Get the free STUDENT CERTIFICATION OF NON-FILING U.S. TAX RETURN 2011-2012 - uvm

Show details

This document is used by students to certify that they have not filed, and will not be required to file, a 2010 U.S. Income Tax Return for financial aid purposes.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign student certification of non-filing

Edit your student certification of non-filing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your student certification of non-filing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit student certification of non-filing online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit student certification of non-filing. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out student certification of non-filing

How to fill out STUDENT CERTIFICATION OF NON-FILING U.S. TAX RETURN 2011-2012

01

Obtain the STUDENT CERTIFICATION OF NON-FILING U.S. TAX RETURN 2011-2012 form from the relevant authority or institution.

02

Fill in your personal details including your name, social security number, and date of birth in the designated sections.

03

Indicate the tax year for which you are certifying non-filing, which is the year 2011-2012.

04

Provide any additional required information specific to your circumstance or institution guidelines.

05

Sign and date the form to confirm the information is accurate and truthful.

06

Submit the completed form to the appropriate office or department as instructed.

Who needs STUDENT CERTIFICATION OF NON-FILING U.S. TAX RETURN 2011-2012?

01

Students who did not file a U.S. tax return for the year 2011-2012 and are applying for financial aid or scholarships.

02

Individuals who are required to provide proof of non-filing for verification purposes.

03

Students seeking to confirm their non-filing status to meet institutional or government requirements.

Fill

form

: Try Risk Free

People Also Ask about

What happens if you don't file taxes as an international student?

It's important to understand that filing tax returns is mandatory for international students, and not doing so by the deadline could result in problems with or a revocation of your visa as well as possible ineligibility for a green card.

Do F-1 students need to file a tax return?

Filing taxes as an international student is required for all F-1 visa holders, even if you decide not to work while pursuing your education.

What is the penalty for not filing 8843?

There is no monetary penalty for not filing Form 8843. However, days of presence that are excluded must be properly recorded by filing Form 8843. Not doing so could affect the taxability of income or treaty benefits.

What happens if an international student does not file taxes?

It's important to understand that filing tax returns is mandatory for international students, and not doing so by the deadline could result in problems with or a revocation of your visa as well as possible ineligibility for a green card.

Why am I getting a verification of a non-filing letter?

A Verification of Non-Filing letter is used by those who did NOT file a tax return, and its purpose is similar to a transcript. If you filed a return and selected the option to print a Verification of Non-Filing, it will likely tell you that you DID file a return.

What are the 3 forms needed for a student to file their tax return?

What Tax Forms Do Students Need? 1040: This is the basic income-reporting form that nearly everyone uses. State tax return forms: States have their own rules for who must pay state taxes. 1098-T: This form tells the IRS how much you paid in tuition and fees. 1098-E: Did you pay any interest on student loans last year?

Does the IRS audit international students?

Myth 3: Not filing your tax return will not have any consequences for international students. As a nonresident alien you do have a filing obligation and the IRS definitely do audits and checks. The implications could be very serious down the road.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

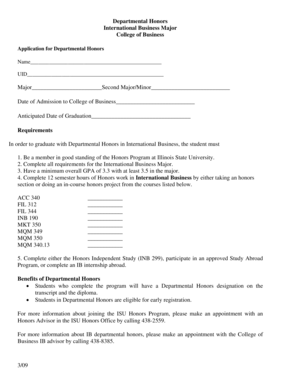

What is STUDENT CERTIFICATION OF NON-FILING U.S. TAX RETURN 2011-2012?

The STUDENT CERTIFICATION OF NON-FILING U.S. TAX RETURN 2011-2012 is a document used by students to confirm that they did not file a federal tax return for the specified tax year. This certification may be required for financial aid purposes.

Who is required to file STUDENT CERTIFICATION OF NON-FILING U.S. TAX RETURN 2011-2012?

Students who did not earn enough income to require filing a federal tax return or who were not required to file for any other reason are typically required to submit this certification, especially when applying for financial assistance.

How to fill out STUDENT CERTIFICATION OF NON-FILING U.S. TAX RETURN 2011-2012?

To fill out the STUDENT CERTIFICATION OF NON-FILING U.S. TAX RETURN 2011-2012, students must provide their personal information, indicate the tax year for which they are certifying non-filing, and sign the form to confirm that the information provided is accurate and truthful.

What is the purpose of STUDENT CERTIFICATION OF NON-FILING U.S. TAX RETURN 2011-2012?

The purpose of the STUDENT CERTIFICATION OF NON-FILING U.S. TAX RETURN 2011-2012 is to allow students to formally declare that they did not file a tax return, which may be necessary for verifying eligibility for financial aid or other programs.

What information must be reported on STUDENT CERTIFICATION OF NON-FILING U.S. TAX RETURN 2011-2012?

The information that must be reported on the STUDENT CERTIFICATION OF NON-FILING U.S. TAX RETURN 2011-2012 includes the student's name, social security number, the tax year in question, and a statement of non-filing, along with the student's signature.

Fill out your student certification of non-filing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Student Certification Of Non-Filing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.