Get the free Department Information and Authority for Payroll Paper Documents - tamhsc

Show details

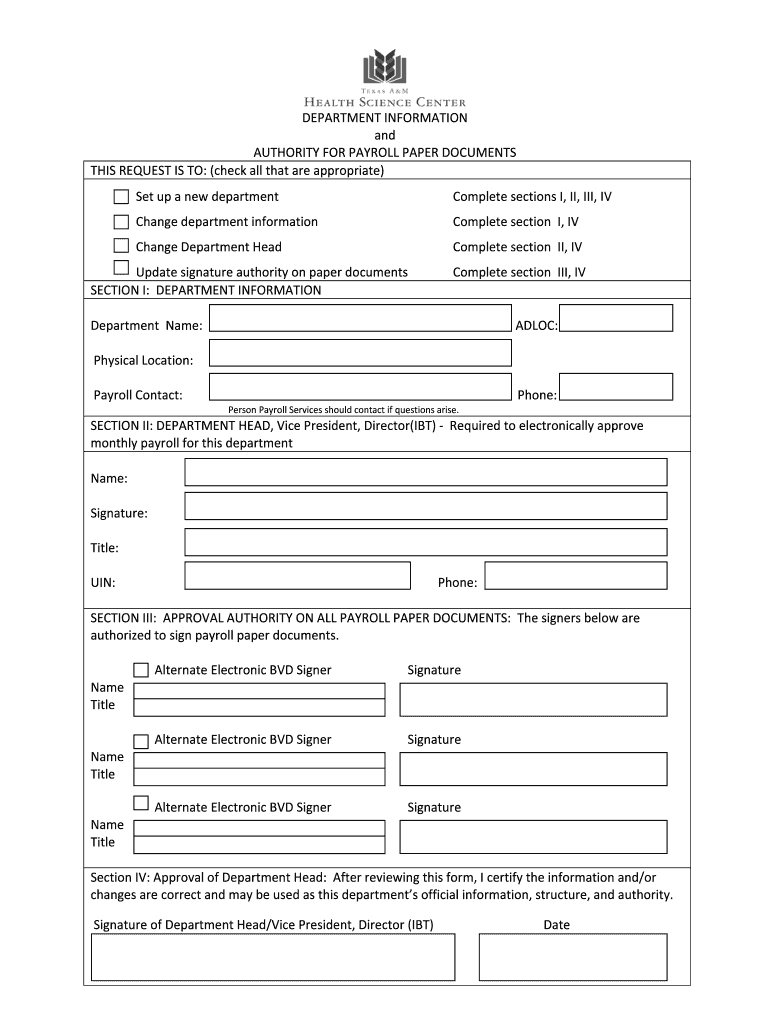

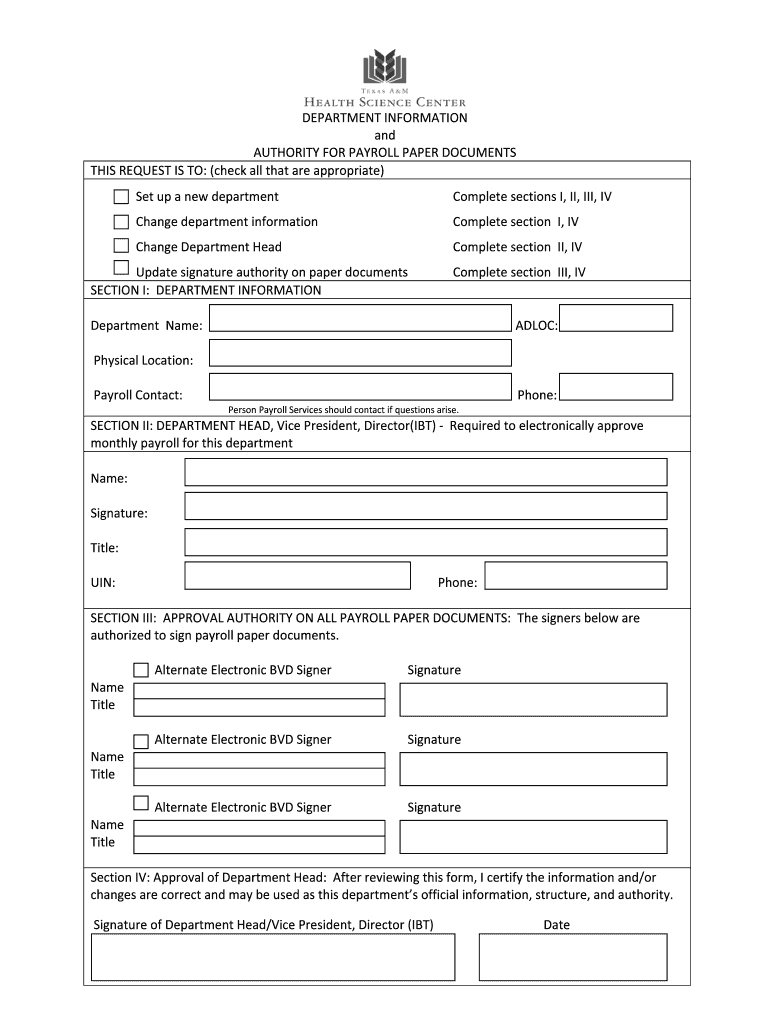

This document is used to set up or update department information, including payroll contact details, department head, and authorization for payroll paper documents.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign department information and authority

