Get the free Custom Rebate Application

Show details

This document is used by customers to apply for a custom rebate for energy efficiency projects, requiring information about the customer, contractor, and project details.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign custom rebate application

Edit your custom rebate application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your custom rebate application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit custom rebate application online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit custom rebate application. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

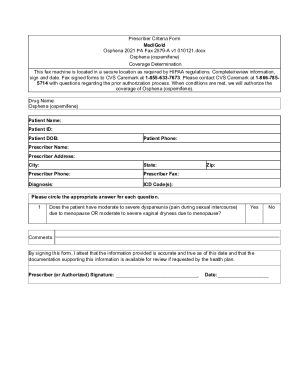

How to fill out custom rebate application

How to fill out Custom Rebate Application

01

Gather all necessary documents, including proof of purchase and eligibility criteria.

02

Complete personal information at the top of the application form, such as name, address, and contact details.

03

Provide details of the product or service that qualifies for the rebate.

04

Attach all required documents, ensuring they are legible and properly formatted.

05

Review the application for accuracy and completeness.

06

Sign and date the application form.

07

Submit the application by the specified method (online, by mail, or in person) as instructed.

Who needs Custom Rebate Application?

01

Consumers who have purchased qualifying products or services.

02

Businesses looking to offset costs through rebates.

03

Individuals or organizations seeking financial incentives from manufacturers or service providers.

Fill

form

: Try Risk Free

People Also Ask about

How does a rebate program work?

Rebate programs are strategic financial incentives that return a portion of purchase prices to customers who meet specific performance criteria. Unlike immediate discounts, rebates are paid after purchases are completed, creating powerful incentives that influence buying behavior while preserving price integrity.

What is the $1500 EV rebate in California?

Buy a used (pre-owned) battery electric vehicle (BEV) and you may be eligible for a cash rebate of $1,500. This rebate only applies to used all-electric vehicles with a purchase price below $40,000.

What is the $7500 tax rebate in California?

Categories. The Clean Vehicle Rebate Project (CVRP) is closed, effective November 8, 2023. CVRP offered up to $7,500 to purchase or lease a new plug-in hybrid electric vehicle (PHEV), battery electric vehicle (BEV), or a fuel cell electric vehicle (FCEV).

Who is eligible for the Golden State rebate?

Who is eligible? To qualify for our instant rebates, you must be a residential customer on a residential rate with an active meter serviced by a Participating California Utility for the installation address.

What is the California energy rebate program?

Home Electrification and Appliance Rebates Program (called “HEEHRA” in California) helps reduce the costs of replacing aging, broken or inefficient home energy equipment. HEEHRA is available only for income-eligible households. HEEHRA Phase I was launched in October 2024 through TECH Clean California.

What is the $1,200 energy tax credit?

The maximum credit you can claim each year is: $1,200 for energy efficient property costs and certain energy efficient home improvements, with limits on exterior doors ($250 per door and $500 total), exterior windows and skylights ($600) and home energy audits ($150)

How do you qualify for inflation reduction act rebates?

Households that earn up to 150% of the area's median income will be eligible. If you make more, there is no need to wait for the state rebates to begin your home project, as your income would not be eligible.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Custom Rebate Application?

A Custom Rebate Application is a formal request submitted by businesses or individuals to claim rebates on customs duties paid for imported goods under specific programs or regulations.

Who is required to file Custom Rebate Application?

Businesses or individuals who have paid customs duties on imported goods and wish to claim a refund or rebate under applicable customs regulations are required to file a Custom Rebate Application.

How to fill out Custom Rebate Application?

To fill out a Custom Rebate Application, one must gather required documentation, accurately complete the application form with relevant information about the imported goods, duties paid, and submit it along with any supporting documents to the customs authority.

What is the purpose of Custom Rebate Application?

The purpose of the Custom Rebate Application is to allow eligible importers to recover a portion or all of the customs duties paid on goods that meet certain criteria and to facilitate fair trade practices.

What information must be reported on Custom Rebate Application?

The Custom Rebate Application must report details such as the importer’s information, description of the goods, customs declaration number, amount of duties paid, and any relevant invoices or supporting documentation.

Fill out your custom rebate application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Custom Rebate Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.