Get the free Agreement for Salary Reduction for Employee Contributions Under St. Jude Defined Con...

Show details

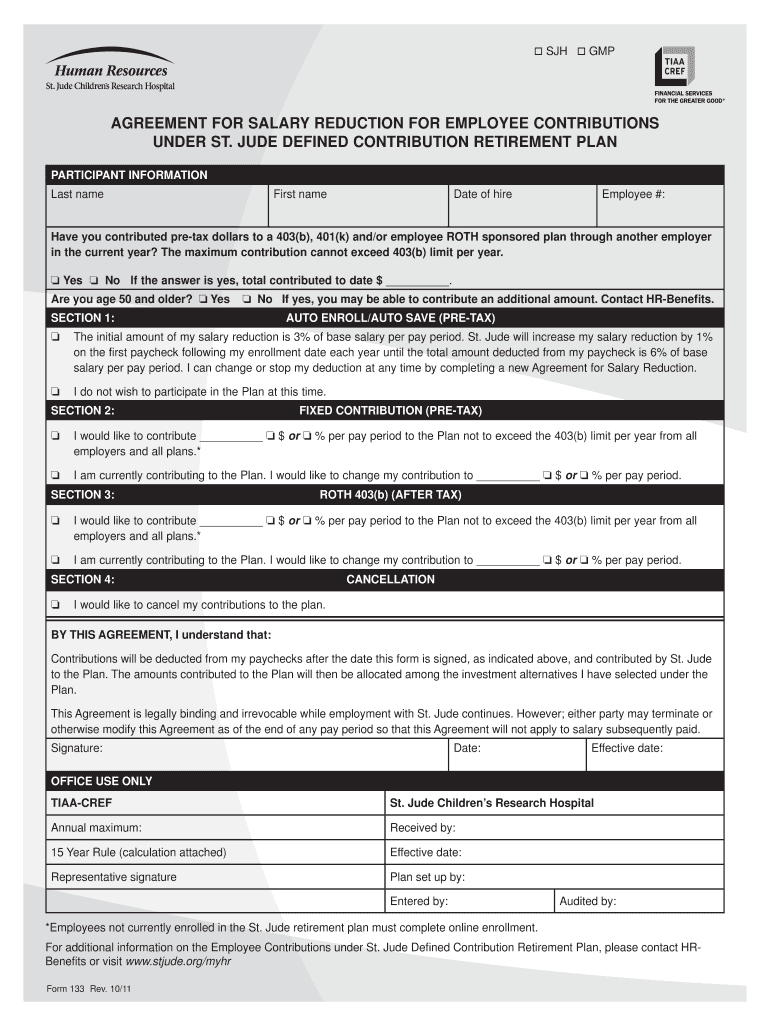

This document outlines an employee's agreement to reduce their salary in order to contribute to a retirement plan, specifying different contribution options and conditions.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign agreement for salary reduction

Edit your agreement for salary reduction form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your agreement for salary reduction form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing agreement for salary reduction online

To use the services of a skilled PDF editor, follow these steps below:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit agreement for salary reduction. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out agreement for salary reduction

How to fill out Agreement for Salary Reduction for Employee Contributions Under St. Jude Defined Contribution Retirement Plan

01

Begin by obtaining the Agreement for Salary Reduction form from the HR department or the company's internal website.

02

Carefully read through the instructions provided on the form to ensure understanding of its purpose.

03

Fill in your personal information such as your name, employee ID, and department in the designated sections of the form.

04

Specify the percentage or dollar amount you wish to reduce from your salary for contributions to the St. Jude Defined Contribution Retirement Plan.

05

Review the terms and conditions of the agreement, including how the contributions will be managed and any changes that may occur.

06

Sign and date the form to indicate your agreement to the salary reduction.

07

Submit the completed form to your HR representative for processing.

Who needs Agreement for Salary Reduction for Employee Contributions Under St. Jude Defined Contribution Retirement Plan?

01

Employees who want to contribute to the St. Jude Defined Contribution Retirement Plan through salary reductions.

02

Individuals looking to maximize their retirement savings while minimizing their taxable income.

03

Any employee of St. Jude who is eligible for participation in the retirement plan.

Fill

form

: Try Risk Free

People Also Ask about

What is a salary reduction retirement plan?

Under salary reduction agreements, an employee can take advantage of tax deferral. through 401(k) or 403(b) plans or by receiving tax-free benefits through a cafeteria plan. Under 401(k) and 403(b) plans, amounts reducing salary are invested in selected. investments or annuities for future retirement.

Is an agreement for the employer to provide benefits payments to employees after they retire?

A pension plan is an agreement between the employer and the employee. The employer will be providing his employee estimated benefits after retirement for the services performed currently and for the services performed from the past.

What is a 457b salary reduction agreement?

An eligible deferred compensation plan under IRC Section 457(b) is an agreement or arrangement (which may be an individual employment agreement) under which the payment of compensation is deferred (whether by salary reduction or by nonelective employer contribution).

Does St. Jude have a pension plan?

See how much you can save Jude helps you prepare for retirement. Your contributions to the Plan, combined with the employer contributions and the effects of compound interest over time, can make a significant difference in your financial well-being in retirement.

What is a Section 403 B salary reduction agreement?

The Salary Reduction Agreement (SRA) is utilized to establish, change, or cancel salary reductions withheld from your paycheck and contributed to the 403(b) Plan on your behalf. The SRA is also used to change the investment providers that receive your contributions.

What is a 403b and how does it work?

These voluntary agreements allow a company, at the discretion of the employee, to reduce the employee's compensation so the company can contribute that reduced amount to their selected retirement accounts.

What is section 403 B salary reduction agreement?

A 403(b) plan may allow: Elective deferrals - employee contributions made under a salary reduction agreement. The agreement allows an employer to withhold money from an employee's salary and deposit it into a 403(b) account.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Agreement for Salary Reduction for Employee Contributions Under St. Jude Defined Contribution Retirement Plan?

The Agreement for Salary Reduction allows employees to choose to have a portion of their salary deducted to contribute to the St. Jude Defined Contribution Retirement Plan, thereby reducing their taxable income.

Who is required to file Agreement for Salary Reduction for Employee Contributions Under St. Jude Defined Contribution Retirement Plan?

Employees who wish to participate in the St. Jude Defined Contribution Retirement Plan and have their salary reduced for contributions must file this agreement.

How to fill out Agreement for Salary Reduction for Employee Contributions Under St. Jude Defined Contribution Retirement Plan?

To fill out the agreement, employees need to provide their personal information, the percentage or amount they wish to contribute from their salary, and sign the document to indicate their consent.

What is the purpose of Agreement for Salary Reduction for Employee Contributions Under St. Jude Defined Contribution Retirement Plan?

The purpose of the agreement is to facilitate employee contributions to the retirement plan through salary reduction, helping employees save for retirement while potentially reducing their current taxable income.

What information must be reported on Agreement for Salary Reduction for Employee Contributions Under St. Jude Defined Contribution Retirement Plan?

The agreement must report the employee's name, employee ID, the amount or percentage of salary reduction, and the effective date of the agreement.

Fill out your agreement for salary reduction online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Agreement For Salary Reduction is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.