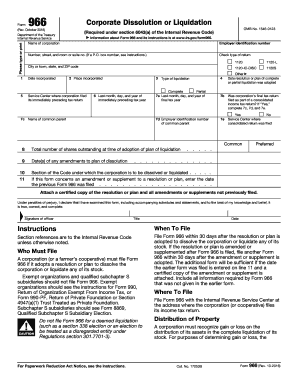

IRS 966 1998 free printable template

Instructions and Help about IRS 966

How to edit IRS 966

How to fill out IRS 966

About IRS previous version

What is IRS 966?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

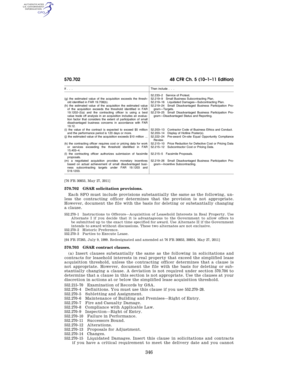

Is the form accompanied by other forms?

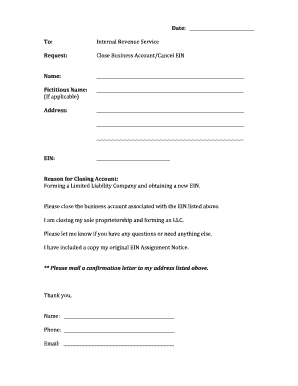

Where do I send the form?

FAQ about IRS 966

What should I do if I need to correct a mistake after submitting IRS 966?

If you need to correct a mistake on your IRS 966 after submission, you can file an amended form using the same process as initially filed. Make sure to clearly indicate that it is an amended submission. Keep documentation of your changes and any correspondence regarding the amendment.

How can I track the status of my IRS 966 submission?

To track your IRS 966 submission, you can use the IRS online tools for checking the status of your filed forms. Be aware of common e-file rejection codes; resolving these quickly can help avoid delays in processing. If your form is rejected, follow the specific instructions provided to correct and resubmit.

Are electronic signatures acceptable on IRS 966 submissions?

Yes, electronic signatures are acceptable when submitting your IRS 966 online, as long as they meet the IRS's standards for security and authenticity. Ensure that your filing software complies with IRS requirements for e-signatures to ensure acceptance.

What should I do if I receive a notice from the IRS regarding my submitted form?

If you receive a notice from the IRS concerning your submitted IRS 966, read it carefully to understand what is required. Typically, you may need to provide additional documentation or clarification. Promptly gather the necessary information and respond in accordance with the instructions provided in the notice.

What common errors should I be aware of when filing IRS 966?

Common errors when filing IRS 966 include omissions of required information and using incorrect entity details. To avoid these issues, cross-check all entries for accuracy and completeness before submission. It is also beneficial to review IRS guidelines to ensure you meet all necessary criteria.

See what our users say