Get the free Employee Request for Refund of Withheld Social Security Taxes - asu

Show details

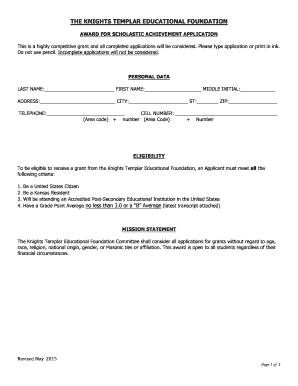

This document allows employees to request a refund of over-collected Social Security taxes by certifying non-application for refunds from the IRS and stating that the request will be handled by Arizona

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign employee request for refund

Edit your employee request for refund form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your employee request for refund form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing employee request for refund online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit employee request for refund. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out employee request for refund

How to fill out Employee Request for Refund of Withheld Social Security Taxes

01

Obtain the Employee Request for Refund of Withheld Social Security Taxes form from your HR department or company's website.

02

Fill in your personal details, including your name, Social Security number, and contact information.

03

Indicate the period for which you are requesting the refund of withheld Social Security taxes.

04

Provide details on the amount of Social Security taxes that were withheld from your paycheck.

05

Attach any supporting documentation, such as pay stubs or tax forms, to substantiate your claim.

06

Review the form for accuracy and completeness before signing and dating it.

07

Submit the completed form to your HR department or the designated contact for processing.

Who needs Employee Request for Refund of Withheld Social Security Taxes?

01

Employees who believe that Social Security taxes were withheld incorrectly from their paychecks and wish to request a refund.

Fill

form

: Try Risk Free

People Also Ask about

Can I get an SSN tax refund?

If necessary, request a refund from the IRS. If you are unable to receive a refund of these taxes from your employer, you may then file Form 843 and 8316 to request a refund from the IRS.

How do I get my overpaid FICA back?

File your taxes. After you file your taxes, any overpayment on your FICA taxes will be applied to your federal income tax liability. Once you're caught up on your federal income tax then the rest of the FICA overpayment will be returned to you as a part of your tax refund.

Does withholding tax get refunded?

Employers remit withholding taxes directly to the IRS in the employee's name. The tax withholding is a credit against the employee's annual income tax bill. If too much money is withheld, an employee receives a tax refund; if too little is withheld, they may have to pay the IRS more with their tax return.

What to do if an employer withholds too much Social Security tax?

Your employer should adjust the excess for you. If the employer doesn't adjust the overcollection, you can use Form 843, Claim for Refund and Request for Abatement to claim a refund. Attach copies of your Forms W-2, Wage and Tax Statement for the year to Form 843.

How do I ask my employer for a FICA refund?

How do I get a FICA Tax Refund? Start with your employer. Notify them of the exemption and have them provide an updated W-2 and refund you. If you're not having any luck with your employer or unable to get the full refund amount from them, your next option is to work directly with the IRS.

How do I request a refund of withholding tax?

To request a refund of your withholdings for previous tax years, please contact the IRS at 1-800-829-1040 for Federal tax withholding refund and your State Revenue Office for state tax withholding refund. If we are not currently withholding State tax, you must call your State Tax office for a refund.

Do you get a refund on Social Security tax withheld?

You may be entitled to a refund if you paid both tier 1 RRTA tax and Social Security tax which, combined, exceed the Social Security wage base. If you had more than one employer and too much tier 2 RRTA tax withheld, you may request a refund of the excess tier 2 RRTA tax using Form 843 PDF.

Are withheld Social Security benefits returned?

Yes. If some of your retirement benefits are withheld because of your earnings, your monthly benefit will increase starting at your full retirement age. This takes into account those months in which benefits were withheld.

Can I get a refund for Social Security tax withheld?

If your employer has withheld Social Security or Medicare taxes in error, follow these steps: Request a refund from your employer. You must first request a refund of these taxes from your employer. If your employer is able to refund these taxes, no further action is necessary.

What if FICA taxes are withheld in error?

If your employer does not refund the full amount, you may submit Form 843 Claim for Refund and Request for Abatement to the IRS to claim the balance. You should attach the following documents to Form 843: A copy of your Form W-2 to prove the amount of social security and Medicare taxes withheld.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Employee Request for Refund of Withheld Social Security Taxes?

The Employee Request for Refund of Withheld Social Security Taxes is a form used by employees to request the refund of Social Security taxes that have been erroneously withheld from their wages.

Who is required to file Employee Request for Refund of Withheld Social Security Taxes?

Employees who believe that their Social Security taxes have been incorrectly withheld or who are not eligible for those taxes due to specific circumstances are required to file this request.

How to fill out Employee Request for Refund of Withheld Social Security Taxes?

To fill out the form, employees need to provide personal information such as name, Social Security number, and details of the wages in question, along with the reason for the refund request.

What is the purpose of Employee Request for Refund of Withheld Social Security Taxes?

The purpose of this request is to allow employees to reclaim funds that were withheld in error from their paychecks, ensuring that they are not unfairly taxed.

What information must be reported on Employee Request for Refund of Withheld Social Security Taxes?

The information that must be reported includes the employee's personal details, the amount of Social Security tax withheld, the pay periods affected, and the explanation for the refund request.

Fill out your employee request for refund online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Employee Request For Refund is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.