Get the free GROUP ANNUITY SINGLE SUM SURVIVOR BENEFIT PAYMENT (ESTATE OR ORGANIZATION) - tiaa-cref

Show details

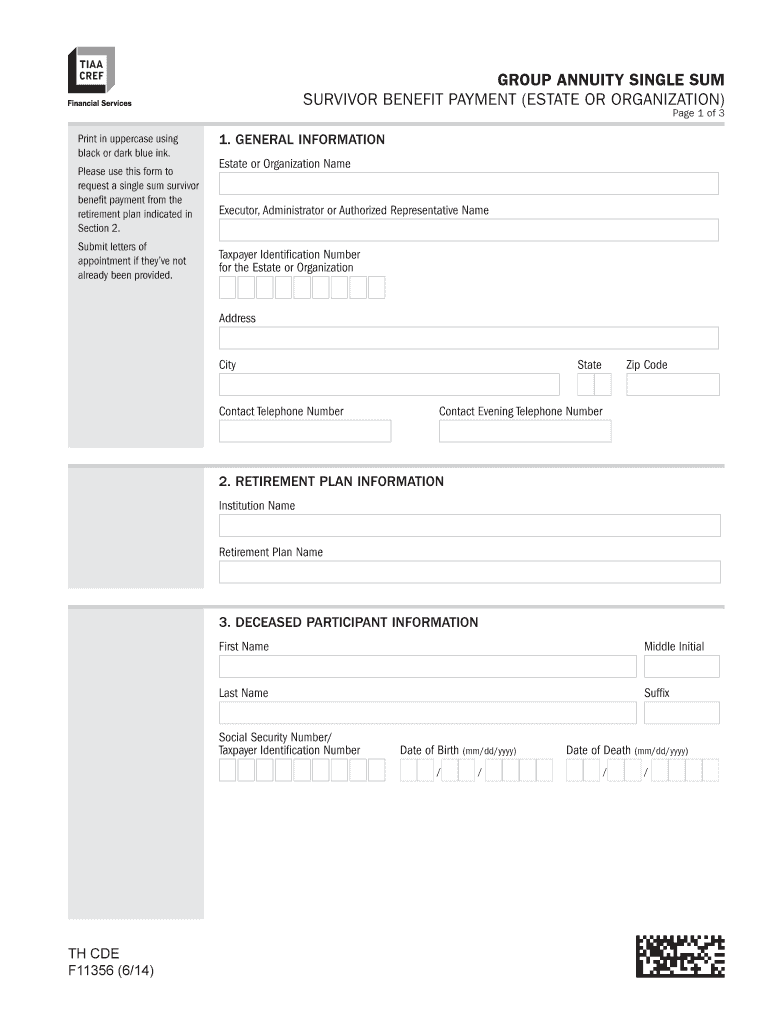

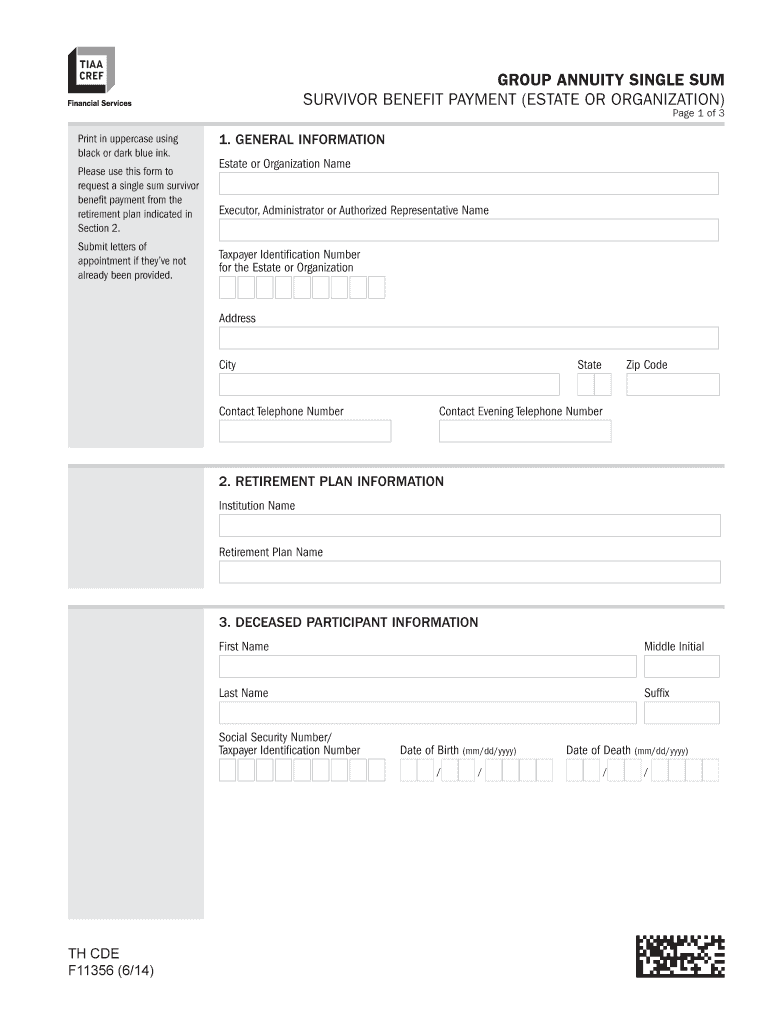

This form is used to request a single sum survivor benefit payment from a retirement plan, providing necessary details about the estate or organization, retirement plan information, deceased participant

