Get the free Accounts Receivable Menu Manual

Show details

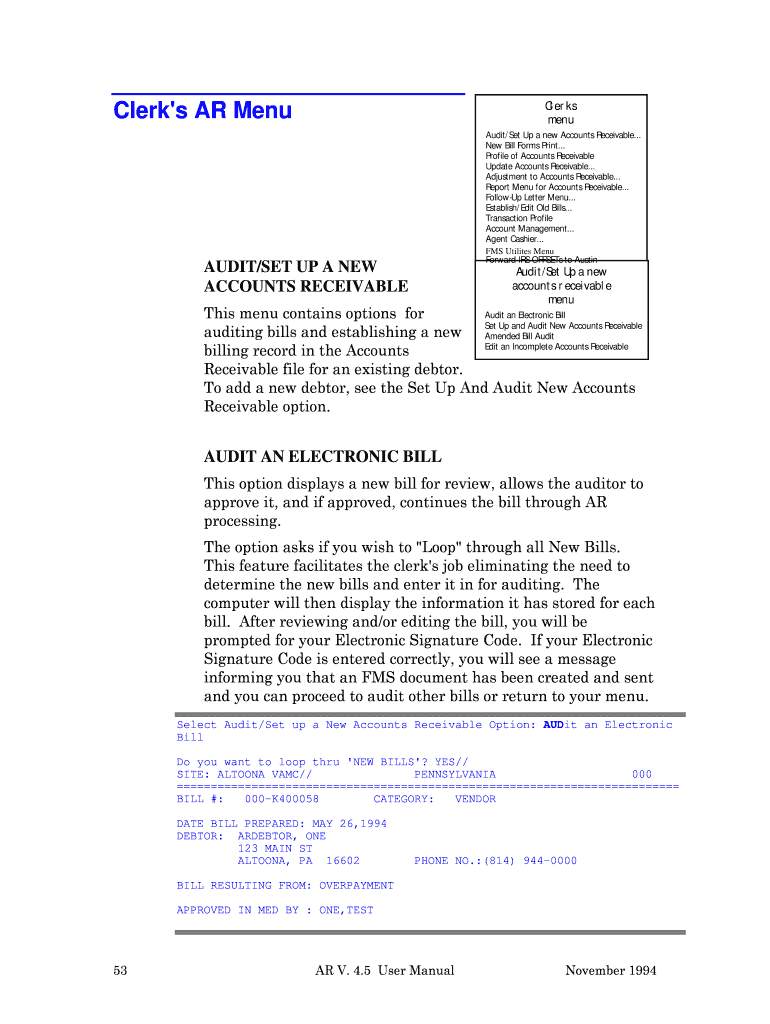

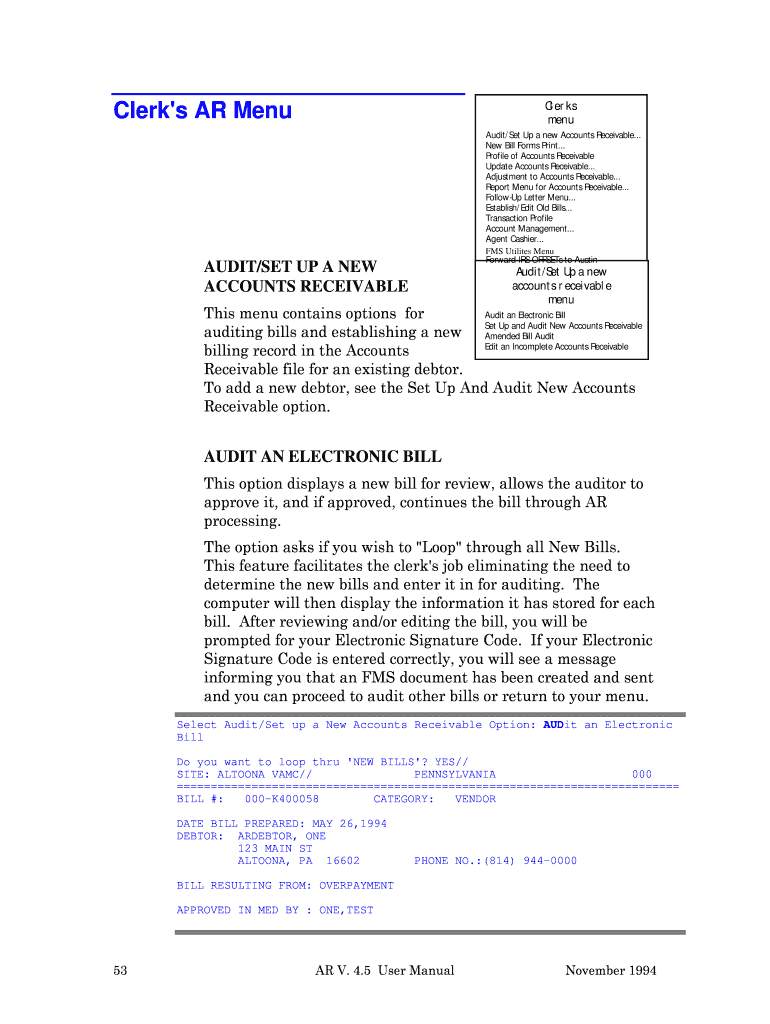

This document serves as a manual for clerks managing accounts receivable within a financial management system, detailing procedures for auditing, billing, and debt collection.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign accounts receivable menu manual

Edit your accounts receivable menu manual form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your accounts receivable menu manual form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing accounts receivable menu manual online

To use the professional PDF editor, follow these steps below:

1

Log into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit accounts receivable menu manual. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out accounts receivable menu manual

How to fill out Accounts Receivable Menu Manual

01

Open the Accounts Receivable Menu Manual document.

02

Review the sections to understand the layout and content.

03

Begin with the header, including the company name and manual title.

04

Move to the introduction, outlining the purpose of the manual.

05

Fill out the specific sections such as customer information, invoice details, and payment terms.

06

Ensure all entries are accurate and complete.

07

Use consistent formatting throughout the document.

08

Review and proofread your entries before finalizing the manual.

Who needs Accounts Receivable Menu Manual?

01

Accounts Receivable staff responsible for managing customer invoices.

02

Financial managers overseeing cash flow and collections.

03

Auditors and compliance officers needing to review accounts.

04

New employees requiring training on the accounts receivable process.

05

IT personnel for integrating software systems with receivable functions.

Fill

form

: Try Risk Free

People Also Ask about

What is the 80 20 rule in accounts receivable?

If the turnover ratio is 10, the DSO would be 36.5, indicating that the company has 36.5 days of outstanding receivables. Analyzing DSO along with the AR turnover ratio gives a more comprehensive picture of the collections process and performance.

What is the 10 rule for accounts receivable?

