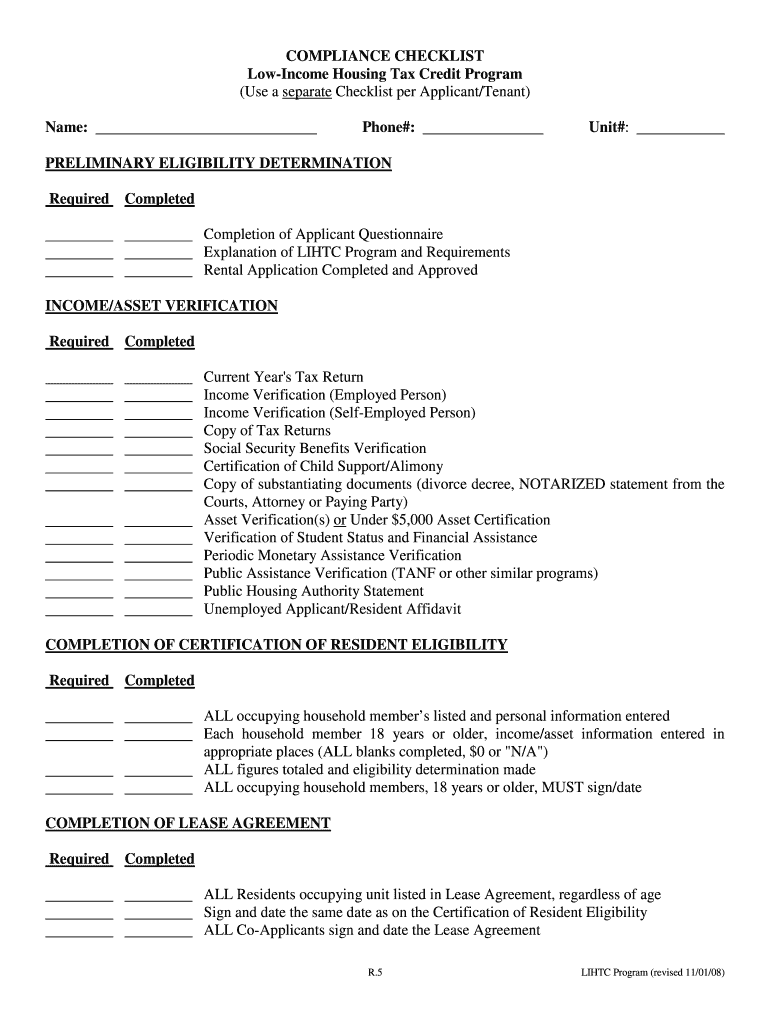

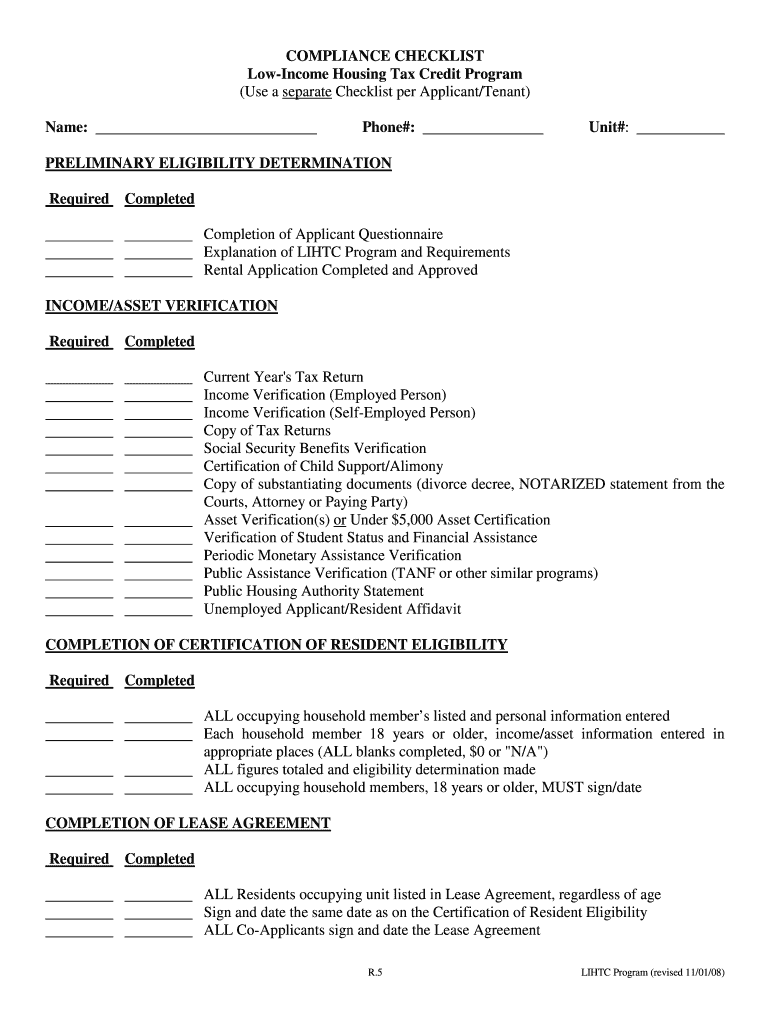

Get the free COMPLIANCE CHECKLIST - Low-Income Housing Tax Credit Program

Show details

A checklist for determining the eligibility of applicants and tenants in the Low-Income Housing Tax Credit Program, including income verification and lease agreement completion.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign compliance checklist - low-income

Edit your compliance checklist - low-income form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your compliance checklist - low-income form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit compliance checklist - low-income online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit compliance checklist - low-income. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out compliance checklist - low-income

How to fill out COMPLIANCE CHECKLIST - Low-Income Housing Tax Credit Program

01

Gather all necessary documentation related to the property and tenants.