Edit your department information and authority form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your department information and authority form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit department information and authority online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit department information and authority. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out department information and authority

How to fill out Department Information and Authority for Payroll Paper Documents

01

Begin by locating the Department Information section on the payroll document.

02

Fill in the 'Department Name' with the official name of your department.

03

Provide the 'Department Head' name and title as specified.

04

Include the 'Contact Information' such as phone number and email address for the department.

05

Enter the 'Department Code' if applicable, which is typically assigned by the HR or payroll department.

06

In the Authority section, specify the 'Authorized Signature' of the person responsible for payroll submissions.

07

Include the 'Date' when the document is filled out.

08

Review all information for accuracy before submission.

Who needs Department Information and Authority for Payroll Paper Documents?

01

HR personnel to process payroll accurately.

02

Department Managers for payroll allocations.

03

Finance department for budgeting purposes.

04

Employees to clarify departmental payroll authority.

Fill

form

: Try Risk Free

People Also Ask about

What are the payroll details of an employee?

Employee inputs like bank account details, PAN, address, income tax declarations, proof of investment, etc., are essential for payroll processing. Usually, the companies collect these inputs from employees at the time of their joining/onboarding by the concerned department/team.

What do you need to put someone on payroll?

Follow these steps to set up payroll: Get an Employer Identification Number (EIN) Find out whether you need state or local tax IDs. Decide if you want an independent contractor or an employee. Ensure new employees return a completed W-4 form. Schedule pay periods to coordinate tax withholding for IRS.

What information do you need for a payroll?

Employee information needed for payroll Basic information, such as the employee's name, address, phone number, email, bank details, social security number, date of birth and marital status. Financial information, including tax ID, previous payslips, existing insurance coverage, tax reports, and more.

What information do you need to set up payroll?

These are the details (and forms) you'll need to keep on hand for each employee or contractor you hire: Full name. Employment start or termination date. Tax filing number (Social Security number or EIN) Date of birth. Current address.

What information do employers need from employees?

If you hire employees, then there is information that you need to secure for your records and forms that you must complete including the following: Employee's eligibility to work in the United States. Employee's Social Security number (SSN) Employee's withholding.

What must exist in every employee's payroll file?

Payroll & Compensation You should keep a written record of an employee's salary and compensation package and update their personal file each time their salary is adjusted. You also need to maintain a record of all employee W-4s and beneficiary forms, payroll records, and timecards.

What employee information is needed for payroll?

Employee information needed for payroll Basic information, such as the employee's name, address, phone number, email, bank details, social security number, date of birth and marital status. Financial information, including tax ID, previous payslips, existing insurance coverage, tax reports, and more.

What are the documents used in the payroll process?

Payroll file checklist Employee name and address. Employee date of birth and Social Security number. Employee occupation. Offer letter. Pay authorization. Form I-9, Employment Eligibility Verification. Form W-2, Wage and Tax Statements. Form W-4, Employee's Withholding Certificate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Department Information and Authority for Payroll Paper Documents?

Department Information and Authority for Payroll Paper Documents is a form that provides necessary details about the department’s authority to process payroll information and maintains proper documentation for payroll purposes.

Who is required to file Department Information and Authority for Payroll Paper Documents?

Departments or organizations that handle payroll processing are required to file Department Information and Authority for Payroll Paper Documents to ensure compliance with legal and regulatory requirements.

How to fill out Department Information and Authority for Payroll Paper Documents?

To fill out the Department Information and Authority for Payroll Paper Documents, complete the required fields including department name, contact information, authorized personnel's signatures, and any other specified details as instructed on the form.

What is the purpose of Department Information and Authority for Payroll Paper Documents?

The purpose of the Department Information and Authority for Payroll Paper Documents is to establish clear authority for processing payroll, ensure accurate reporting of wage information, and maintain compliance with payroll regulations.

What information must be reported on Department Information and Authority for Payroll Paper Documents?

The information that must be reported includes the department's name, address, contact information, names of authorized personnel, signatures of the approvers, and any other relevant identifiers or codes needed for payroll processing.

Fill out your department information and authority online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Department Information And Authority is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.