Get the free CREDIT UNION BOND FORM 23 QUESTIONNAIRE

Show details

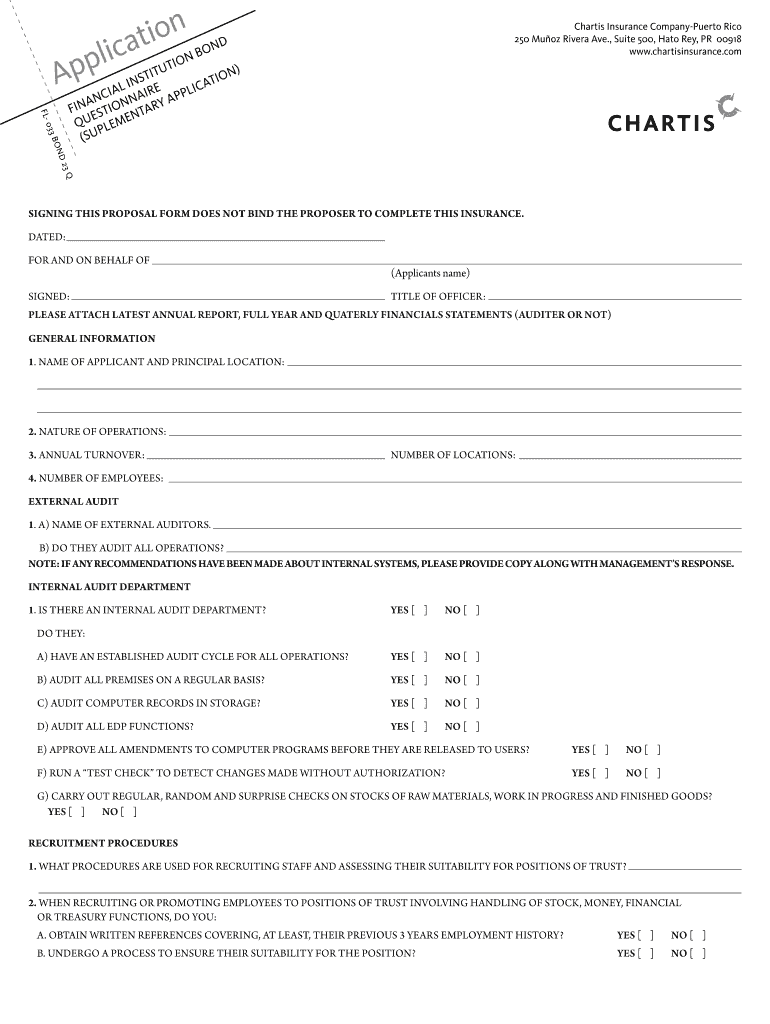

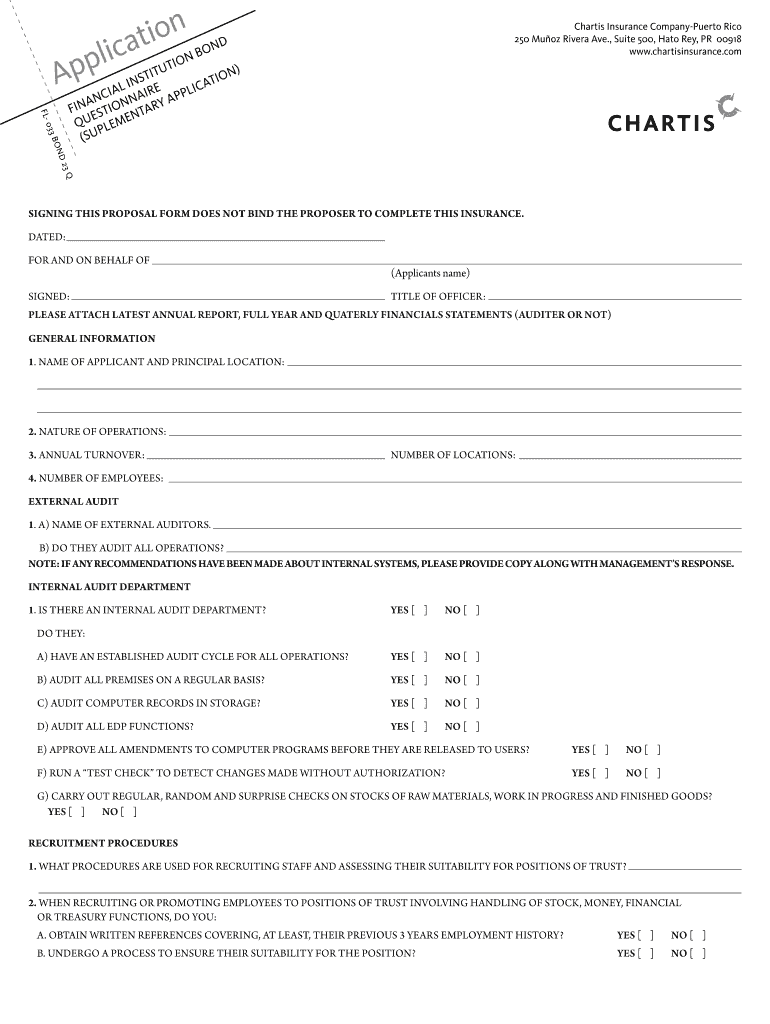

This document is a proposal form for insurance coverage related to credit unions, including questions about operations, audits, recruitment, employee controls, and security measures.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit union bond form