The 10% Rule specifically suggests that if 10% or more of a customer's receivables are significantly overdue, all receivables from that customer may be considered high-risk.

What is a 10 times receivables turnover?

What are the 5 C's of accounts receivable management and their significance? The 5 C's—Character, Capacity, Capital, Conditions, and Collateral—help assess a customer's creditworthiness.

What is account receivable English?

Meaning of accounts receivable in English. the amounts in a company's accounts that show money that is owed to the company by its customers: At the end of the fiscal year, the company had $106 million in accounts receivable.

What are the GAAP rules for accounts receivable?

The rule is often used to point out that 80% of a company's revenue is generated by 20% of its customers. Viewed in this way, it might be advantageous for a company to focus on the 20% of clients that are responsible for 80% of revenues and market specifically to them.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Accounts Receivable Menu Manual?

The Accounts Receivable Menu Manual is a comprehensive guide that provides procedures, policies, and instructions for managing and recording accounts receivable transactions effectively.

Who is required to file Accounts Receivable Menu Manual?

Typically, businesses that manage credit sales and have outstanding customer invoices are required to file the Accounts Receivable Menu Manual as part of their financial reporting.

How to fill out Accounts Receivable Menu Manual?

To fill out the Accounts Receivable Menu Manual, you must follow the outlined steps in the manual, which include entering relevant account details, transaction dates, amounts owed, and providing customer information.

What is the purpose of Accounts Receivable Menu Manual?

The purpose of the Accounts Receivable Menu Manual is to ensure accurate tracking and reporting of amounts owed by customers, improving cash flow management and financial accuracy.

What information must be reported on Accounts Receivable Menu Manual?

The information that must be reported includes customer names, invoice numbers, amounts due, due dates, payment terms, and any relevant notes regarding the transactions.

Fill out your accounts receivable menu manual online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Accounts Receivable Menu Manual is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.