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign group annuity single sum

Edit your group annuity single sum form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your group annuity single sum form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit group annuity single sum online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit group annuity single sum. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out group annuity single sum

How to fill out GROUP ANNUITY SINGLE SUM SURVIVOR BENEFIT PAYMENT (ESTATE OR ORGANIZATION)

01

Obtain the GROUP ANNUITY SINGLE SUM SURVIVOR BENEFIT PAYMENT form from the relevant organization.

02

Read the instructions carefully to understand the requirements and eligibility.

03

Fill in the personal details of the deceased annuitant, including name, ID number, and date of birth.

04

Specify the name and details of the estate or organization that will receive the payment.

05

Provide any necessary documentation, such as proof of death, organizational identification, or tax identification number.

06

Sign the form and date it to confirm the information provided is accurate.

07

Submit the completed form and any supporting documents to the address specified on the form.

Who needs GROUP ANNUITY SINGLE SUM SURVIVOR BENEFIT PAYMENT (ESTATE OR ORGANIZATION)?

01

Beneficiaries designated in the annuitant's policy who are entitled to receive survivor benefits.

02

Estates of deceased annuitants who require processing for final benefits.

03

Organizations that may have been designated to receive benefits as part of a trust or estate plan.

Fill

form

: Try Risk Free

People Also Ask about

Does a survivor annuity count as income?

Monthly or Periodic Payments. Monthly or periodic SBP annuity payments are treated as wages for federal income tax withholding (FITW) purposes. An annuitant, however, may elect no withholding of federal income tax.

Is money from an annuity considered income?

While the money in an annuity will grow tax-deferred, once you start withdrawing your money, all or a portion of that withdrawal will become taxed as ordinary income. When it comes to taxes on the money you paid into your annuity, the taxation depends on how you funded the annuity.

Does survivor annuity count as income?

Monthly or Periodic Payments. Monthly or periodic SBP annuity payments are treated as wages for federal income tax withholding (FITW) purposes. An annuitant, however, may elect no withholding of federal income tax.

Are survivor benefits considered earned income?

Social Security income, such as survivor's benefits, is con- sidered unearned income, but separate Internal Revenue Service rules govern whether it should be counted toward the tax filing threshold.

What is a survivor benefit annuity?

Survivor benefits provide monthly payments to eligible family members of people who worked and paid Social Security taxes before they died.

Does an inherited annuity count as earned income?

But with a qualified annuity, you must pay taxes on all of the withdrawals. So, when you inherit a qualified annuity, Uncle Sam comes calling! Since the owner didn't pay taxes on any of the money, all of the death benefit withdrawals are considered income. Therefore, they're subject to ordinary income tax rates.

Is survivor benefits a monthly payment?

All payments received from OPM after the annuitant's date of death must be returned to the Treasury Department. If payments are made by check, please write the beneficiary's date of death on the check and return the check to the Treasury Department address on the envelope.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is GROUP ANNUITY SINGLE SUM SURVIVOR BENEFIT PAYMENT (ESTATE OR ORGANIZATION)?

The Group Annuity Single Sum Survivor Benefit Payment is a one-time payment made to the beneficiaries or estate of a deceased individual who was covered under a group annuity plan. It provides a lump sum payment to eligible parties upon the death of the annuitant.

Who is required to file GROUP ANNUITY SINGLE SUM SURVIVOR BENEFIT PAYMENT (ESTATE OR ORGANIZATION)?

The filing of the Group Annuity Single Sum Survivor Benefit Payment is typically required by the estate or the organization managing the group annuity plan, as they are responsible for disbursing the benefits to the designated beneficiaries.

How to fill out GROUP ANNUITY SINGLE SUM SURVIVOR BENEFIT PAYMENT (ESTATE OR ORGANIZATION)?

To fill out the Group Annuity Single Sum Survivor Benefit Payment form, one must provide details such as the annuitant's information, beneficiary details, the amount of the benefit, and any required documentation to verify the claim.

What is the purpose of GROUP ANNUITY SINGLE SUM SURVIVOR BENEFIT PAYMENT (ESTATE OR ORGANIZATION)?

The purpose of the Group Annuity Single Sum Survivor Benefit Payment is to provide financial support to the beneficiaries or estate of a deceased individual, ensuring that the value of the annuity is distributed as intended after the annuitant's passing.

What information must be reported on GROUP ANNUITY SINGLE SUM SURVIVOR BENEFIT PAYMENT (ESTATE OR ORGANIZATION)?

Information that must be reported includes the name and contact details of the annuitant, the beneficiary or estate information, the specifics of the group annuity plan, the payment amount, and any pertinent documentation like death certificates or proof of claim.

Fill out your group annuity single sum online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Group Annuity Single Sum is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.