Edit your credit union bond form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit union bond form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit union bond form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit credit union bond form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

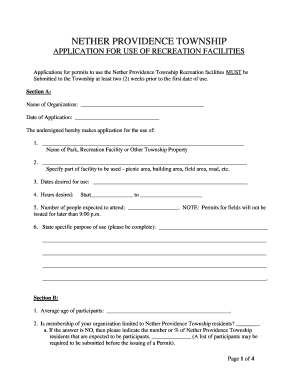

How to fill out credit union bond form

How to fill out CREDIT UNION BOND FORM 23 QUESTIONNAIRE

01

Obtain the CREDIT UNION BOND FORM 23 QUESTIONNAIRE from the credit union.

02

Read the instructions carefully at the beginning of the form.

03

Fill in your personal information, including your name, address, and contact details in the designated sections.

04

Provide information about your credit union, including its name and address.

05

Answer all eligibility questions truthfully and to the best of your ability.

06

Include any required financial information or documentation as specified in the form.

07

Review your completed form for accuracy and completeness.

08

Sign and date the form where indicated.

09

Submit the completed form to the appropriate credit union representative.

Who needs CREDIT UNION BOND FORM 23 QUESTIONNAIRE?

01

Individuals applying for a bond through a credit union.

02

Credit union members who need to secure a bond for financial transactions.

03

Organizations seeking coverage provided by the bond.

Fill

form

: Try Risk Free

People Also Ask about

Can credit unions be organized around common bonds?

As set forth in the Act and Chartering Manual, there are three types of federal credit union charters: single common bond (one occupational or associational group), multiple common bond (multiple groups), and community.

Do credit unions have a common bond?

Credit unions are member-owned and democratically controlled financial institutions which primarily provide loans and savings products to their members. Under the Credit Unions Act 1979, credit union members must have specific common bonds between them. These are the links and common communities between members.

What is the common bond that unites members of a credit union may be?

That common bond is known as the credit union's field of membership (FOM). Every credit union must establish a FOM that is permissible under law and regulation, and only persons or groups within the FOM—and a few others by virtue of their close relationship to a member—may join the credit union.

How to form a credit union?

How to Start a Credit Union Step One: Determine Need. Step Two: Form a Committee. Step Three: Establish Membership Guidelines. Step Four: Decide Financial Services. Step Five: Create a Business Plan. Step Six: Secure Startup Costs. Step Seven: Apply for a Charter. Step Eight: Choose a Location and Open.

Which financial institution whose members have a common bond?

Credit Unions. Credit unions are cooperative financial institutions, formed by groups of people with a "common bond." These groups of people pool their funds to form the institution's deposit base; the group owns and controls the institution together.

What is a multiple common bond credit union?

As the name indicates, a multiple common bond charter serves multiple entities. Each entity has its own common bond, but each does not share the same SCB with the other entities.

What is a credit union bond?

Coverage for losses committed by credit union employees, management and directors and officers involving fraud, theft and dishonesty are addressed under the Bond.

What does it mean to be bonded at a credit union?

The required bonds are a type of insurance agreement which guarantees reimbursement to the union for any financial losses caused by fraudulent or dishonest acts by officers or employees, such as theft, embezzlement, or forgery.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CREDIT UNION BOND FORM 23 QUESTIONNAIRE?

The CREDIT UNION BOND FORM 23 QUESTIONNAIRE is a document used by credit unions to provide necessary information for surety bond underwriting, assessing risk, and ensuring compliance with regulatory requirements.

Who is required to file CREDIT UNION BOND FORM 23 QUESTIONNAIRE?

Credit unions that are seeking a surety bond or renewing their existing bond are required to file the CREDIT UNION BOND FORM 23 QUESTIONNAIRE.

How to fill out CREDIT UNION BOND FORM 23 QUESTIONNAIRE?

To fill out the CREDIT UNION BOND FORM 23 QUESTIONNAIRE, the credit union must provide detailed information about its operations, financial condition, management practices, and any relevant incidents or claims that may affect bonding.

What is the purpose of CREDIT UNION BOND FORM 23 QUESTIONNAIRE?

The purpose of the CREDIT UNION BOND FORM 23 QUESTIONNAIRE is to collect essential information that helps underwriters assess the credit union's risk profile and determine bond eligibility and terms.

What information must be reported on CREDIT UNION BOND FORM 23 QUESTIONNAIRE?

Information that must be reported includes financial statements, details on the credit union's operations, risk management procedures, history of claims or losses, and any other relevant data that could impact the bonding process.

Fill out your credit union bond form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Union Bond Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.