill out PH BIR 1604-E on an Android device?

Use the pdfFiller Android app to finish your PH BIR 1604-E and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is PH BIR 1604-E?

PH BIR 1604-E is an annual information return that tax-exempt organizations in the Philippines must file to report their income from local and foreign sources, as well as to declare their expenses and liabilities.

Who is required to file PH BIR 1604-E?

Entities that are classified as tax-exempt organizations, such as cooperatives and non-profit organizations, are required to file PH BIR 1604-E.

How to fill out PH BIR 1604-E?

To fill out PH BIR 1604-E, organizations must provide their name, address, tax identification number, and complete the schedule of income, expenses, and liabilities following the format specified by the Bureau of Internal Revenue.

What is the purpose of PH BIR 1604-E?

The purpose of PH BIR 1604-E is to ensure compliance with tax regulations by reporting the financial activities of tax-exempt organizations in order to maintain their tax-exempt status.

What information must be reported on PH BIR 1604-E?

The information that must be reported on PH BIR 1604-E includes the organization's name, address, tax identification number, detailed listings of income received, expenses incurred, and any liabilities as required by the Bureau of Internal Revenue.

Fill out your PH BIR 1604-E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PH BIR 1604-E is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.