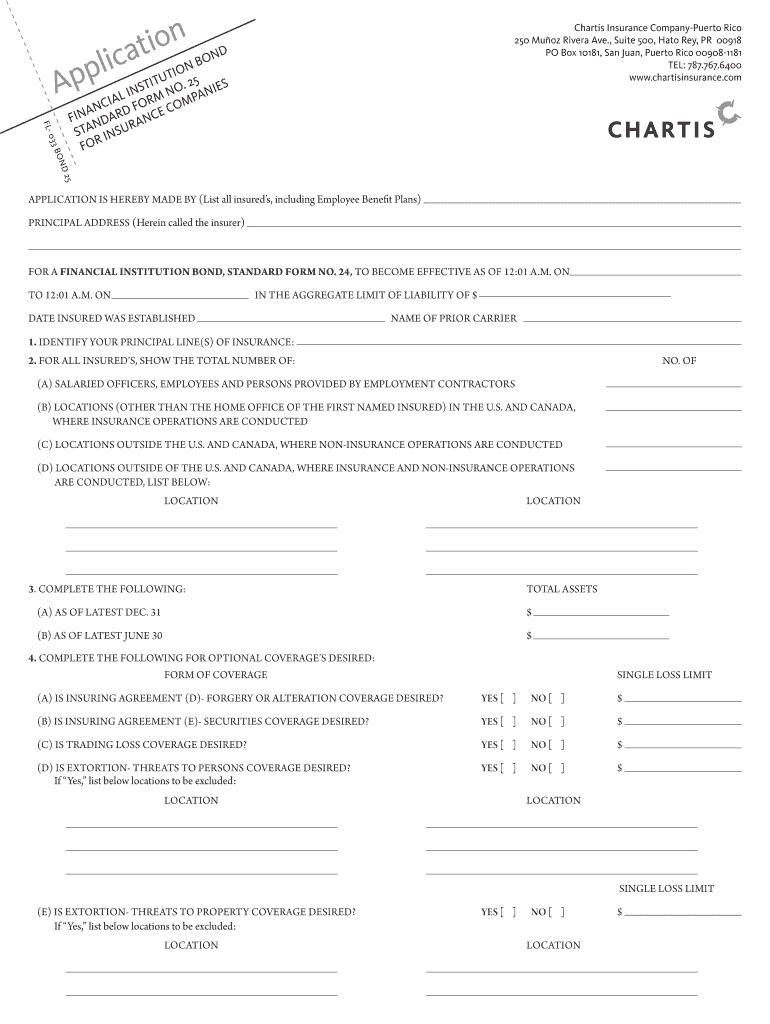

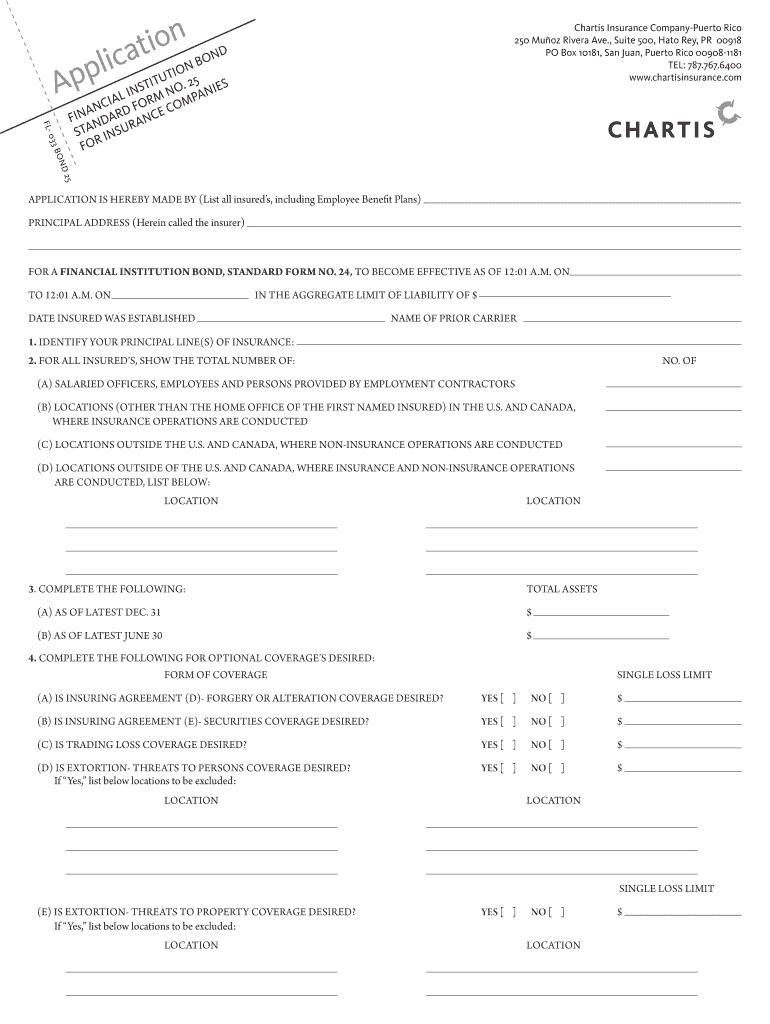

Get the free Financial Institution Bond Application

Show details

This document is an application for a financial institution bond, detailing specific insurance needs and requesting coverage for various risks associated with the operations of the insured.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign financial institution bond application

