Get the free Trust Fund Payroll - fitchburgstate

Show details

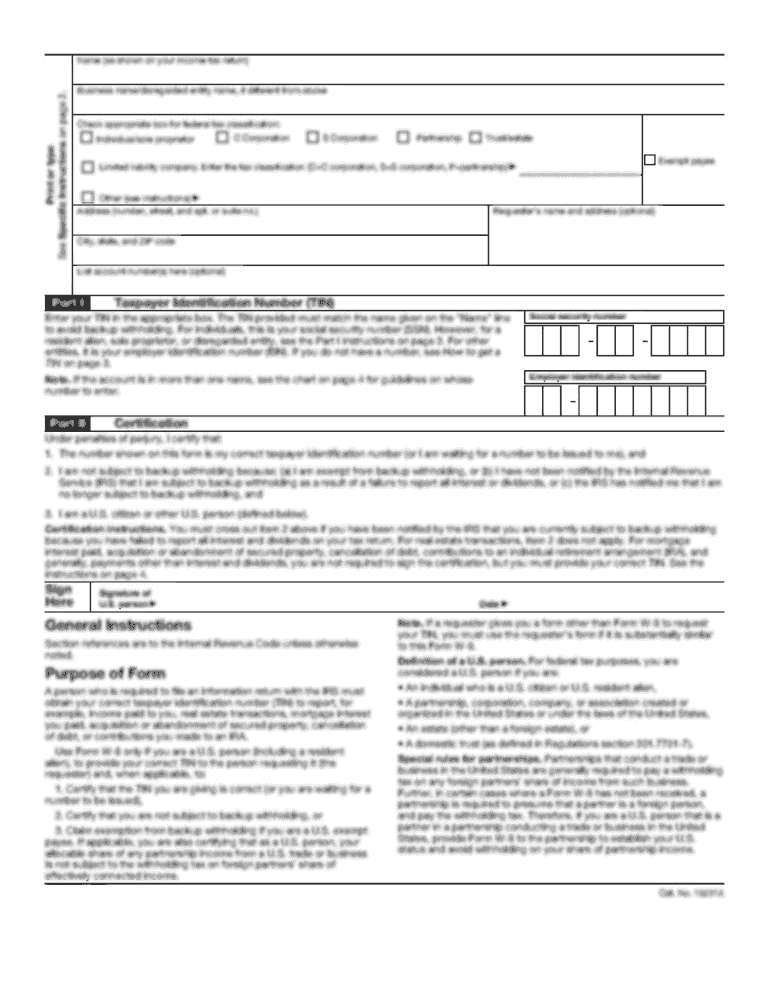

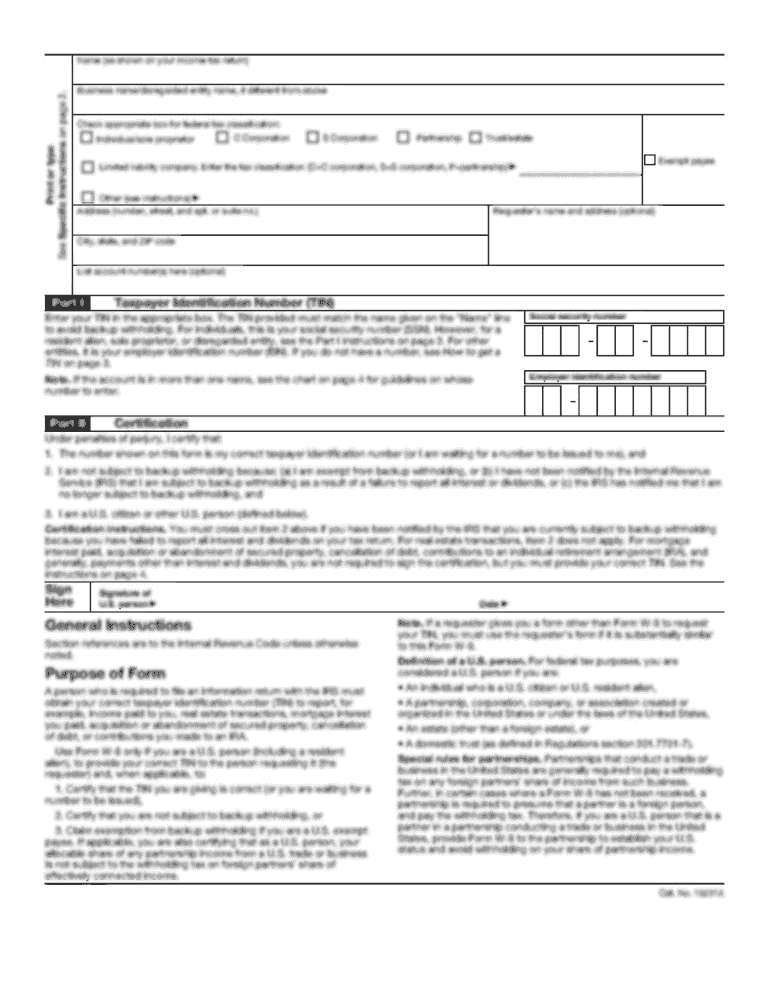

This document specifies the conditions under which Commonwealth of Massachusetts employees and retirees are exempt from contributing to OBRA. It requires personal information and proof of agency affiliation.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign trust fund payroll

