Get the free Acceptance Form: Gifts-in-Kind from Individuals - mtu

Show details

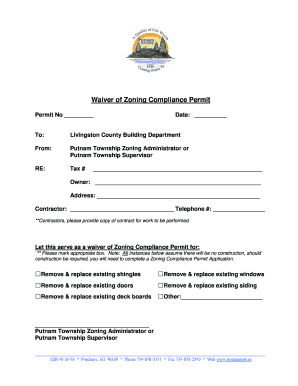

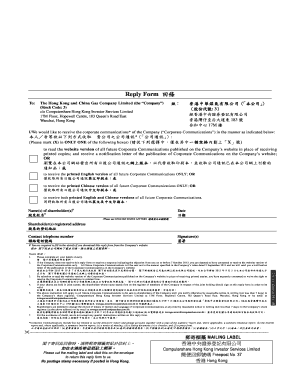

This document serves as a formal acceptance form for gifts-in-kind donated to the Michigan Tech Fund, allowing donors to provide their information and details about the gift, which will be acknowledged

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign acceptance form gifts-in-kind from

Edit your acceptance form gifts-in-kind from form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your acceptance form gifts-in-kind from form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit acceptance form gifts-in-kind from online

Follow the steps below to benefit from a competent PDF editor:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit acceptance form gifts-in-kind from. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out acceptance form gifts-in-kind from

How to fill out Acceptance Form: Gifts-in-Kind from Individuals

01

Obtain the Acceptance Form: Gifts-in-Kind from Individuals template.

02

Fill in the date at the top of the form.

03

Provide the name and contact details of the donor.

04

Describe the item being donated, including quantity and condition.

05

Include an estimated fair market value of the gift.

06

Specify any restrictions or special conditions associated with the gift.

07

Have the donor sign the form to confirm their contribution.

08

Submit the completed form to the appropriate department for processing.

Who needs Acceptance Form: Gifts-in-Kind from Individuals?

01

Individuals or organizations wishing to donate gifts-in-kind to a nonprofit.

02

Nonprofits that need to document and acknowledge donations received from individuals.

03

Accountants or finance personnel handling charitable contributions for an organization.

Fill

form

: Try Risk Free

People Also Ask about

How to write an acknowledgement for a donation?

What To Include in Donor Acknowledgement Letters Donor's name. Address the donor by name. Organization's name. Clearly state your nonprofit's name to make the letter official and avoid confusion. Donation amount and date. Type of donation. Tax information. Mission impact. Closing with gratitude. Clear Subject Line.

How to write a receipt for an in-kind donation?

In-kind donation receipts should include the donor's name, the description of the gift, and the date the gift was received. Cash donation receipt. A cash donation receipt provides written documentation of a cash gift.

How do you acknowledge receipt of donation in-kind?

How should I recognize in-kind donations? Send the donor an acknowledgment that includes your tax ID number, a description of the goods and/or services they donated and the date you received them. This letter should also confirm that donors received no substantial goods or services in exchange for their contribution.

What are examples of gifts in kind?

An in-kind donation is the transfer of any other type of asset. In-kind gifts are contributions of goods or services, other than cash grants. Examples of in-kind gifts include: Goods, like computers, software, furniture, and office equipment, for use by your organization or for special event auctions.

How to accept in-kind donations?

Process for accepting In-Kind donations Some organizations will have donors fill out a form with details of the gift. There will then be an approval process before the gift is accepted. Let the donor know what to expect in terms of your in-kind donation acceptance process.

What are the rules for gifts in kind?

For example, a committee makes an in-kind contribution when it: Pays for consulting, polling or printing services provided to a candidate committee; Donates office supplies or mailing lists to a campaign; Sponsors a fundraising event benefiting a candidate; or.

How do I acknowledge an in-kind donation?

Standards for gifts in kind The principles include: Need driven: Driven by a genuine and thorough understanding of the needs of the recipients. Quality controlled: Goods are carefully chosen, of appropriate quality, and in consultation with the recipient. Determined by informed choices.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Acceptance Form: Gifts-in-Kind from Individuals?

The Acceptance Form: Gifts-in-Kind from Individuals is a document used by organizations to formally acknowledge and accept non-monetary donations from individuals, known as gifts-in-kind.

Who is required to file Acceptance Form: Gifts-in-Kind from Individuals?

Organizations that receive non-cash donations from individuals are required to file the Acceptance Form: Gifts-in-Kind from Individuals to document the acceptance of such gifts.

How to fill out Acceptance Form: Gifts-in-Kind from Individuals?

To fill out the Acceptance Form, an organization must provide information about the donor, describe the gifts being accepted, assess the value of the gifts, and include signatures from relevant parties.

What is the purpose of Acceptance Form: Gifts-in-Kind from Individuals?

The purpose of the Acceptance Form is to create a record of the acceptance of gifts-in-kind, ensuring compliance with legal and accounting standards, and to provide acknowledgment to the donor.

What information must be reported on Acceptance Form: Gifts-in-Kind from Individuals?

Information that must be reported includes the donor's name and contact details, a detailed description of the gifts, the estimated value of the gifts, the date of donation, and any conditions associated with the gift.

Fill out your acceptance form gifts-in-kind from online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Acceptance Form Gifts-In-Kind From is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.