Get the free Direct Payment Form Instructions - uwstout

Show details

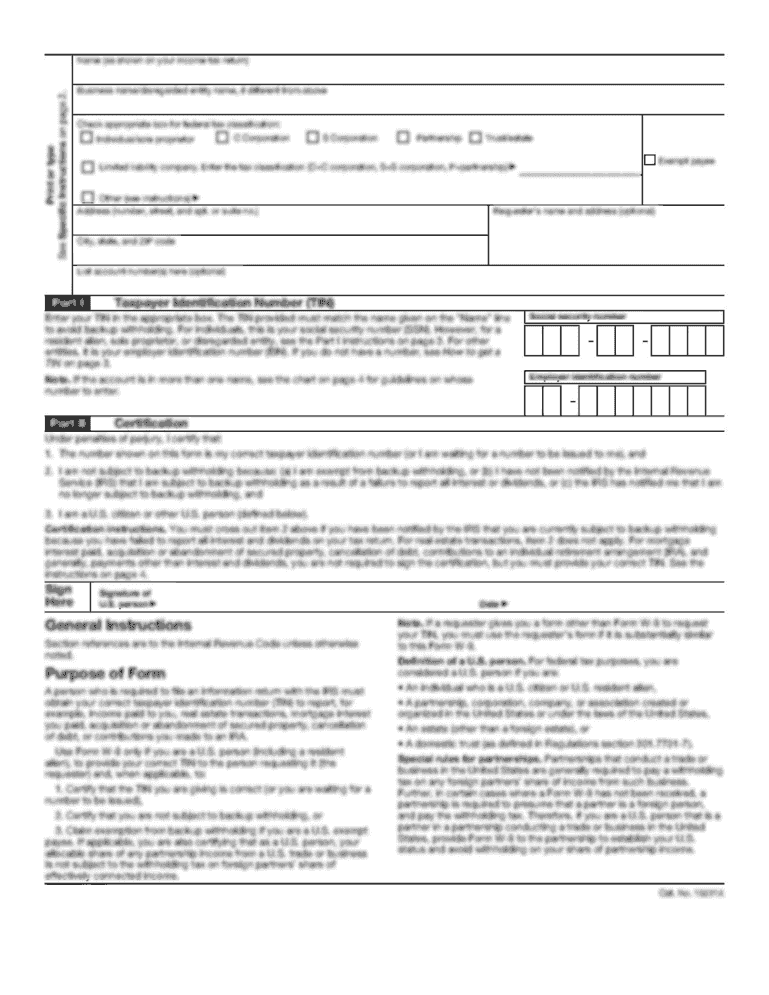

Instructions for completing the Direct Payment form used for making individual payments to vendors without requiring purchase orders at the University of Wisconsin-Stout.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign direct payment form instructions

Edit your direct payment form instructions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your direct payment form instructions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing direct payment form instructions online

To use the professional PDF editor, follow these steps below:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit direct payment form instructions. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out direct payment form instructions

How to fill out Direct Payment Form Instructions

01

Obtain the Direct Payment Form from your financial institution or organization's website.

02

Read the instructions carefully to understand the requirements.

03

Fill in your personal information, including your name, address, and contact details.

04

Provide your account information, including the account number and the bank’s routing number.

05

Specify the payment amount and frequency (one-time or recurring).

06

Sign and date the form to authorize the payment.

07

Submit the completed form to the appropriate department or organization as directed in the instructions.

Who needs Direct Payment Form Instructions?

01

Individuals or organizations that wish to set up automatic payments for bills or other recurring expenses.

02

Employees who are enrolling in a direct deposit program for their salaries.

03

Businesses looking to streamline their payment processes with vendors or service providers.

Fill

form

: Try Risk Free

People Also Ask about

What are the 5 steps of IRS direct pay?

How to pay your taxes with IRS Direct Pay [Step-by-step guide] Step 1: Visit the IRS Direct Pay page. Step 2: Enter your tax information. Step 3: Verify your identity. Step 4: Enter your payment information. Step 5: Confirm your information and submit it to the IRS. The bottom line.

What is an example of a direct payment?

Examples of Direct Payment Direct Deposits: Employers transfer salaries directly into employees' bank accounts. Wire Transfers: Large sums of money are moved between banks.

What is meant by direct payment?

So what is meant by the term, direct payment? Well, direct payment is a way for consumers to pay their bills automatically and electronically. In other words, it is a way to transfer money from a consumer's bank account to the company they wish to pay.

What is a direct payment form?

DIRECT PAYMENT FORM. This form is used to authorize payment to a company or individual when a requisition/purchase order is not required. Original itemized receipt (s) and/or invoice (s) must be attached.

What are the disadvantages of direct payments?

Disadvantages of direct payments You may find it a burden having to commission your own care and support. You may have to employ people and comply with tax and employment law. This can be quite complicated.

How do I get IRS form and instructions?

Need to find a product or place a telephone order? Visit the Forms, instructions & publications page to download products or call 800-829-3676 to place your order.

What is an example of a direct payment?

Examples of Direct Payment Direct Deposits: Employers transfer salaries directly into employees' bank accounts. Wire Transfers: Large sums of money are moved between banks.

Who qualifies for a direct payment?

Direct payments are normally available if you: have been assessed as needing services under health and personal social services legislation. have a disability and are aged 16 or over (including disabled parents) are a carer aged 16 or over, including people with parental responsibility for a child with disabilities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Direct Payment Form Instructions?

Direct Payment Form Instructions provide guidelines on how to properly complete and submit the Direct Payment Form for tax payments or transactions.

Who is required to file Direct Payment Form Instructions?

Individuals or entities making direct payments to tax authorities or other agencies are required to file the Direct Payment Form Instructions.

How to fill out Direct Payment Form Instructions?

To fill out the Direct Payment Form Instructions, follow the step-by-step guidance provided in the form, ensuring all required information is accurate and complete.

What is the purpose of Direct Payment Form Instructions?

The purpose of Direct Payment Form Instructions is to ensure that taxpayers understand how to submit their payments correctly to avoid errors and delay in processing.

What information must be reported on Direct Payment Form Instructions?

The information that must be reported includes the taxpayer's identification details, payment amount, payment period, and any relevant tax codes or transaction identifiers.

Fill out your direct payment form instructions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Direct Payment Form Instructions is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.