Get the free Independent Club Event Liability Insurance Coverage

Show details

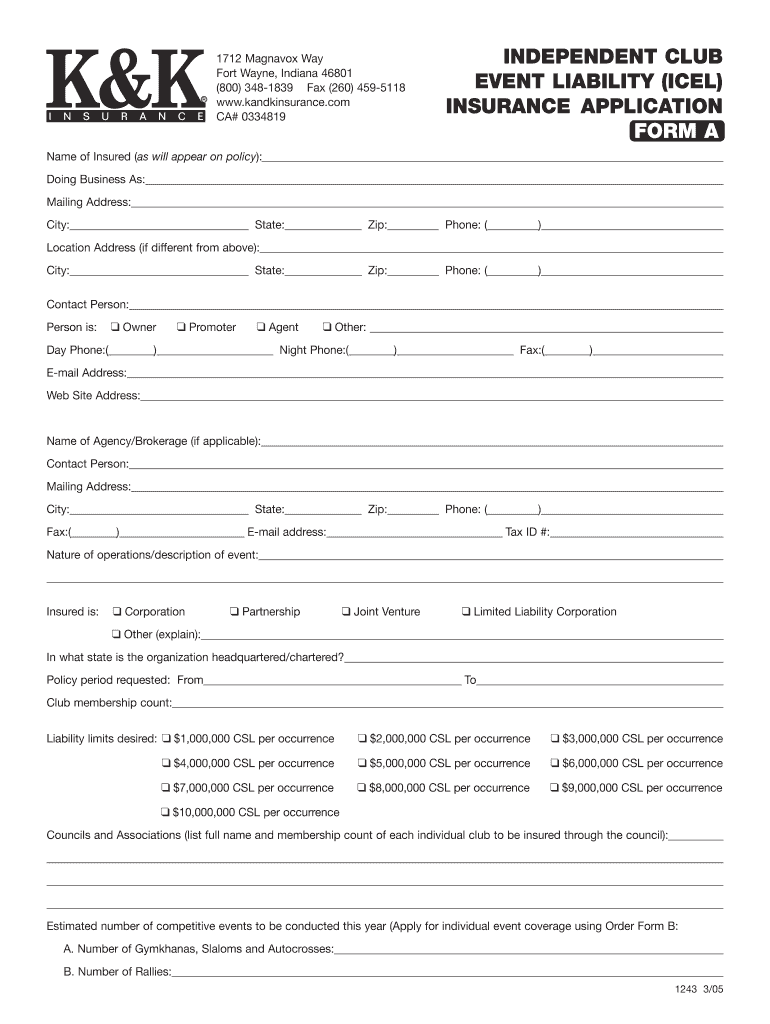

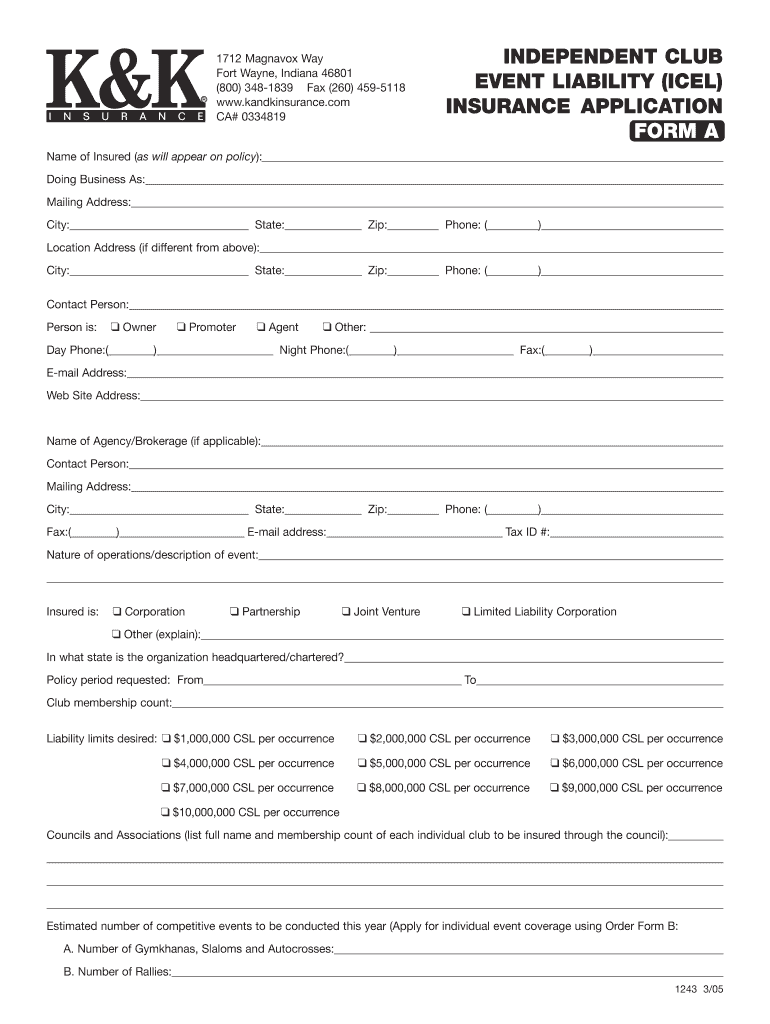

This document outlines the eligibility, coverage options, and submission instructions for independent clubs seeking general liability insurance for motorsports-related events. It details the qualifying

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign independent club event liability

Edit your independent club event liability form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your independent club event liability form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing independent club event liability online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit independent club event liability. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out independent club event liability

How to fill out Independent Club Event Liability Insurance Coverage

01

Gather necessary information about your event, including date, location, and number of expected attendees.

