Get the free Dependent Parent Tax Return Transcript Information - uvu

Show details

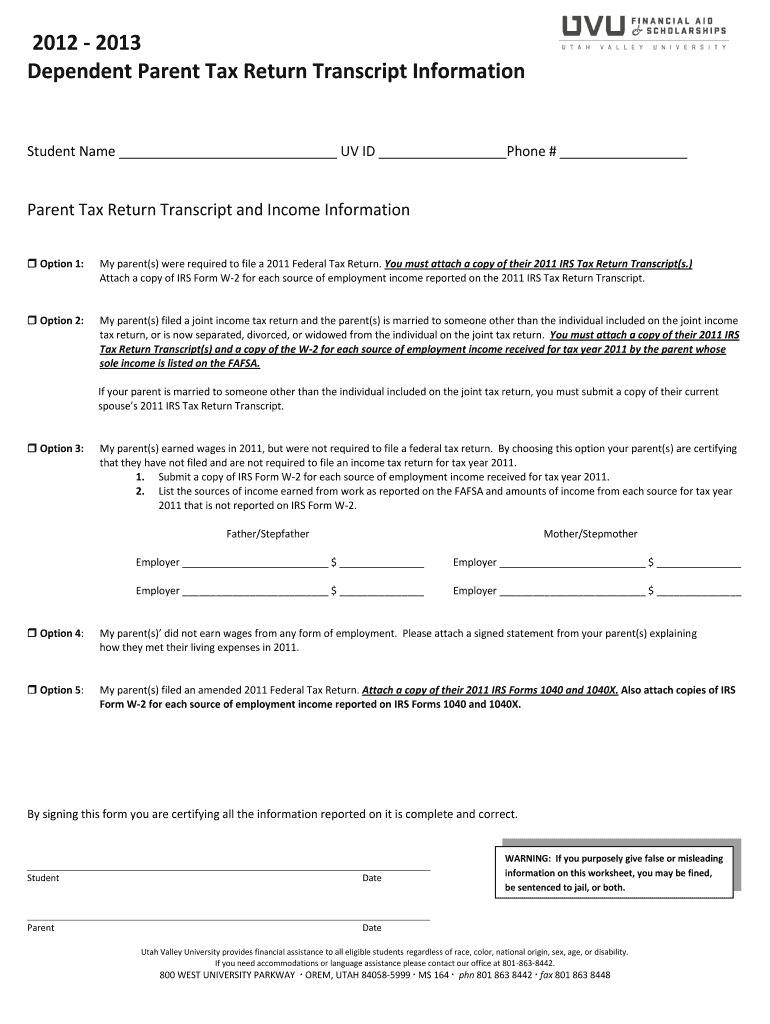

This document is used by students to provide their parent(s)' tax return transcript and income information for financial aid applications.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign dependent parent tax return

Edit your dependent parent tax return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dependent parent tax return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing dependent parent tax return online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit dependent parent tax return. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out dependent parent tax return

How to fill out Dependent Parent Tax Return Transcript Information

01

Gather your parent's tax documents, including their previous year's tax return.

02

Obtain Form 4506-T from the IRS website or local IRS office.

03

Fill out the form by providing your parent's information, including their Social Security number, address, and tax year.

04

Indicate the specific type of transcript you need (e.g., tax return transcript).

05

Sign the form, ensuring you have authority to request this information as a dependent.

06

Submit the completed form via mail, fax, or online through the IRS website.

07

Wait for the IRS to process your request and send the transcript.

Who needs Dependent Parent Tax Return Transcript Information?

01

Dependent students applying for financial aid to prove their parent's income.

02

Individuals who need to verify their parent's tax information for loan applications.

03

Taxpayers who are claimed as dependents and need to file their own tax returns.

Fill

form

: Try Risk Free

People Also Ask about

What kind of proof does the IRS need for dependents?

The dependent's birth certificate, and if needed, the birth and marriage certificates of any individuals, including yourself, that prove the dependent is related to you. For an adopted dependent, send an adoption decree or proof the child was lawfully placed with you or someone related to you for legal adoption.

Is dependent income reporting on parent's return?

The general rule is that a parent can claim a dependent child's investment income on their own return up to a certain amount —above that, the child needs to file themselves. To claim a child's income on a parent's tax return, the child needs to be considered a qualifying child dependent of the parent.

Is a return transcript the same as a W2?

Requesting a transcript from the IRS may be beneficial if you are looking for wage and income information reported on a tax return within the past 10 years. A transcript will include information reported on Form W-2, Form 1099 series, Form 1098 series, and Form 5498 series.

What does it mean if my parents claim me on their taxes?

Claiming a Qualifying Child or Qualifying Relative means you may be able to claim specific tax benefits. Qualifying child: You may be eligible to claim the Child Tax Credit, Child and Dependent Care Credit, Other Dependent Credit, Earned Income Tax Credit, or file using the Head of Household filing status.

How to get parent tax return transcript?

Ways to get transcripts If you're unable to register, or you prefer not to use Individual Online Account, you may order a tax return transcript and/or a tax account transcript through Get transcript by mail or by calling the automated phone transcript service at 800-908-9946.

Do I have to file taxes if my parents claim me as a dependent?

Just to be clear, you still have to file your taxes if your parents claim you as a dependent. On the line on the 1040 tax form where it asks if someone can claim you as a dependent, you would follow the instructions for what to do if someone is claiming you as a dependent.

What is a tax return transcript?

What is a tax transcript? A tax transcript is like a summary of your tax return. It contains essential information about your income, deductions, and credits. Additionally, an IRS tax return transcript offers a convenient way to access your tax information without needing a full copy of your tax return.

What is a parent tax return transcript?

A tax return transcript is the formatted record of a tax return filed with the IRS. The IRS makes tax return transcripts available to individuals that request it free of charge. Why does my school need a Tax Return Transcript? Can't I just give them a copy of my tax return?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Dependent Parent Tax Return Transcript Information?

Dependent Parent Tax Return Transcript Information refers to the financial data required from a student's parents when the student is considered a dependent for tax purposes. This information is typically used for financial aid applications and assists in determining eligibility for assistance programs.

Who is required to file Dependent Parent Tax Return Transcript Information?

Students who are considered dependents on their parents' tax returns are required to file Dependent Parent Tax Return Transcript Information when applying for financial aid or scholarships that require financial information from their parents.

How to fill out Dependent Parent Tax Return Transcript Information?

To fill out the Dependent Parent Tax Return Transcript Information, students should collect their parents' tax returns and financial documents. They should accurately report income, tax paid, and other relevant financial details on the application or form as specified by the institution or financial aid program.

What is the purpose of Dependent Parent Tax Return Transcript Information?

The purpose of Dependent Parent Tax Return Transcript Information is to provide a clear and accurate depiction of the family's financial situation, which aids schools and financial aid programs in assessing an applicant's financial need and determining appropriate aid.

What information must be reported on Dependent Parent Tax Return Transcript Information?

Information that must be reported includes the parents' adjusted gross income, tax deductions, and credits, as well as any other relevant family financial information such as assets, untaxed income, or benefits received.

Fill out your dependent parent tax return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dependent Parent Tax Return is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.