Get the free CORPORATE DEFERMENT CONTRACT - fit

Show details

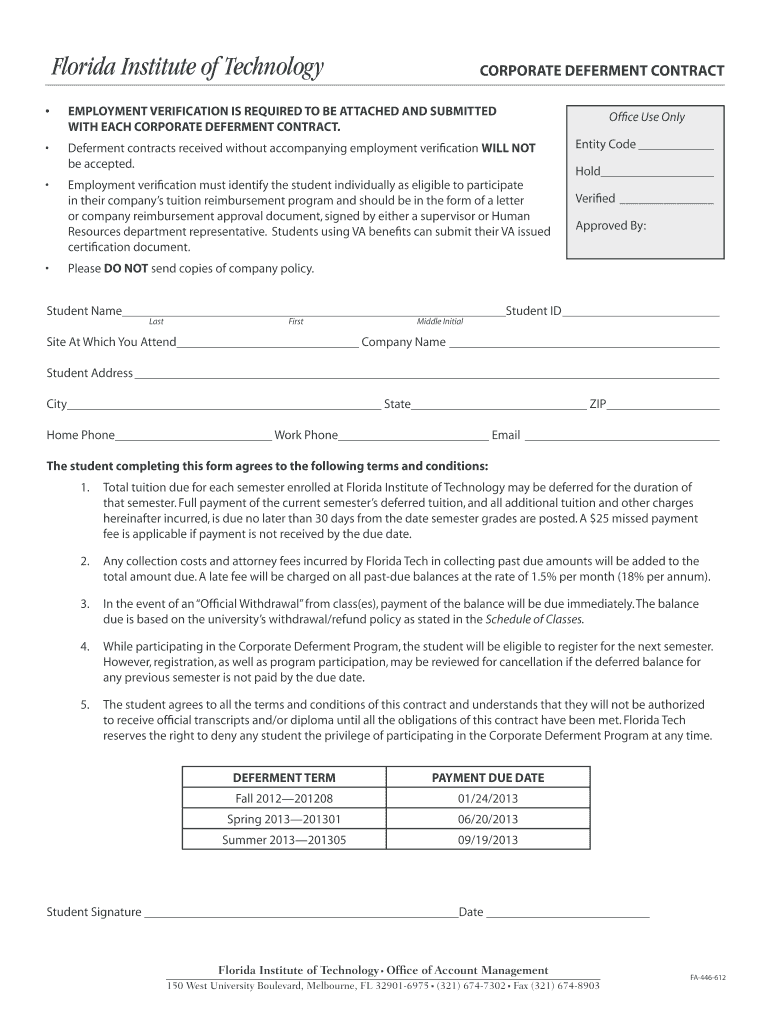

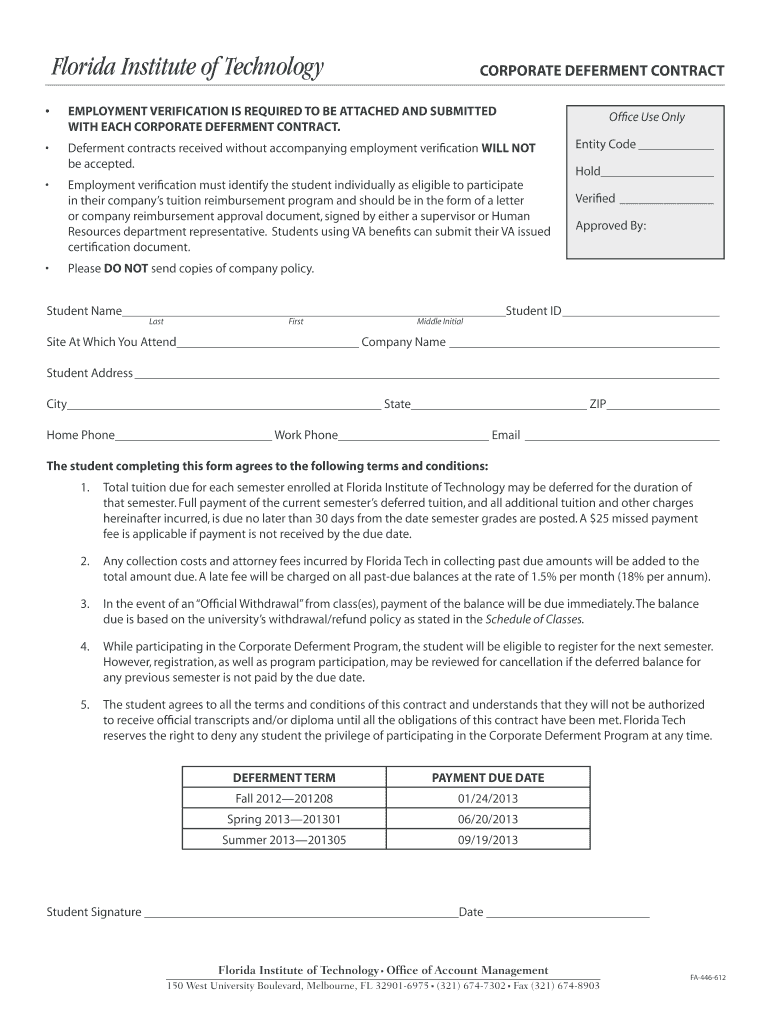

This contract allows students at Florida Institute of Technology to defer tuition payments while participating in a corporate tuition reimbursement program, contingent upon submission of valid employment

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign corporate deferment contract

Edit your corporate deferment contract form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your corporate deferment contract form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing corporate deferment contract online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit corporate deferment contract. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out corporate deferment contract

How to fill out CORPORATE DEFERMENT CONTRACT

01

Begin by obtaining the CORPORATE DEFERMENT CONTRACT document from the relevant authority or agency.

02

Read the guidelines and instructions provided in the contract carefully to understand the requirements.

03

Fill in your company name and registration details accurately in the designated sections.

04

Specify the reason for deferment and provide any required supporting documentation.

05

Complete the financial information section, including any payment history or current obligations.

06

Ensure all required signatures from authorized personnel are included at the end of the contract.

07

Review the completed contract for accuracy and completeness before submission.

08

Submit the signed contract to the designated agency or authority within the specified deadline.

Who needs CORPORATE DEFERMENT CONTRACT?

01

Corporations experiencing financial difficulties that need temporary relief from obligations.

02

Businesses that have unforeseen circumstances impacting their operations.

03

Companies seeking to manage cash flow more effectively during challenging economic conditions.

04

Entities that need structured guidance on legal deferment processes.

Fill

form

: Try Risk Free

People Also Ask about

What is an example of a deferred payment?

Disadvantages of a Deferred Payment Agreement Your care costs aren't written off – they're just delayed. The cost of your care will have to be repaid by you or your estate. As this is a loan, your agreed interest and charges are added to the cost of your care fees. Interest is usually applied on a compound basis.

Are deferred payments a good idea?

Disadvantages of Deferred Compensation Even if the company remains solid, your money is locked up, in many cases, until retirement, meaning that you cannot access it easily. Depending on the plan's structure, you also may find yourself with limited investment options.

