Get the free Payroll Outside of WTE - emich

Show details

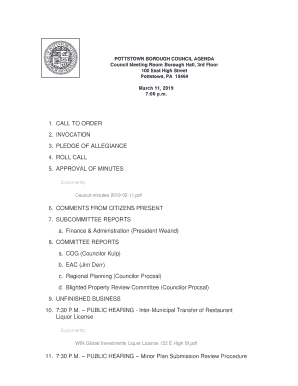

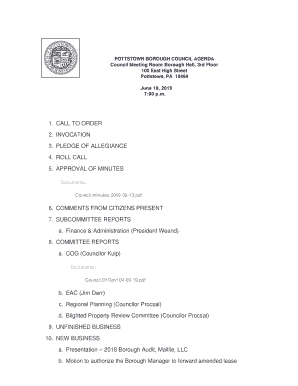

This form is used to report payroll items not included as Web Time Entry (WTE) options, requiring completion by an approver or proxy, along with signatures and submission to the Payroll department.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign payroll outside of wte

Edit your payroll outside of wte form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your payroll outside of wte form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit payroll outside of wte online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit payroll outside of wte. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out payroll outside of wte

How to fill out Payroll Outside of WTE

01

Gather employee information such as names, IDs, and hours worked.

02

Calculate total wages for each employee based on hours worked and pay rate.

03

Fill out the payroll form with employee details, including deductions and bonuses.

04

Verify the accuracy of the entered information.

05

Submit the completed payroll forms to the appropriate department for processing.

Who needs Payroll Outside of WTE?

01

Companies that employ freelancers or contractors.

02

Businesses that operate outside of the typical WTE arrangements.

03

Organizations with employees not enrolled in standard payroll systems.

04

Employers needing to manage specific payroll scenarios that WTE cannot accommodate.

Fill

form

: Try Risk Free

People Also Ask about

What are the different types of payroll?

The most common payroll cycle types are weekly, bi-weekly (every two weeks), semi-monthly (twice a month) and monthly. On a global scale, the most common pay cycle is a monthly payroll, but there are differences between countries.

Can you do payroll on simple practice?

Learn how to easily manage a group practice in SimplePractice, including how to add team members, manage your calendar, and calculate payroll.

What is the meaning of payroll in English?

payroll in American English 1. a list of employees to be paid, with the amount due to each. 2. the sum total of these amounts.

Can I do manual payroll?

Manual payroll: running payroll manually can be cost-effective but also time-consuming and prone to human error. Payroll software: payroll solutions automate the process to help minimise errors and save time. Outsourcing: payroll service providers can handle all your payroll tasks for a more hands-off approach.

How to do manual calculation for payroll?

Your manual payroll calculations are based on the pay frequency and their hourly wage. So, for someone who is full time making $11 an hour on a biweekly pay schedule, the calculation would look like this: 40 hours x 2 weeks = 80 hours x $11/hour = $880 (gross regular pay).

Can you do payroll manually?

When you do your own payroll, you can either do everything manually or use payroll software. Regardless of which method you choose, you must start by gathering some information to calculate hours worked. To run payroll for your employees, you first need information such as: Federal Employer Identification Number (FEIN)

Where does the word payroll come from?

payroll(n.) also pay-roll, 1740, "a list of persons to be paid, with indication of the sums to which they are entitled," from pay (v.) + roll (n.). The meaning "total amount paid to employees over a period" is by 1898.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Payroll Outside of WTE?

Payroll Outside of WTE refers to payroll-related activities and compensation that are not included in the Work Time Equivalent (WTE) calculations, often involving employees who do not directly contribute hours worked to the WTE metrics.

Who is required to file Payroll Outside of WTE?

Entities or organizations that employ workers on a contractual basis, include independent contractors, or have employees whose compensation is not tracked through WTE must file Payroll Outside of WTE.

How to fill out Payroll Outside of WTE?

To fill out Payroll Outside of WTE, organizations need to gather required employee information, document their compensation, and comply with specific reporting formats and guidelines provided by relevant governing bodies.

What is the purpose of Payroll Outside of WTE?

The purpose of Payroll Outside of WTE is to ensure accurate reporting and compliance for employees whose compensation is not calculated within the standard WTE framework, allowing for transparency and regulatory adherence.

What information must be reported on Payroll Outside of WTE?

Information that must be reported includes employee names, identification numbers, compensation amounts, the period of payment, and any relevant classifications or contract details.

Fill out your payroll outside of wte online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Payroll Outside Of Wte is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.