Get the free HOUSEHOLD INFORMATION INDEPENDENT STUDENT 2012-2013 - calvin

Show details

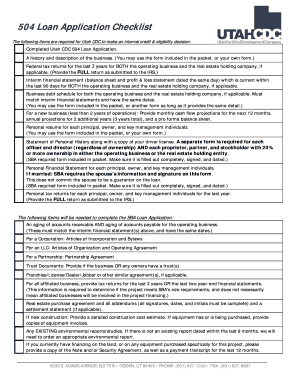

This document collects information about household members for the purpose of determining financial aid eligibility for independent students attending college.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign household information independent student

Edit your household information independent student form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your household information independent student form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing household information independent student online

Follow the steps down below to benefit from a competent PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit household information independent student. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out household information independent student

How to fill out HOUSEHOLD INFORMATION INDEPENDENT STUDENT 2012-2013

01

Gather necessary documents such as tax returns, W-2 forms, and any other income documentation.

02

Start with the basic information, including your name, date of birth, and Social Security number.

03

List details about your household members, including their names, ages, and relationship to you.

04

Provide information on your current living situation, indicating if you are living alone or with others.

05

Include income details for all members of the household, including employment, benefits, and other sources.

06

Be honest and accurate in reporting your financial situation as this will affect your eligibility for financial aid.

07

Double-check all entries for accuracy before submitting the form.

Who needs HOUSEHOLD INFORMATION INDEPENDENT STUDENT 2012-2013?

01

Independent students applying for federal financial aid to help pay for college expenses.

02

Students who have been determined to be independent from their parents for financial aid purposes.

03

Non-traditional students, such as veterans or those who have been in foster care.

Fill

form

: Try Risk Free

People Also Ask about

Why is FAFSA saying I'm an independent student?

To be considered independent on the FAFSA without meeting the age requirement, an associate or bachelor's degree student must be at least one of the following: married; a U.S. veteran; in active duty military service other than training purposes; an emancipated minor; a recently homeless youth or self-supporting and at

What qualifies you as an independent student for FAFSA?

Unless you plan on paying for your entire college education out-of-pocket, everyone should submit the FAFSA. There are no FAFSA income limits, meaning there's nothing stopping even the richest college students from submitting a FAFSA.

Should I file FAFSA as a student or parent?

Your dependency status has nothing to do with whether your parent claims you on their tax return. In addition, if the FAFSA determines that you are a dependent undergraduate student, it does not matter which parent claims you on their taxes.

Do you get more money as a dependent or independent FAFSA?

No, it is almost certainly more taxes saved (or tax credits earned) for your parents by claiming you as a dependent. You would be saving yourself a small amount while costing them a larger amount.

Is it better to file FAFSA as a dependent or independent?

Independent students typically qualify for more need-based scholarships and grants. The federal student aid program may offer more loans or access to need-based loans. Independent students should reach out to a tax professional to inquire about tax benefits such as education credits and deductions.

Is it better for a college student to file independent or dependent?

We strongly recommend that your child, the student, start their own FAFSA form and complete their sections first to save time and prevent errors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is HOUSEHOLD INFORMATION INDEPENDENT STUDENT 2012-2013?

HOUSEHOLD INFORMATION INDEPENDENT STUDENT 2012-2013 refers to a section of the financial aid application that collects information about the student's household, including income, number of family members, and the number of family members in college.

Who is required to file HOUSEHOLD INFORMATION INDEPENDENT STUDENT 2012-2013?

Independent students who are applying for federal student aid must file HOUSEHOLD INFORMATION INDEPENDENT STUDENT 2012-2013 as part of their financial aid application.

How to fill out HOUSEHOLD INFORMATION INDEPENDENT STUDENT 2012-2013?

To fill out HOUSEHOLD INFORMATION INDEPENDENT STUDENT 2012-2013, provide accurate details about your household size and the income earned by household members, along with any other required financial information.

What is the purpose of HOUSEHOLD INFORMATION INDEPENDENT STUDENT 2012-2013?

The purpose of HOUSEHOLD INFORMATION INDEPENDENT STUDENT 2012-2013 is to assess the financial need of independent students applying for financial aid and to determine the amount of aid they may be eligible to receive.

What information must be reported on HOUSEHOLD INFORMATION INDEPENDENT STUDENT 2012-2013?

Information that must be reported includes family size, the number of family members in college, the student's income, and the income of other household members if applicable.

Fill out your household information independent student online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Household Information Independent Student is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.