Get the free SBA Counseling Information Form - fhsu

Show details

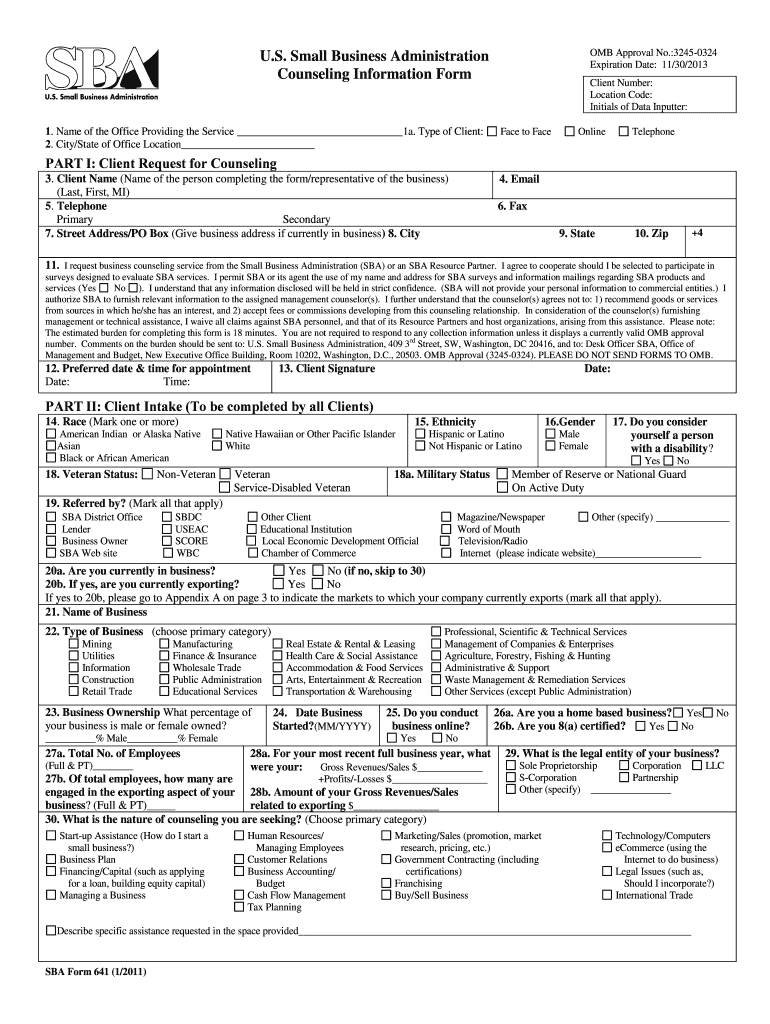

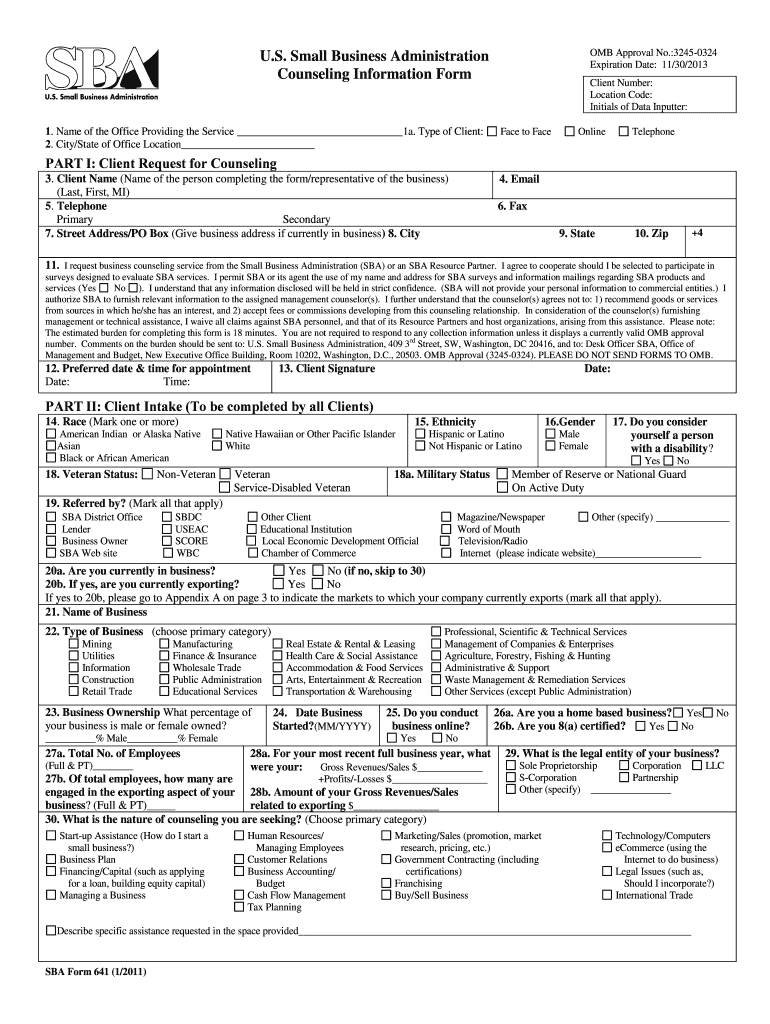

This form is used by clients seeking business counseling services from the U.S. Small Business Administration (SBA) or its Resource Partners. It gathers essential information about the client's business

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sba counseling information form

Edit your sba counseling information form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sba counseling information form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sba counseling information form online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit sba counseling information form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sba counseling information form

How to fill out SBA Counseling Information Form

01

Start by entering your personal information such as name, address, and contact details.

02

Provide information about your business, including its name, address, and the type of business.

03

Indicate the specific services you are seeking counseling for, such as business planning, funding, or marketing.

04

Fill out any financial information requested, like income and expenses if applicable.

05

Review the form carefully for any missing information or errors.

06

Submit the form either online or via the recommended method provided by the SBA.

Who needs SBA Counseling Information Form?

01

Small business owners looking for guidance and support to improve their business operations.

02

Entrepreneurs seeking advice on starting a new business.

03

Individuals needing assistance with business planning or securing financing.

04

Those looking to expand their existing business and require expert counseling.

Fill

form

: Try Risk Free

People Also Ask about

What is the minimum revenue for SBA loan?

Revenue: At least $50,000 on average, annually Businesses must have at least $50,000 in average annual revenue to qualify for an SBA 7(a) working capital loan. Your loan size will vary based upon the amount of your revenue. Generally speaking, higher revenue amounts translate into higher loan amounts.

What is SBA Form 159?

The purpose of Form 159 in the SBA 7(a) loan process is to record any fees getting paid for SBA financing in order to keep lenders from paying related parties additional fees – and then charging you. This keeps the total costs of the loan lower, making affordable loans more of a possibility for small businesses.

What is the SBA 641 form?

SBA Form 641 is used to collect information from the Agency's resource partners, including: Small Business Development Centers, SCORE, and Women's Business Centers that provide training and counseling to existing or potential small business owners through SBA funded grants, or cooperative agreements.

