Get the free Payments of Honoraria to Foreign Guests - acu

Show details

This document outlines the procedures required for making payments to foreign guest speakers or service providers visiting the USA, including an online interview process and necessary tax documentation.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign payments of honoraria to

Edit your payments of honoraria to form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your payments of honoraria to form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit payments of honoraria to online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit payments of honoraria to. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out payments of honoraria to

How to fill out Payments of Honoraria to Foreign Guests

01

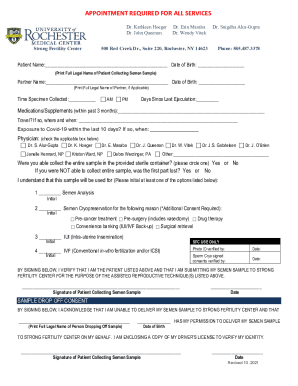

Gather all necessary personal information of the foreign guest including full name, nationality, and passport details.

02

Determine the amount of honoraria to be paid based on the agreement or contract.

03

Fill out the payment request form, ensuring to include the guest's information and payment amount.

04

Attach any required documentation such as a contract, invoice, or confirmation of services rendered.

05

Submit the completed form and documentation to the appropriate financial department for processing.

06

Ensure compliance with tax regulations, including any withholding taxes, if applicable.

Who needs Payments of Honoraria to Foreign Guests?

01

Institutions or organizations hosting foreign guests for seminars, workshops, or speaking engagements.

02

Event organizers requiring payment to foreign speakers or consultants.

03

Academic institutions providing honoraria to international scholars visiting for research or lectures.

Fill

form

: Try Risk Free

People Also Ask about

What is included in the honoraria payment?

Honoraria: An honorarium is a payment received for making a speech, publishing an article or attending any public or private conference, convention, meeting, social event, meal or similar gathering.

What is an example of honorarium expenses?

Treatment of an Honorarium as Employment Income Related expenses may, for example, range from an air ticket to the printing of speech materials, or from using a cellphone for business to maintaining a website for which the speaker may deduct the cost.

What is considered honoraria?

An Honoraria is defined as a gratuitous payment of money, or any other thing of value, to a person for the person's participation in a usual academic activity for which no fee is legally required.

What is the 9 5 6 rule for honorarium?

9/5/6 Rule for Honorarium Payments: No more than 9 days stay at one institution. No more than 5 institutions making honorarium payments. Received in the prior 6 months.

What is the 9 5 6 rule for honorarium?

9/5/6 Rule for Honorarium Payments: No more than 9 days stay at one institution. No more than 5 institutions making honorarium payments. Received in the prior 6 months.

Is a foreign honorarium taxable?

Taxes for Foreign National Honorariums An honorarium paid to a foreign national is subject to 30% federal tax withholding.

What is the difference between honorarium and honoraria?

The correct plural of honorarium can be either honorariums or honoraria. Technically speaking, honoraria is the Latin-based plural form of honorarium. (Many other Latin-derived words can be pluralized in the same way, but many are rarely used, such as stadia as the plural for stadium.)

What is an example of honoraria payment?

Examples of honoraria include: Compensation for delivering a speech. Writing an article. Attending a meeting.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Payments of Honoraria to Foreign Guests?

Payments of Honoraria to Foreign Guests refers to compensatory payments made to foreign individuals for participating in events, conferences, or lectures without being considered formal employees of the organization making the payment.

Who is required to file Payments of Honoraria to Foreign Guests?

Organizations or institutions that make honoraria payments to foreign guests for their services or participation in activities are required to file Payments of Honoraria to Foreign Guests.

How to fill out Payments of Honoraria to Foreign Guests?

To fill out Payments of Honoraria to Foreign Guests, organizations must include information such as the name and address of the foreign guest, the amount paid, the purpose of the payment, and any relevant tax identification numbers.

What is the purpose of Payments of Honoraria to Foreign Guests?

The purpose of Payments of Honoraria to Foreign Guests is to compensate foreign individuals for their expertise or participation in certain activities, recognizing their contributions while adhering to tax obligations.

What information must be reported on Payments of Honoraria to Foreign Guests?

The information that must be reported includes the names and addresses of the foreign guests, the date of the payment, the total amount paid, the purpose of the payment, and any tax identification details applicable.

Fill out your payments of honoraria to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Payments Of Honoraria To is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.