Get the free TUITION REMISSION APPLICATION FOR EMPLOYEES - fit

Show details

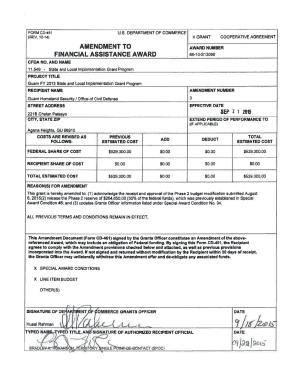

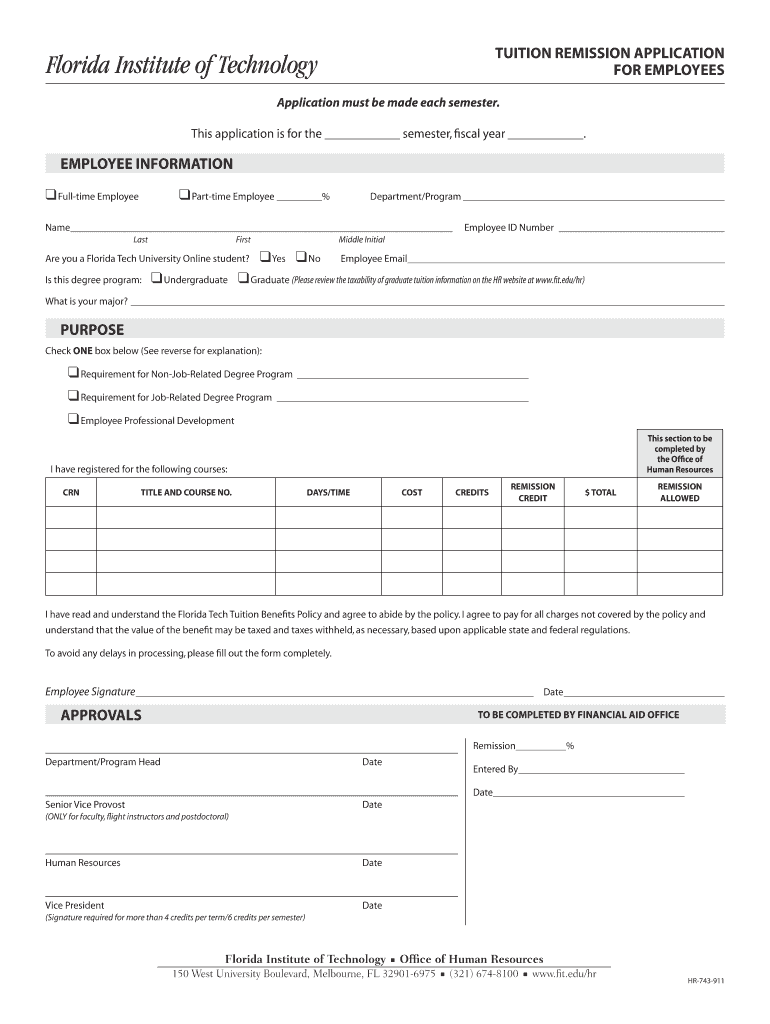

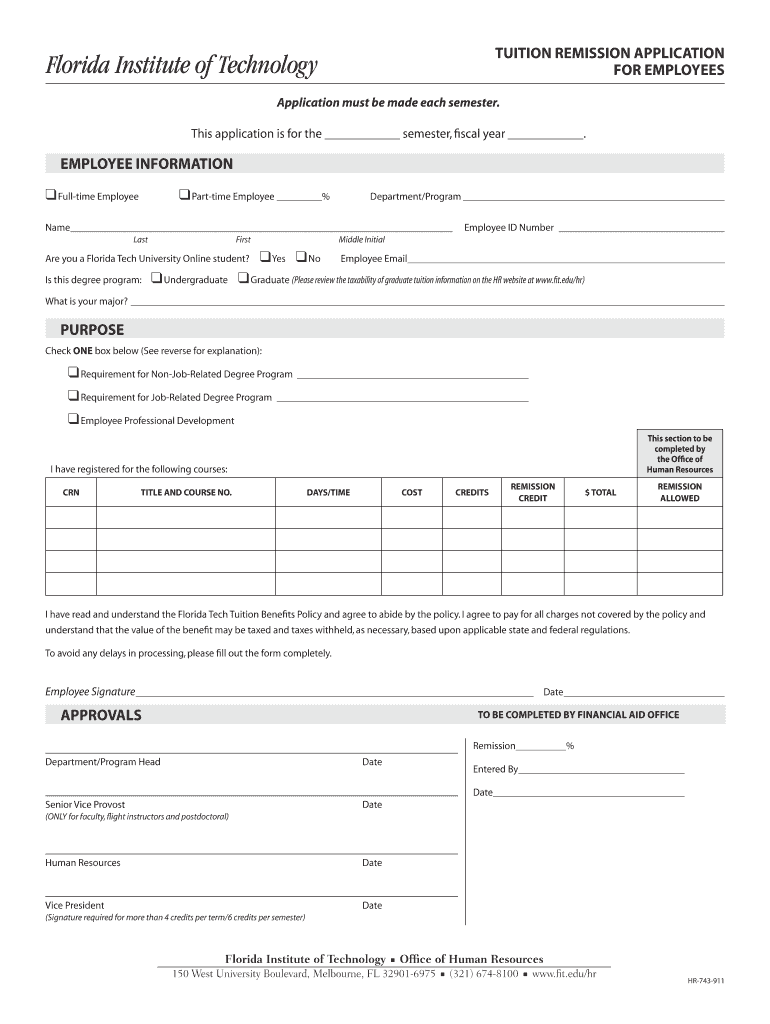

This document serves as an application for employees of Florida Tech seeking tuition remission for courses in either job-related or non-job-related degree programs, or for professional development.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tuition remission application for

Edit your tuition remission application for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tuition remission application for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tuition remission application for online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tuition remission application for. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tuition remission application for

How to fill out TUITION REMISSION APPLICATION FOR EMPLOYEES

01

Obtain the TUITION REMISSION APPLICATION FOR EMPLOYEES form from your HR department or the company's employee portal.

02

Read the instructions on the form carefully to understand the eligibility criteria and requirements.

03

Fill in your personal information, including your name, employee ID, and department.

04

Provide details about the course or program for which you are requesting tuition remission, including the course name, institution, and start date.

05

Attach any necessary documentation, such as proof of enrollment or acceptance into the program.

06

Review the form for any errors or missing information before submitting it.

07

Submit the completed application form to your supervisor or the designated HR representative by the specified deadline.

Who needs TUITION REMISSION APPLICATION FOR EMPLOYEES?

01

Employees who wish to further their education by taking courses or programs at an accredited institution.

02

Staff members seeking financial assistance for their tuition expenses through their employer's tuition remission benefit.

Fill

form

: Try Risk Free

People Also Ask about

How does tuition reimbursement work with an employer?

Tuition reimbursement (also known as tuition assistance) is an employee benefit through which an employer pays for a predetermined amount of continuing education credits or college coursework to be applied toward a degree.

How to reimburse employees for education expenses?

If you're wondering how it works, it's simple: You decide on the approved programs (or give your employees free rein). They pay their tuition at the beginning of the term. They stay with your company for the course duration. They submit their grades and receipts. You process the reimbursement through payroll.

What are the IRS rules on employer tuition reimbursement?