What is the form for SBA loan forgiveness?

The PPP loan forgiveness application form 3508S is the form that small business owners can use to apply for forgiveness for PPP loans of $150,000 or less. There are three forms that borrowers can use to apply for PPP loan forgiveness: Form 3508. Form 3508EZ.

Which are the eligibility requirements for a small business administration (SBA) grant?

Eligibility requirements Be an operating business. Operate for profit. Be located in the U.S. Be small under SBA size requirements. Not be a type of ineligible business. Not be able to obtain the desired credit on reasonable terms from non-federal, non-state, and non-local government sources.

What is the SBA personal financial statement form?

SBA Form 413, formally titled “Personal Financial Statement,” is a document that the U.S. Small Business Administration uses to assess the creditworthiness and repayment ability of its loan applicants. This form collects information about your personal finances, such as assets, liabilities and sources of income.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is SBA Counseling Information Form?

The SBA Counseling Information Form is a document used by the Small Business Administration (SBA) to collect information from individuals seeking counseling services related to small business development.

Who is required to file SBA Counseling Information Form?

Individuals who are seeking counseling or assistance from SBA-approved counseling organizations are required to file the SBA Counseling Information Form.

How to fill out SBA Counseling Information Form?

To fill out the SBA Counseling Information Form, individuals should provide their personal information, business details, and any specific needs or goals related to their counseling session, ensuring all sections of the form are completed accurately.

What is the purpose of SBA Counseling Information Form?

The purpose of the SBA Counseling Information Form is to gather relevant information that helps counselors understand the needs of the entrepreneur and tailor their advice and support accordingly.

What information must be reported on SBA Counseling Information Form?

The information that must be reported on the SBA Counseling Information Form includes the individual’s name, contact information, details about their business, type of assistance needed, and any specific goals they have for their counseling sessions.

Fill out your sba counseling information form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sba Counseling Information Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.