Edit your trust fund payroll form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your trust fund payroll form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit trust fund payroll online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit trust fund payroll. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out trust fund payroll

How to fill out Trust Fund Payroll

01

Collect all necessary employee information including names, addresses, and social security numbers.

02

Determine the correct pay period for the payroll.

03

Calculate gross wages based on hours worked and pay rates.

04

Deduct any applicable taxes and benefits from the gross wages.

05

Prepare the payroll register summarizing payroll details.

06

Ensure compliance with federal and state regulations for trust fund contributions.

07

Submit payments to the appropriate trust funds electronically or by check.

08

Keep accurate records of all payroll transactions for future reference.

Who needs Trust Fund Payroll?

01

Employers who are required to withhold payroll taxes for employees.

02

Organizations that manage or contribute to employee trust funds.

03

Businesses that are subject to unemployment insurance and other payroll-related obligations.

04

Any entity that is responsible for reporting and remitting payroll taxes to government agencies.

Fill

form

: Try Risk Free

People Also Ask about

What are trust fund payments?

A trust fund is an estate planning tool that holds assets for a beneficiary, typically paying them an income for many years. Depending on how it's set up, a trust fund can help shield those assets from estate taxes and probate when you pass away.

Can you get monthly payments from a trust fund?

Setting up a trust fund is one of the best ways to ensure financial security for your loved ones. This is because a trust can reduce estate taxes, eliminate probate, make investment, and schedule monthly distributions to yourself or your loved ones.

What is an employee trust fund?

An employee trust fund is a form of long-term savings plan established as a job benefit. The best-known forms of employee trust fund are the stock ownership plan and the pension plan. Both the employer and the employee may contribute to an employee trust fund.

Do you have to report a trust fund to the IRS?

Yes, if the trust is a simple trust or complex trust, the trustee must file a tax return for the trust (IRS Form 1041) if the trust has any taxable income (gross income less deductions is greater than $0), or gross income of $600 or more.

How much money is typically in a trust fund?

While some may hold millions of dollars, based on data from the Federal Reserve, the median size of a trust fund is around $285,000. That's certainly not “set for life” money, but it can play a large role in helping families of all means transfer and protect wealth.

What is a payroll trust account?

In the context of payment and payroll, trusts can also be used to hold payroll funds to make sure they're properly disbursed, and that relevant taxes and fees are paid to the appropriate authorities.

How do trust fund payments work?

A grantor sets it up and funds it with money or assets. One or more beneficiaries receive the assets under specified terms. The trustee manages the trust and distributes its assets at a prescribed time. The trustee is in charge of managing the assets in an irrevocable trust while the grantor is still alive.

Why would someone use a trust fund?

Trust funds serve several purposes, such as ensuring assets are protected, distributed properly, and transferred smoothly. Most trusts are living trusts — trusts that are created and enacted during the grantor's lifetime — that designate how assets should be managed and distributed when the grantor dies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Trust Fund Payroll?

Trust Fund Payroll refers to the portion of payroll that is withheld from employees' wages for specific purposes, such as federal and state taxes. This money is held in trust until it is paid to the government.

Who is required to file Trust Fund Payroll?

Employers who withhold taxes from their employees' wages are required to file Trust Fund Payroll. This typically includes all businesses that have employees and are subject to federal and state tax regulations.

How to fill out Trust Fund Payroll?

To fill out Trust Fund Payroll, employers need to report wages paid to employees, the amount of tax withheld, and any other required information on the appropriate tax forms. This may include completing forms such as 941 or 944 depending on the business size and tax obligations.

What is the purpose of Trust Fund Payroll?

The purpose of Trust Fund Payroll is to ensure that taxes withheld from employees' wages are accurately reported and remitted to the appropriate tax authorities. This helps maintain compliance with tax laws and regulations.

What information must be reported on Trust Fund Payroll?

The information that must be reported on Trust Fund Payroll includes the total wages paid to employees, the amount of federal income tax withheld, Social Security and Medicare taxes withheld, and any additional state or local taxes that apply.

Fill out your trust fund payroll online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Trust Fund Payroll is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.