UK WIT02 2011 free printable template

Show details

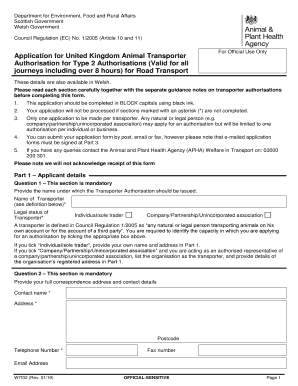

Department for Environment, Food and Rural Affairs Scottish Government Welsh Government Council Regulation (EC) No 1/2005 (Article 10 and 11) For Official Use Only Application for United Kingdom Animal

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign application for united kingdom

Edit your application for united kingdom form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for united kingdom form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application for united kingdom online

Follow the steps below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit application for united kingdom. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK WIT02 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out application for united kingdom

How to fill out UK WIT02

01

Obtain the UK WIT02 form from the official HM Revenue and Customs (HMRC) website.

02

Ensure you have your personal information ready, including your National Insurance number, contact details, and relevant tax information.

03

Fill in the applicant's details accurately in the specified fields.

04

Provide information regarding your work, including the type of work done and the duration.

05

Include your income details, ensuring to specify any taxable earnings.

06

Review all filled information for accuracy and completeness.

07

Sign and date the form as required.

08

Send the completed form to the appropriate HMRC address, ensuring to keep a copy for your records.

Who needs UK WIT02?

01

Individuals or businesses that are claiming tax relief on their expenses in the UK.

02

People who have completed work that qualifies for tax deductions under UK law.

03

Those who need to report their income and request adjustments for taxes owed.

Fill

form

: Try Risk Free

People Also Ask about

How do I become a licensed pet transporter in the UK?

You must have a transporter authorisation if you transport animals as part of an economic activity (a business or trade), for a distance over 65km. You will need a: type 1 transporter authorisation for journeys over 65km and up to 8 hours. type 2 transporter authorisation for journeys over 8 hours.

How long can you keep cattle in a trailer?

If livestock are being transported for longer than 28 consecutive hours, they must be offloaded for at least 5 consecutive hours to get feed, water, and rest. The U.S. Department of Agriculture enforces the Law.

How long can animals be transported in UK?

Road vehicles and containers used to transport animals on journeys over 8 hours, must be inspected and approved by a certifying body. Certificates of vehicle approval are valid for up to 5 years.

How do you transport livestock overseas?

Animals that travel by air or sea are placed in special containers that are safe for them to be in for the duration of the trip. Modified 747 aircrafts with specialized cargo containers are often used for transporting livestock. In other instances, cattle are sent by ship.

How do I export live animals from the UK?

You'll usually need to complete an export health certificate ( EHC ) and some supporting documents to export a live animal. Check the export health certificate ( EHC ) finder to see if a certificate exists for your animal or product. If you find an EHC , follow the EHC process to export.

What are the rules of transporting animals in the UK?

You must have a transporter authorisation if you transport animals as part of an economic activity (a business or trade), for a distance over 65km. You will need a: type 1 transporter authorisation for journeys over 65km and up to 8 hours. type 2 transporter authorisation for journeys over 8 hours.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit application for united kingdom straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing application for united kingdom right away.

How do I fill out the application for united kingdom form on my smartphone?

Use the pdfFiller mobile app to fill out and sign application for united kingdom on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I edit application for united kingdom on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute application for united kingdom from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is UK WIT02?

UK WIT02 is a form used for reporting certain tax information related to withholding tax obligations in the United Kingdom.

Who is required to file UK WIT02?

Entities that have withholding tax obligations, such as companies paying interest, royalties, or dividends to non-residents, are required to file UK WIT02.

How to fill out UK WIT02?

To fill out UK WIT02, gather the required information regarding payments made, complete the form with accurate details, and ensure all figures are calculated correctly before submitting to the tax authorities.

What is the purpose of UK WIT02?

The purpose of UK WIT02 is to ensure compliance with UK tax laws by reporting the withholding tax deducted from payments made to non-resident individuals and entities.

What information must be reported on UK WIT02?

UK WIT02 requires information such as the payer's details, payee's details, amounts paid, the nature of the payments, and the amount of withholding tax deducted.

Fill out your application for united kingdom online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For United Kingdom is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.