Get the free Verification of Additional Financial Information and Untaxed Income - moravian

Show details

This document verifies financial details and untaxed income for students applying for financial aid, requiring personal financial information from both students and parents.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign verification of additional financial

Edit your verification of additional financial form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your verification of additional financial form via URL. You can also download, print, or export forms to your preferred cloud storage service.

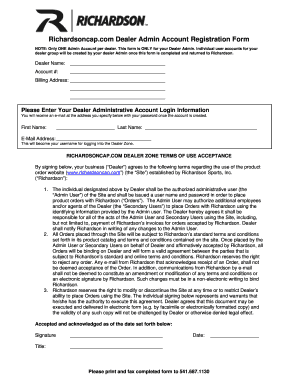

How to edit verification of additional financial online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit verification of additional financial. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

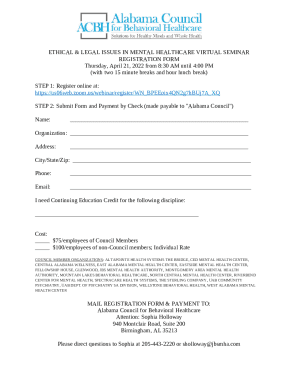

How to fill out verification of additional financial

How to fill out Verification of Additional Financial Information and Untaxed Income

01

Obtain the Verification of Additional Financial Information and Untaxed Income form.

02

Read the instructions carefully to understand the sections required to be filled out.

03

Provide your basic information, including your name, address, and Social Security number in the designated fields.

04

Fill out the section for additional financial information by detailing any additional income sources such as untaxed income, child support, or other specified financial support.

05

Document any income received that is not reported on tax returns, ensuring to specify the source and amount.

06

If applicable, consult your financial records or statements to accurately report amounts that might be requested.

07

Review the completed form for accuracy and completeness.

08

Sign and date the form, certifying that the information provided is correct.

09

Submit the form as directed by the requesting entity, ensuring it is done by the specified deadline.

Who needs Verification of Additional Financial Information and Untaxed Income?

01

Applicants seeking financial aid or assistance programs.

02

Students applying for federal or state student aid.

03

Individuals who receive untaxed income and need to provide verification for loan applications.

Fill

form

: Try Risk Free

People Also Ask about

What is an example of untaxed income for FAFSA?

Untaxed income is income that is excluded from federal income taxation under the IRS code. Examples include Supplemental Security Income, child support, alimony, and federal or public assistance.

What could be used as proof of income?

Create Your Own Paystub The most common method of how to show proof of income if paid in cash is creating your pay stub. Get a template for your use. You can complete the template and then print it out.

How do I show proof of income if I get paid under the table?

For example, business owners can provide pay stubs (if they pay themselves the salary), employed individuals can use employment verification letters (which they should request from their employer), and retirees can verify their proof of income through documents like annual pension statements, trust fund income or

What is untaxed income on W-2?

Non-taxable items would show up on an employee's pay stub, but not in the employee's W-2, as they are not taxable to the employee. Examples of non-taxable income would include reimbursements for mileage, allowances, or other types of non-taxable expenses you incurred that were paid back to you in a payroll run.

How do I get a verification of income?

Supporting Documents Paystubs. W2s or other wage statements. IRS Form 1099s. Tax filings. Bank statements demonstrating regular income. Attestation from a current or former employer.

How to obtain income verification?

Supporting Documents Paystubs. W2s or other wage statements. IRS Form 1099s. Tax filings. Bank statements demonstrating regular income. Attestation from a current or former employer.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Verification of Additional Financial Information and Untaxed Income?

Verification of Additional Financial Information and Untaxed Income is a process used to confirm the financial resources individuals or families have that are not subject to taxation, ensuring that they qualify for financial aid or support programs.

Who is required to file Verification of Additional Financial Information and Untaxed Income?

Individuals who are applying for financial aid or support programs and have untaxed income or additional financial resources that need to be verified are required to file this verification.

How to fill out Verification of Additional Financial Information and Untaxed Income?

To fill out the Verification of Additional Financial Information and Untaxed Income, individuals need to provide accurate details of their untaxed income sources, including amounts, and any relevant financial documents to support their claims.

What is the purpose of Verification of Additional Financial Information and Untaxed Income?

The purpose of this verification is to ensure that the financial aid awarding process is fair and accurate by confirming the financial circumstances of the applicants.

What information must be reported on Verification of Additional Financial Information and Untaxed Income?

Information that must be reported includes details of all untaxed income sources, such as child support, social security benefits, and other forms of non-taxed financial support, as well as any additional financial information relevant to the application.

Fill out your verification of additional financial online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Verification Of Additional Financial is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.