02

Identify the types of coverage needed based on the activities that will take place during the event.

03

Fill out the application form provided by the insurance company, ensuring all details are accurate.

04

Include information about the organization hosting the event, such as its legal name and contact information.

05

Specify any additional insured parties, if needed, such as vendors or sponsors.

06

Review the coverage limits and deductibles offered, and choose options that meet your needs.

07

Submit the completed application along with any required documentation and payment for the premium.

08

Await confirmation of coverage and any further instructions from the insurance provider.

Who needs Independent Club Event Liability Insurance Coverage?

01

Clubs and organizations hosting events such as parties, fundraisers, or community gatherings.

02

Event organizers who want to protect against potential liabilities arising from accidents or injuries.

03

Sponsors or vendors participating in events that require proof of liability coverage.

04

Individuals planning large gatherings that may involve significant risk.

Fill

form

: Try Risk Free

People Also Ask about

How much is liability insurance for an event?

How much does event insurance cost? Event Insurance can range from $75 to $235, depending on coverage limits and coverage options chosen. Liability limits start at $500,000 and liquor liability can be excluded if there is no alcohol being served at the event (lowering the premium).

What is covered by the liability policy?

Liability coverage helps cover damages you're responsible for to another party because of an accident. It doesn't cover damages to your property or your injuries. Your damages and injuries are protected under other coverages such as: Collision.

How does event liability insurance work?

Liability insurance provides coverage for injury or property damage to others as a result of your event. This is the most common type of event insurance. In fact, some venues require their clients to have a minimum amount of event liability insurance.

How much is liability insurance for an event?

How much does event insurance cost? Event Insurance can range from $75 to $235, depending on coverage limits and coverage options chosen. Liability limits start at $500,000 and liquor liability can be excluded if there is no alcohol being served at the event (lowering the premium).

How much does liability insurance cost for an event?

How much does event insurance cost? Event Insurance can range from $75 to $235, depending on coverage limits and coverage options chosen. Liability limits start at $500,000 and liquor liability can be excluded if there is no alcohol being served at the event (lowering the premium).

How much does a $1,000,000 liability insurance policy cost?

On average, a $1 million liability insurance policy costs $69 a month, or $824 a year, for our small business owners. ** Keep in mind that every business is different, so the $1 million liability insurance cost will vary.

Why purchase event insurance?

Insurance that is related to events will cover and then protect planners in a number of different areas. Event insurance will provide a general liability for certain types of events. Planners will be able to purchase extra coverage that will protect them from things such as event cancellation and liquor liability.

How much is liability insurance for a club?

Costs to insure a nightclub will vary ing to many factors. However, typically your clients can expect to pay $3000 to $5000 each year for insurance packages.

Can you get liability insurance for a one day event?

Most event venues require clients to purchase one-day event liability insurance to protect their property from damage and to avoid responsibility for injuries at the event.

What is a good price for liability insurance?

The average cost of liability car insurance is $829 a year, or $69 a month. Average rates range from $372 a year in Wyoming to $1,597 in Michigan. Car insurance rates can vary by state because of factors such as different state coverage requirements, accident rates and crime rates.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Independent Club Event Liability Insurance Coverage?

Independent Club Event Liability Insurance Coverage is a type of insurance that protects clubs and event organizers from financial losses due to liabilities arising from accidents, injuries, or damages that occur during events they host.

Who is required to file Independent Club Event Liability Insurance Coverage?

Clubs and organizations that host events, particularly those involving large gatherings, public activities, or and serving alcohol, are generally required to file for Independent Club Event Liability Insurance Coverage.

How to fill out Independent Club Event Liability Insurance Coverage?

To fill out Independent Club Event Liability Insurance Coverage, applicants need to provide detailed information about the event, including the date, location, expected attendance, types of activities, and any additional insured parties.

What is the purpose of Independent Club Event Liability Insurance Coverage?

The purpose of Independent Club Event Liability Insurance Coverage is to mitigate financial risk by covering legal fees, medical expenses, and damages related to claims made against the event organizer due to injuries or property damage occurring during the event.

What information must be reported on Independent Club Event Liability Insurance Coverage?

The information that must be reported includes the event details (date, location, and duration), expected number of attendees, description of activities, any alcohol service, and contact information of the event organizer.

Fill out your independent club event liability online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Independent Club Event Liability is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.