Get the free Small Group Underwriting

Show details

This document notifies Aetna members of upcoming changes to their health plan designs, including compliance with federal laws and simplification of plan choices.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign small group underwriting

Edit your small group underwriting form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your small group underwriting form via URL. You can also download, print, or export forms to your preferred cloud storage service.

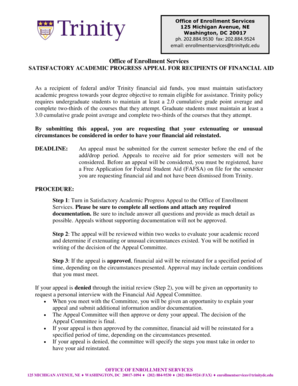

How to edit small group underwriting online

Follow the steps below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit small group underwriting. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

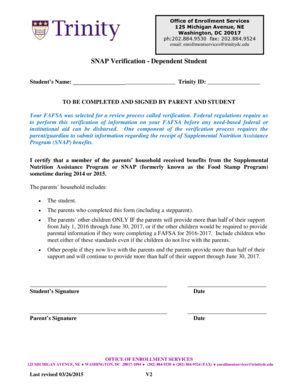

How to fill out small group underwriting

How to fill out Small Group Underwriting

01

Gather necessary business information, including the number of employees and their ages.

02

Determine the type of coverage you want to provide for your employees.

03

Fill out the application form with accurate employee details and coverage choices.

04

Prepare any required supporting documents, such as payroll records or tax documents.

05

Submit the completed application to the insurance provider.

06

Review the proposal from the insurer and discuss any questions or changes.

07

Finalize the policy by signing the agreement and making the initial payment.

Who needs Small Group Underwriting?

01

Small businesses with a limited number of employees seeking group health insurance.

02

Employers who want to provide employee benefits to attract and retain talent.

03

Organizations aiming to comply with legal requirements for employee health coverage.

04

Companies looking to lower their overall health insurance costs through group rates.

Fill

form

: Try Risk Free

People Also Ask about

What does a group underwriter do?

The main function of an insurance underwriting group is not to pool funds to purchase securities but to do calculations of risk and determine the correct rate for an insurance policy.

What is one of the differences between group underwriting and individual underwriting?

Most states define a small group as an organization with between two and 50 employees. However, some states consider a company with between two and 100 employees a small group. The Affordable Care Act (ACA) only requires employers with 50 or more full-time equivalent employees (FTEs) to offer health insurance.

How to underwrite group health insurance?

Underwriting in group health insurance involves assessing the collective risk of a group. This includes evaluating the medical history, age, occupation, and sometimes lifestyle choices of the group members. The primary goal is to ascertain the potential healthcare costs that the insurer might incur.

How do you become a group underwriter?

Insurance underwriters typically need a bachelor's degree to enter the occupation. However, candidates who have an associate's degree or a high school diploma and insurance-related work experience sometimes qualify for positions. Certification may be beneficial.

How do I become a health insurance underwriter?

It's essential to have a strong educational base in business, math, finance, or healthcare. Employers will typically offer on-the-job training, but they may require that you obtain certification or undertake continuing education classes to advance your career.

What is the underwriting process for health insurance?

Medical underwriting involves researching the medical history of an applicant for insurance in order to identify risk factors and price coverage ingly. In recent years, regulations have limited the use of medical underwriting in determining rates.

What is considered when underwriting group insurance?

Group underwriting does not assess individuals but considers group data like size and claims history. Group premiums are determined by factors such as morbidity, claims experience, and policy benefits. Requirements like participation percentages reduce adverse selection in group plans.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Small Group Underwriting?

Small Group Underwriting is the process of evaluating and determining the insurance risk associated with a small group of individuals, typically businesses with a limited number of employees, for the purpose of providing health insurance or other types of coverage.

Who is required to file Small Group Underwriting?

Employers or business owners who offer health insurance coverage to a small group of employees are required to file Small Group Underwriting.

How to fill out Small Group Underwriting?

To fill out Small Group Underwriting, employers must complete an application form that typically includes information about the business, employee demographics, and health history. It's important to provide accurate and comprehensive information to ensure proper risk assessment.

What is the purpose of Small Group Underwriting?

The purpose of Small Group Underwriting is to assess the risk presented by a small group to determine appropriate premium rates, coverage options, and to ensure regulatory compliance in providing health insurance.

What information must be reported on Small Group Underwriting?

The information that must be reported includes the number of employees, their ages, health status, any pre-existing conditions, and other relevant data that could affect the insurance risk.

Fill out your small group underwriting online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Small Group Underwriting is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.