By law, tax-free benefits under an educational assistance program are limited to $5,250 per employee per year. Normally, assistance provided above that level is taxable as wages. For other requirements, see Publication 15-B, Employer's Tax Guide to Fringe Benefits.

How do I ask my employer for tuition assistance?

If you're wondering how it works, it's simple: You decide on the approved programs (or give your employees free rein). They pay their tuition at the beginning of the term. They stay with your company for the course duration. They submit their grades and receipts. You process the reimbursement through payroll.

How do you handle employee tuition reimbursement?

Employers may provide each employee with up to $5,250 of educational assistance per year on a tax-free basis. The tuition remission benefit that the University offers employees not covered by the above exclusion is eligible for this exclusion.

What is tuition remission for employees?

State Your Intent: Clearly state your desire to pursue a master's degree and why you believe it will benefit both you and the company. Request Tuition Support: Politely ask if the company would be willing to cover the costs, explaining how it aligns with the company's goals and your career development.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is TUITION REMISSION APPLICATION FOR EMPLOYEES?

The Tuition Remission Application for Employees is a formal request submitted by employees to receive tuition assistance or reimbursement for educational expenses incurred while pursuing further studies.

Who is required to file TUITION REMISSION APPLICATION FOR EMPLOYEES?

Employees who wish to receive tuition remission for their education are required to file the Tuition Remission Application, typically those enrolled in approved courses at eligible institutions.

How to fill out TUITION REMISSION APPLICATION FOR EMPLOYEES?

To fill out the Tuition Remission Application, employees need to complete the designated form, providing necessary details such as their personal information, course information, and proof of enrollment or tuition payment.

What is the purpose of TUITION REMISSION APPLICATION FOR EMPLOYEES?

The purpose of the Tuition Remission Application is to enable employees to apply for financial assistance from their employer for their education costs, thereby supporting their professional development and further learning.

What information must be reported on TUITION REMISSION APPLICATION FOR EMPLOYEES?

The information that must be reported includes the employee's name, employee ID, course details (such as course title and institution), amount of tuition being requested, and any required supporting documentation.

Fill out your tuition remission application for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tuition Remission Application For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.