Get the free Individual Characteristics Form (ICF) for Work Opportunity Tax Credit - laworks

Show details

This form is used to determine eligibility for the Work Opportunity Tax Credit (WOTC) program, collecting information from employers and applicants regarding their qualifications.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign individual characteristics form icf

Edit your individual characteristics form icf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your individual characteristics form icf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing individual characteristics form icf online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit individual characteristics form icf. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

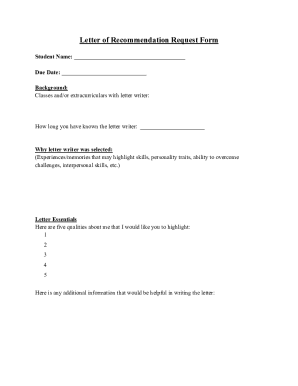

How to fill out individual characteristics form icf

How to fill out Individual Characteristics Form (ICF) for Work Opportunity Tax Credit

01

Obtain the Individual Characteristics Form (ICF) from the official IRS website or your employer.

02

Start by entering the applicant's full name in the designated field.

03

Provide the applicant's Social Security Number (SSN) accurately.

04

Fill in the date of birth of the applicant.

05

Indicate the applicant's gender by checking the appropriate box.

06

Specify the eligible target group the applicant belongs to, as per the WOTC guidelines.

07

Ensure to provide the necessary documentation to support the claims made about the applicant's eligibility.

08

Review all entered information for accuracy and completeness.

09

Sign and date the form to certify the information provided.

10

Submit the completed form to the employer or appropriate agency as directed.

Who needs Individual Characteristics Form (ICF) for Work Opportunity Tax Credit?

01

Employers who are hiring individuals from targeted groups for the Work Opportunity Tax Credit (WOTC) program.

02

Individuals applying for jobs who meet specific criteria under the WOTC guidelines.

Fill

form

: Try Risk Free

People Also Ask about

Is the work opportunity tax credit legit?

Are you an employer? The Work Opportunity Tax Credit (WOTC) is a federal tax credit for employers who hire people from certain target groups like veterans, former felons, youth, SNAP recipients, and more. You could receive a federal tax credit of up to $9,600.

Who qualifies for the American Opportunity Tax Credit?

A student eligible for the American Opportunity tax credit: has not completed the first four years of post-secondary education. enrolls in at least one academic semester during the applicable tax year. maintains at least half-time status in a program leading to a degree or other credential.

Who benefits from the work opportunity tax credit?

Are you an employer? The Work Opportunity Tax Credit (WOTC) is a federal tax credit for employers who hire people from certain target groups like veterans, former felons, youth, SNAP recipients, and more. You could receive a federal tax credit of up to $9,600.

Who fills out form 9061?

The form may be completed, on behalf of the job applicant, by: 1) the employer or employer's representative, 2) the applicant directly (if a minor, the parent or guardian must sign the form), or 3) a participating agency, and signed by the individual completing the form.

How do you qualify for work opportunity tax credit?

Candidates who were unemployed for at least 27 consecutive weeks before they were hired and received any government assistance during their unemployment period qualify for WOTC.

Who is eligible for the work opportunity credit?

For TANF recipients, veterans, ex-felons, designated community residents, vocational rehabilitation referrals, summer youth workers, SNAP recipients, SSI recipients, or long-term unemployed: 40% tax credit if the employee works at least 400 hours. 25% tax credit if the employee works 120–399 hours.

Who falls under WOTC?

An employer may claim the WOTC for an individual who is certified as a member of any of the following targeted groups under section 51 of the Code: the formerly incarcerated or those previously convicted of a felony; recipients of state assistance under part A of title IV of the Social Security Act (SSA);

Should I fill out the Work Opportunity tax credit questionnaire?

Completing the WOTC questionnaire is a simple, secure, and advantageous step in your job application process. It not only helps potential employers but can also significantly improve your employment prospects.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Individual Characteristics Form (ICF) for Work Opportunity Tax Credit?

The Individual Characteristics Form (ICF) for Work Opportunity Tax Credit is a form used by employers to document the characteristics of individuals who may qualify for the Work Opportunity Tax Credit (WOTC), which incentivizes hiring employees from certain target groups.

Who is required to file Individual Characteristics Form (ICF) for Work Opportunity Tax Credit?

Employers who wish to claim the Work Opportunity Tax Credit for hiring eligible individuals from specific target groups are required to file the Individual Characteristics Form (ICF).

How to fill out Individual Characteristics Form (ICF) for Work Opportunity Tax Credit?

To fill out the Individual Characteristics Form (ICF), employers need to provide accurate information about the employee, including their personal details, eligibility criteria for the targeted groups, and signatures where required. The form must be submitted alongside other WOTC documentation to the relevant tax authority.

What is the purpose of Individual Characteristics Form (ICF) for Work Opportunity Tax Credit?

The purpose of the Individual Characteristics Form (ICF) is to collect and verify necessary information about job applicants to determine their eligibility for the Work Opportunity Tax Credit and to provide evidence for tax credits claimed by employers.

What information must be reported on Individual Characteristics Form (ICF) for Work Opportunity Tax Credit?

The Individual Characteristics Form (ICF) must report information such as the individual's name, Social Security number, date of birth, eligibility criteria related to target groups, and any other relevant details that support their qualification for the Work Opportunity Tax Credit.

Fill out your individual characteristics form icf online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Individual Characteristics Form Icf is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.