What are the disadvantages of deferred payment?

Otherwise, for example, a debtor might try to select a standard of deferred payment of debt that is forecast to drop in value so the real value of his payment to the lender will be lower. The lender can avoid this by selecting a denomination of debt that is forecast to maintain its value.

What are the disadvantages of a deferred payment?

Deferred compensation in NHL contracts allows teams to reduce cap hits by paying players after their contract ends. Though this strategy offers cap advantages, it's rare due to the potentially minimal impact on cap savings and players' preference for immediate earnings.

What is the problem of deferred payment?

Deferring a payment may help alleviate financial pressure when you're in a pinch. And while the act of deferring payments alone won't hurt your credit, how you handle your credit account prior to and following deferment can impact your credit in the long run.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CORPORATE DEFERMENT CONTRACT?

A CORPORATE DEFERMENT CONTRACT is a legal agreement between a corporation and a governmental entity that allows the corporation to postpone certain tax obligations or regulatory requirements to a later date.

Who is required to file CORPORATE DEFERMENT CONTRACT?

Corporations that are eligible for tax deferment or other financial benefits under governmental policies are required to file a CORPORATE DEFERMENT CONTRACT.

How to fill out CORPORATE DEFERMENT CONTRACT?

To fill out a CORPORATE DEFERMENT CONTRACT, a corporation should provide its legal name, address, tax identification number, details of the tax obligations being deferred, the reason for the deferment, and any other required documentation as specified by the governing body.

What is the purpose of CORPORATE DEFERMENT CONTRACT?

The purpose of a CORPORATE DEFERMENT CONTRACT is to provide financial relief to corporations by allowing them to defer payment of taxes or fees, thus improving cash flow and giving them time to manage their finances more effectively.

What information must be reported on CORPORATE DEFERMENT CONTRACT?

The information that must be reported includes the corporation's identifying details, the specific taxes being deferred, the amount of the deferment, the duration of the deferment, and any relevant financial statements or supporting documentation.

Fill out your corporate deferment contract online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Corporate Deferment Contract is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.