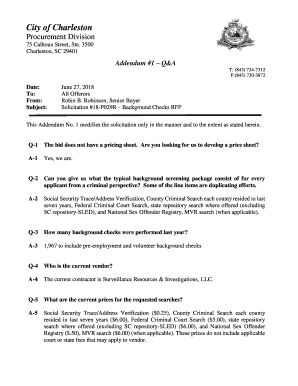

Get the free 1099 Pro® 2002 Help Manual

Show details

This document serves as a comprehensive help manual for the 1099 Pro® 2002 software, providing instructions on installation, usage, troubleshooting, and IRS-related information for tax document preparation

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 1099 pro 2002 help

Edit your 1099 pro 2002 help form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 1099 pro 2002 help form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 1099 pro 2002 help online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 1099 pro 2002 help. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 1099 pro 2002 help

How to fill out 1099 Pro® 2002 Help Manual

01

Gather all necessary information including payee details and amounts.

02

Open the 1099 Pro® 2002 software and navigate to the appropriate section.

03

Select the type of 1099 form you need to fill out (e.g., 1099-MISC, 1099-INT).

04

Enter the payer's information, including name, address, and taxpayer identification number.

05

Input the payee's information including name, address, and taxpayer identification number.

06

Fill in the payment amounts in the correct boxes as per IRS guidelines.

07

Review the entries for accuracy to avoid errors.

08

Print the 1099 forms or file electronically as required.

Who needs 1099 Pro® 2002 Help Manual?

01

Businesses or individuals who have paid non-employees or independent contractors.

02

Accountants and tax professionals handling client tax filings.

03

Anyone required to report miscellaneous income payments to the IRS.

Fill

form

: Try Risk Free

People Also Ask about

How long do you have to correct a 1099?

There is no hard deadline to file a 1099 tax form correction. The IRS generally prefers for 1099 tax forms to be corrected within three years of their initial filing date. This is because there is a three year window to amend your personal tax return and collect a refund from a corrected 1099 tax form.

Can you correct a 1099 electronically?

With Tax1099, you can easily file your 1099 Corrections online, re-transmit the form to the IRS and avoid heavy penalties.

Is there a penalty for correcting a 1099?

Penalties for Correcting a 1099 Form The IRS will issue some penalty depending on the type of error and whether it was intentional. A business generally must pay $100 per incident. The business may also pay a separate $100 fee after the IRS sends a statement to any taxpayer who received an incorrect tax form.

Can you manually write a 1099?

Yes, you can handwrite a 1099 or W2, but be very cautious when doing so. The handwriting must be completely legible using black ink block letters to avoid processing errors. The IRS says, “Although handwritten forms are acceptable, they must be completely legible and accurate to avoid processing errors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

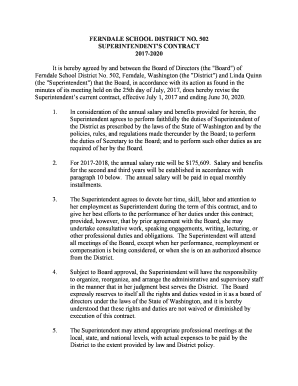

What is 1099 Pro® 2002 Help Manual?

The 1099 Pro® 2002 Help Manual is a comprehensive guide designed to assist users in understanding and utilizing the 1099 Pro software, which is used for preparing and filing various 1099 forms.

Who is required to file 1099 Pro® 2002 Help Manual?

Businesses and individuals who are required to report certain types of payments made during the tax year, such as independent contractor payments, rent, or interest, must utilize the 1099 Pro® 2002 Help Manual to ensure proper filing.

How to fill out 1099 Pro® 2002 Help Manual?

To fill out the 1099 Pro® 2002 Help Manual, users should follow step-by-step instructions provided in the manual, which typically include entering payer and payee information, payment amounts, and the appropriate form selection.

What is the purpose of 1099 Pro® 2002 Help Manual?

The purpose of the 1099 Pro® 2002 Help Manual is to provide users with guidance and instructions for accurately completing and filing various 1099 forms in compliance with IRS regulations.

What information must be reported on 1099 Pro® 2002 Help Manual?

The information that must be reported typically includes the payer's and payee's names, addresses, taxpayer identification numbers, and the amounts paid during the tax year that are subject to reporting.

Fill out your 1099 pro 2002 help online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

1099 Pro 2002 Help is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.