Get the free IRA Rollover Letter - pts

Show details

This document serves as a formal request to initiate a direct charitable distribution from an Individual Retirement Account (IRA) to a designated charity, ensuring compliance with IRS regulations.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ira rollover letter

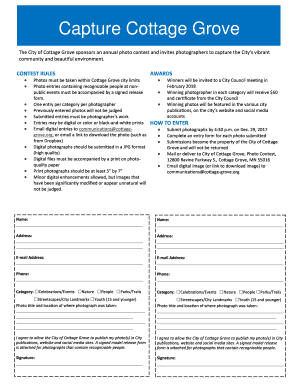

Edit your ira rollover letter form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ira rollover letter form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ira rollover letter online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ira rollover letter. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ira rollover letter

How to fill out IRA Rollover Letter

01

Start by addressing the letter to your current IRA custodian or administrator.

02

Include your full name, address, and contact information at the top of the letter.

03

State the purpose of the letter clearly, mentioning that you are requesting an IRA rollover.

04

Specify the account details of your current IRA and the new IRA account where you want the funds to be transferred.

05

Include any necessary account numbers and addresses for both the current and new IRA institutions.

06

Mention the amount you wish to roll over, ensuring to specify if it is a full or partial rollover.

07

Provide any required identification or documentation for the rollover process.

08

Sign and date the letter at the bottom.

09

Keep a copy of the letter for your records and send it via certified mail to ensure delivery.

Who needs IRA Rollover Letter?

01

Individuals who are changing jobs and want to roll over their 401(k) or other retirement plans into an IRA.

02

People who are looking to consolidate their retirement accounts to simplify management.

03

Individuals who wish to avoid early withdrawal penalties by transferring funds into an IRA.

04

Anyone seeking to take advantage of different investment options or benefits offered by a new IRA custodian.

Fill

form

: Try Risk Free

People Also Ask about

How does IRS verify IRA contributions?

IRA contributions will be reported on Form 5498: IRA contribution information is reported for each person for whom any IRA was maintained, including SEP or SIMPLE IRAs. An IRA includes all investments under one IRA plan. The institution maintaining the IRA files this form.

How do I prove a 60 day rollover?

To qualify for the 60-day rule, the two accounts must be the same type of IRA – Roth or traditional IRA. The original custodian will send a tax form called a 1099-R, which you will file with your yearly income taxes. The custodian will also submit a Form 5498 to the IRS showing the contributed/transferred amount.

How do I prove a rollover to the IRS?

These procedures are generally sufficient: employee certification of the source of the funds. verification of the payment source (on the incoming rollover check or wire transfer) as the participant's IRA or former plan.

How do I prove IRA rollover to IRS?

Review Form 5498. This is an information form that provides details about the rollover and confirms to the IRS that the distribution was successfully rolled over.

Do you always get a 1099-R for a rollover?

Any funds that you rolled over will generate Form 1099-R for the year of the rollover. There may be more than one form.

What is a letter of determination for rollover?

An IRS determination letter expresses an opinion on the qualified status of the plan document. This document is required to be generated from the old provider of the 401(k) you wish to roll over, and is needed to complete the rollover.

What is a letter of acceptance for a rollover?

If you are rolling money into your Guideline account, the financial institution sending the funds may require a Letter of Acceptance (LOA). This letter simply confirms that Guideline is able to accept the funds from your inbound rollover.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is IRA Rollover Letter?

An IRA Rollover Letter is a document used to instruct the transfer of assets from one Individual Retirement Account (IRA) to another, typically without incurring tax penalties.

Who is required to file IRA Rollover Letter?

Individuals who wish to move their retirement savings from one IRA to another without triggering tax consequences are required to file an IRA Rollover Letter.

How to fill out IRA Rollover Letter?

To fill out an IRA Rollover Letter, you generally need to provide your personal information, the details of the current IRA provider, the new IRA provider details, account numbers, and the amount being rolled over.

What is the purpose of IRA Rollover Letter?

The purpose of an IRA Rollover Letter is to facilitate the transfer of funds between IRA accounts while ensuring that the transaction complies with IRS regulations and avoids tax penalties.

What information must be reported on IRA Rollover Letter?

The IRA Rollover Letter must include personal identification details, current and new IRA account numbers, the amount being rolled over, and signatures from the account holder.

Fill out your ira rollover letter online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ira Rollover Letter is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.