Get the free Financial Strategies for Successful Retirement - business vcu

Show details

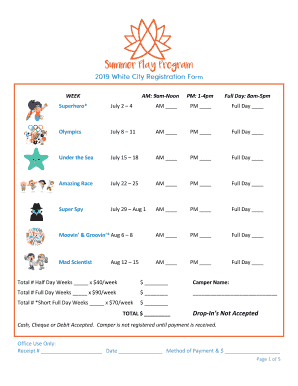

This document serves as a registration form for a seminar focused on retirement planning, offering educational content on managing finances for retirement, including various strategies, potential

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign financial strategies for successful

Edit your financial strategies for successful form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your financial strategies for successful form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit financial strategies for successful online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit financial strategies for successful. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out financial strategies for successful

How to fill out Financial Strategies for Successful Retirement

01

Start by assessing your current financial situation, including income, expenses, savings, and debts.

02

Determine your retirement goals, such as lifestyle expectations, travel plans, and living arrangements.

03

Estimate your retirement income sources, like Social Security, pensions, or retirement accounts.

04

Create a detailed budget that accounts for expected expenses during retirement.

05

Develop a savings plan that includes contributions to retirement accounts like 401(k)s or IRAs.

06

Consider investment options to grow your savings, such as stocks, bonds, or mutual funds.

07

Review healthcare costs and plan for insurance and medical expenses in retirement.

08

Consult with a financial advisor for tailored strategies and to stay informed about changes in tax laws and retirement policies.

09

Regularly revisit and adjust your financial plan to align with changing circumstances and goals.

Who needs Financial Strategies for Successful Retirement?

01

Individuals planning for retirement who want to secure their financial future.

02

Pre-retirees looking to optimize their savings and investments before retiring.

03

Those seeking to maintain their current lifestyle post-retirement.

04

Any workers who want to understand their financial needs and options for a comfortable retirement.

05

Families looking to ensure financial stability for their loved ones in retirement.

Fill

form

: Try Risk Free

People Also Ask about

How much do I need in a 401k to get $1000 a month?

The savings guideline states that for every $1,000 of monthly income you want to generate in your golden years, you'll need to have $240,000 saved in your retirement account. The rule assumes a 5% annual withdrawal rate and a 5% annual return.

What is the 70% rule for retirement?

A common rule of thumb is the 4% rule, which suggests withdrawing 4% of a balanced stock/bond portfolio annually, adjusted for inflation. While it's not foolproof, it offers a rough estimate: $500,000 could potentially provide $20,000 per year for 25 to 30 years, depending on investment returns and market conditions.

What is the $1000 a month rule for retirement?

Another rule of thumb that you can use to figure out how much you'll need to save for retirement is the so-called “70% rule,” which says your retirement spending will be 70% of your pre-retirement post-tax income, ing to Experian, a credit rating agency.

What is the 3 bucket retirement strategy?

The 3 Bucket Strategy is a well-known financial planning method that categorizes assets into three separate 'buckets': short-term income needs, intermediate requirements and long-term necessities. Assets within each bucket should be invested in different ways depending on when the money will need to be accessed.

How long would $500,000 last in retirement?

Yes, retiring comfortably with $500,000 is achievable. This amount can support an annual withdrawal of up to $34,000, covering a 25-year period from age 60 to 85. If your lifestyle can be maintained at $30,000 per year or about $2,500 per month, then $500,000 should be sufficient for a secure retirement.

How many people have $1,000,000 in retirement savings?

Only approximately 10% of American retirees have successfully saved $1 million or more, as indicated by a Survey of Consumer Finances conducted by the Federal Reserve in 2022.

Is $2000 a month enough to retire on?

“Retiring on $2,000 per month is very possible,” said Gary Knode, president at Safe Harbor Financial. “In my practice, I've seen it work. The key is reducing expenses and eliminating any market risk that could impact your savings if there were a major market downturn.”

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Financial Strategies for Successful Retirement?

Financial Strategies for Successful Retirement refer to planned methods and approaches that individuals use to accumulate enough resources to support their lifestyle in retirement. This includes saving, investing, budgeting, and utilizing retirement accounts and benefits.

Who is required to file Financial Strategies for Successful Retirement?

Individuals who are planning for retirement, including employees, self-employed persons, and those managing their retirement funds, should consider filing or formalizing their Financial Strategies for Successful Retirement.

How to fill out Financial Strategies for Successful Retirement?

To fill out Financial Strategies for Successful Retirement, individuals should assess their current financial situation, determine their retirement goals, list available resources and retirement accounts, calculate expected expenses, and document a timeline for achieving these goals.

What is the purpose of Financial Strategies for Successful Retirement?

The purpose of Financial Strategies for Successful Retirement is to ensure that individuals can maintain their desired lifestyle after they stop working by having sufficient funds and resources set aside to cover living expenses and unexpected costs.

What information must be reported on Financial Strategies for Successful Retirement?

Information that must be reported includes current income, savings, investment portfolios, anticipated retirement income sources, projected expenses during retirement, and any debts or financial obligations that must be considered.

Fill out your financial strategies for successful online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Financial Strategies For Successful is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.