Get the free TEXAS CONDUCT SURETY/ MIXED BEVERAGE TAX BOND APP

Show details

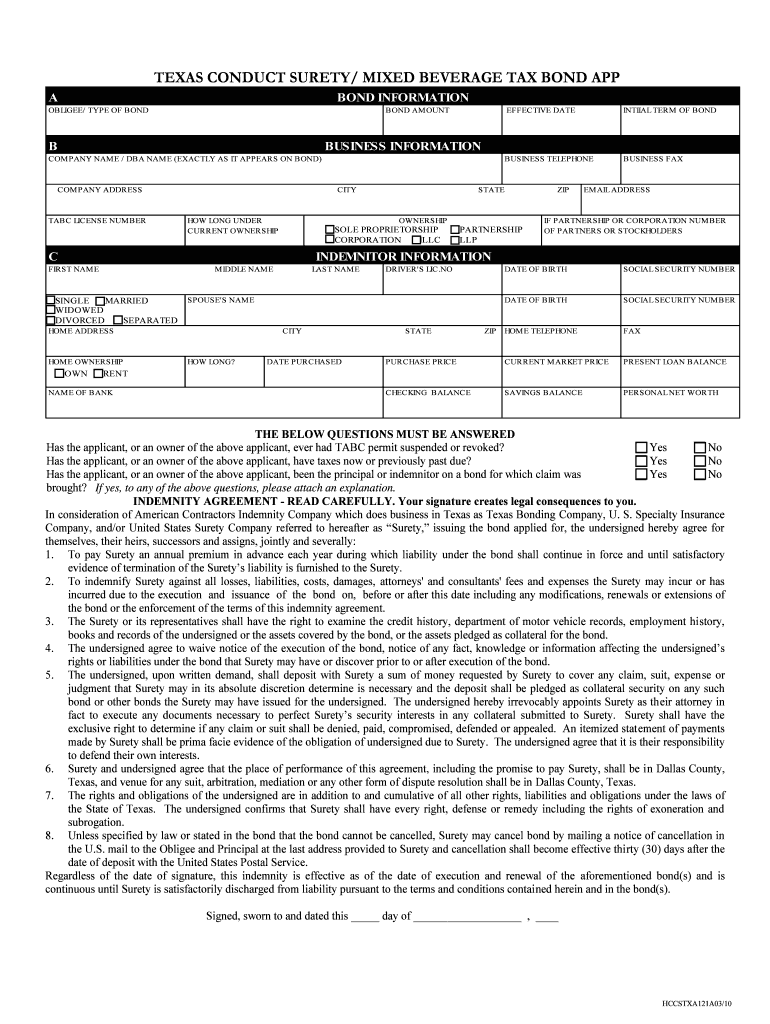

This document serves as an application for a tax bond related to the mixed beverage industry in Texas, requiring detailed business and personal information from the applicant.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign texas conduct surety mixed

Edit your texas conduct surety mixed form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your texas conduct surety mixed form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing texas conduct surety mixed online

Follow the steps below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit texas conduct surety mixed. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out texas conduct surety mixed

How to fill out TEXAS CONDUCT SURETY/ MIXED BEVERAGE TAX BOND APP

01

Obtain the TEXAS CONDUCT SURETY/ MIXED BEVERAGE TAX BOND APP form from the Texas Comptroller's website.

02

Fill in the applicant's name and contact information accurately at the top section of the form.

03

Provide the legal business name if it differs from the applicant's name.

04

Indicate the type of business entity (sole proprietorship, partnership, corporation, etc.).

05

List any required permits or licenses associated with the mixed beverage tax.

06

Fill in the bond amount required based on your business's needs and the Texas state requirements.

07

Include your federal employer identification number (FEIN) or Social Security number.

08

Sign and date the application, ensuring the signature is from an authorized representative.

09

Submit the completed application along with any necessary attachments to the appropriate Texas Comptroller’s office.

Who needs TEXAS CONDUCT SURETY/ MIXED BEVERAGE TAX BOND APP?

01

Individuals or businesses that wish to conduct mixed beverage sales in Texas are required to submit the TEXAS CONDUCT SURETY/ MIXED BEVERAGE TAX BOND APP.

02

Establishments such as bars, restaurants, or venues serving alcohol are mandated to file this bond application to comply with state regulations.

Fill

form

: Try Risk Free

People Also Ask about

What is the sales tax bond in Texas?

There is no fee for the permit, but you may be required to post a security bond. For more information on security bonds, contact a Comptroller field office. Once I have obtained a Texas sales and use tax permit, what are my obligations as a permit holder?

How much does a Texas sales tax permit cost?

Tax-based Revenue Bonds are secured by revenues derived from one or more designated taxes levied for a specific purpose, including income taxes, excise taxes (such as taxes on tobacco, alcoholic beverages, fuel, etc.), Special Assessments, hotel occupancy taxes and sales taxes.

What is the bond for a liquor license in Texas?

The Texas Alcoholic Beverage Commission enforces several separate surety bond requirements: Texas Alcoholic Beverage Code Section 11.11 requires general alcohol permit applicants to file a $5,000 conduct surety bond. The bond amount increases to $10,000 if the business is located within 1,000 feet of a public school.

What is the bond for sales tax permit in Texas?

Sales Tax Bond Requirements in Texas Applicants for a tax permit may be required to provide a bond or security that equals either $100,000 or four times their average monthly tax liability. For itinerant vendors, while a bond may also be necessary, the minimum bond amount cannot be less than $500.

What is the Texas Comptroller of Public Accounts mixed beverage tax?

The mixed beverage gross receipts tax rate is 6.7 percent, and the mixed beverage sales tax rate is 8.25 percent. Does the type of TABC permit or license I hold determine whether my sales of malt beverages and wine are subject to sales tax or mixed beverage taxes?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is TEXAS CONDUCT SURETY/ MIXED BEVERAGE TAX BOND APP?

The Texas Conduct Surety/Mixed Beverage Tax Bond Application is a document that businesses must submit to obtain a surety bond required for operating establishments that sell mixed beverages in Texas.

Who is required to file TEXAS CONDUCT SURETY/ MIXED BEVERAGE TAX BOND APP?

Businesses or individuals who plan to sell mixed beverages in Texas must file the Texas Conduct Surety/Mixed Beverage Tax Bond Application as part of the licensing process.

How to fill out TEXAS CONDUCT SURETY/ MIXED BEVERAGE TAX BOND APP?

To fill out the application, provide information about the business, including name, address, and type of ownership, along with the required signatures and any additional documentation as specified.

What is the purpose of TEXAS CONDUCT SURETY/ MIXED BEVERAGE TAX BOND APP?

The purpose of the application is to secure a surety bond that guarantees compliance with Texas laws governing the sale of mixed beverages, ensuring that the state can collect taxes owed on sales.

What information must be reported on TEXAS CONDUCT SURETY/ MIXED BEVERAGE TAX BOND APP?

Information required includes the applicant's business name, address, tax identification number, type of business, and details regarding any previous bonds or tax compliance.

Fill out your texas conduct surety mixed online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Texas Conduct Surety Mixed is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.