02

Review the specific compliance requirements set by the Low-Income Housing Tax Credit Program.

03

Complete tenant eligibility forms for all tenants residing in the property.

04

Verify income sources and calculate tenant income to ensure it meets low-income requirements.

05

Document all lease agreements and ensure they comply with program guidelines.

06

Check property maintenance and management records to ensure compliance with health and safety standards.

07

Maintain records of annual certifications and recertifications for each tenant.

08

Ensure you understand the reporting deadlines and submit the checklist in a timely manner.

09

Keep copies of all documentation for auditing purposes.

Who needs COMPLIANCE CHECKLIST - Low-Income Housing Tax Credit Program?

01

Property owners and managers participating in the Low-Income Housing Tax Credit Program.

02

Compliance officers responsible for overseeing program adherence.

03

Tax professionals advising landlords on Low-Income Housing Tax Credit matters.

04

Investors seeking to understand compliance requirements for tax credits.

Fill

form

: Try Risk Free

People Also Ask about

What is compliance for Section 42 tax credit?

What is Compliance? Compliance means that you fit all the guidelines necessary to live in a Section 42 apartment. Who determines the maximum income levels? Income levels are determined by the Department of Housing and Urban Development (HUD) for each county or metropolitan statistical area.

What is LIHTC compliance?

A: Through a compliance monitoring process, CTCAC enforces the IRS rules of the LIHTC program to ensure properties are renting to income-eligible households, rents are restricted at or below the maximum allowed by the program, and that the property units are maintained in safe, sanitary, and good condition.

Who receives a tax incentive for the low-income housing tax credit program?

The Low-Income Housing Tax Credit provides a tax incentive to construct or rehabilitate affordable rental housing for low-income households. The Low-Income Housing Tax Credit (LIHTC) subsidizes the acquisition, construction, and rehabilitation of affordable rental housing for low- and moderate-income tenants.

How does low-income tax credit work?

The LIHTC gives investors a dollar-for-dollar reduction in their federal tax liability in exchange for providing financing to develop affordable rental housing. Investors' equity contribution subsidizes low-income housing development, thus allowing some units to rent at below-market rates.

How does the state housing finance agency document and report non-compliance findings to the IRS?

For properties in their federal Compliance Period, the Commission files Form 8823, "Low-Income Housing Credit Agencies Report of Noncompliance," with the IRS at the end of the correction period, whether or not the noncompliance is corrected.

How does the low income housing tax credit work?

The LIHTC gives investors a dollar-for-dollar reduction in their federal tax liability in exchange for providing financing to develop affordable rental housing. Investors' equity contribution subsidizes low-income housing development, thus allowing some units to rent at below-market rates.

How much does the low-income housing tax credit cost?

An LIHTC housing project must rent to tenants whose average income is below the area's median income, and this commitment must be maintained for a period of 15 years. The tax credit costs the U.S. government an estimated $13.5 billion every year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is COMPLIANCE CHECKLIST - Low-Income Housing Tax Credit Program?

The Compliance Checklist for the Low-Income Housing Tax Credit (LIHTC) Program is a tool used to ensure that properties meet the requirements set forth by the Internal Revenue Service (IRS) and state agencies for the allocation of tax credits. It assists in the monitoring and compliance process to maintain eligibility for the tax benefits.

Who is required to file COMPLIANCE CHECKLIST - Low-Income Housing Tax Credit Program?

Property owners or managers of developments that have received Low-Income Housing Tax Credits are required to file the Compliance Checklist. This includes entities responsible for the management and oversight of affordable housing projects using LIHTC.

How to fill out COMPLIANCE CHECKLIST - Low-Income Housing Tax Credit Program?

To fill out the Compliance Checklist, property owners should gather necessary documentation that proves compliance with LIHTC requirements, including tenant income certifications, rent records, and occupancy information. Each section of the checklist should be completed accurately, and supporting documents should be attached as needed.

What is the purpose of COMPLIANCE CHECKLIST - Low-Income Housing Tax Credit Program?

The purpose of the Compliance Checklist is to ensure that property owners adhere to the regulations of the LIHTC Program, maintain the affordability of housing, and provide ongoing compliance monitoring to protect both tenants and the tax credit program.

What information must be reported on COMPLIANCE CHECKLIST - Low-Income Housing Tax Credit Program?

The Compliance Checklist must report information such as tenant income and eligibility, lease agreements, rent amounts, utilities included, and any changes in occupancy. Additionally, it may require reporting of property maintenance and management practices related to compliance with the program's regulations.

Fill out your compliance checklist - low-income online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Compliance Checklist - Low-Income is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.