Edit your financial institution bond application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your financial institution bond application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit financial institution bond application online

Follow the guidelines below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit financial institution bond application. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out financial institution bond application

How to fill out Financial Institution Bond Application

01

Obtain the Financial Institution Bond Application form from the appropriate financial regulatory body or institution.

02

Fill in the name of the financial institution applying for the bond.

03

Provide the complete address and contact information of the institution.

04

Specify the nature of the business and the types of services offered.

05

Indicate the amount of coverage required for the bond.

06

List the names and addresses of the principal officers and directors of the institution.

07

Provide details about the institution's financial condition, including balance sheets and income statements.

08

Complete any additional questions regarding previous claims or bonds held.

09

Review the application for accuracy and completeness before submission.

10

Submit the application along with any required documentation and payment to the appropriate office.

Who needs Financial Institution Bond Application?

01

Financial institutions such as banks, credit unions, and savings associations seeking protection against financial losses due to fraud, theft, or other dishonest acts.

02

Businesses that require a bond to comply with regulatory requirements or to enhance client trust and credibility.

03

Institutions that are involved in the handling of clients' funds and need to protect their own assets and their clients' assets.

Fill

form

: Try Risk Free

People Also Ask about

What entities are eligible for financial institution bonds?

Financial Institution Bonds Provides coverage for financial institutions, such as banks, non-bank lenders, asset managers, and insurance companies. Coverages include employee dishonesty, theft on premises, forgery, computer systems fraud, impersonation fraud, and a variety of other risks.

What is a financial institution bond?

Financial institution bond (FI bond) insurance, also known as a fidelity bond, is designed to help protect financial institutions against a variety of fraudulent risks, including losses from employee dishonesty, such as theft or forgery, as well as certain external perils.

What are financial institution bonds?

Financial institution bond (FI bond) insurance, also known as a fidelity bond, is designed to help protect financial institutions against a variety of fraudulent risks, including losses from employee dishonesty, such as theft or forgery, as well as certain external perils.

What is an institutional bond?

A: Institutional bonds are debt commitments that allow the University to make investments in large capital projects, similar to what private citizens do when they buy a home and take on a mortgage.

What is a bond application form?

The bond form is a legal document and must be accepted by all parties to the agreement. The bond form states the terms that the principal must adhere to. A commercial bond form will usually state the general terms of the bond and may also reference corresponding legal statutes.

What is the difference between a financial institution bond and a crime policy?

Fidelity bonds provide coverage for acts of employee dishonesty, but not for crimes committed by third parties. If you want coverage for both employee-committed crimes and third-party crimes, you likely need a commercial crime insurance policy.

What is a financial institution that offers memberships to people with a common bond?

Credit unions are financial institutions, similar to banks, that provide members with a variety of financial services. Credit unions are not-for-profit organizations that are consumer-focused and for members only. Banks are for-profit financial institutions that are generally available to anyone.

What is an example of a financial bond?

For example, if a company wants to build a new plant, it may issue bonds and pay investors a stated interest rate until the bond matures. The company also repays the original principal. But unlike buying stock in a company, purchasing a corporate bond doesn't confer a share of ownership.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Financial Institution Bond Application?

A Financial Institution Bond Application is a formal request submitted by a financial institution to obtain a bond that protects against specific risks such as fraud, employee dishonesty, or errors and omissions.

Who is required to file Financial Institution Bond Application?

Financial institutions, including banks, credit unions, and other entities engaged in financial services, are required to file a Financial Institution Bond Application.

How to fill out Financial Institution Bond Application?

To fill out a Financial Institution Bond Application, one must provide necessary details about the institution, including its legal name, business structure, assets, and the types of coverage being requested.

What is the purpose of Financial Institution Bond Application?

The purpose of the Financial Institution Bond Application is to secure a bond that safeguards the financial institution from losses due to fraudulent activities or other specified risks.

What information must be reported on Financial Institution Bond Application?

The information that must be reported includes institutional details, contact information, risk exposures, number of employees, and details about past claims or losses related to the risks covered by the bond.

Fill out your financial institution bond application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Financial Institution Bond Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.