Get the free Publication 598 - irs

Show details

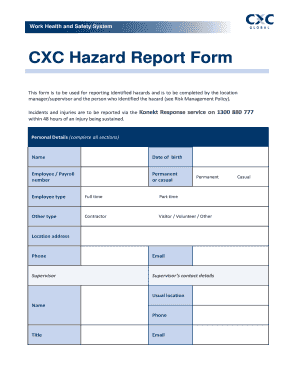

This publication covers the rules for the tax on unrelated business income of exempt organizations. It explains which organizations are subject to the tax, the requirements for filing a tax return,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign publication 598 - irs

Edit your publication 598 - irs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your publication 598 - irs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit publication 598 - irs online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit publication 598 - irs. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out publication 598 - irs

How to fill out Publication 598

01

Gather all necessary financial information for the tax year.

02

Start with the top section of Publication 598, filling in your organization's name and address.

03

Indicate the type of organization you are filing for (e.g., nonprofit, foreign organization).

04

Fill out Part I with details regarding your organization's exempt activities.

05

Complete Part II by reporting income and expenses related to your exempt purpose.

06

Ensure all accompanying documents, such as schedules and statements, are included.

07

Review all entries for accuracy before submission.

08

Submit the completed Publication 598 to the IRS according to the instructions provided.

Who needs Publication 598?

01

Organizations applying for or maintaining tax-exempt status under Section 501(c)(3) of the IRS code.

02

Nonprofits that receive unrelated business income and need to report it to the IRS.

03

Charitable organizations that must disclose their financial information to maintain transparency.

Fill

form

: Try Risk Free

People Also Ask about

What is publication 559 IRS?

Publication 559 is designed to help those in charge (personal representatives) of the property (estate) of an individual who has died (decedent). It shows them how to complete and file federal income tax returns and explains their responsibility to pay any taxes due on behalf of the decedent.

What is IRS publication 538?

This publication explains some of the rules for accounting periods and accounting methods. It is not intended as a guide to general business and tax accounting rules.

What is IRS Publication 3 known as?

About Publication 3, Armed Forces' Tax Guide.

What is the IRS 90% rule?

Generally, most taxpayers will avoid this penalty if they either owe less than $1,000 in tax after subtracting their withholding and refundable credits, or if they paid withholding and estimated tax of at least 90% of the tax for the current year or 100% of the tax shown on the return for the prior year, whichever is

What is publication 538?

This publication explains some of the rules for accounting periods and accounting methods. It is not intended as a guide to general business and tax accounting rules.

What is the IRS 7 year rule?

Keep records for 3 years from the date you filed your original return or 2 years from the date you paid the tax, whichever is later, if you file a claim for credit or refund after you file your return. Keep records for 7 years if you file a claim for a loss from worthless securities or bad debt deduction.

What is the purpose of the IRS publication?

IRS publications provide detailed guidance on tax issues, but not line-by-line instructions for filling out tax forms. Each publication is identified by a number and usually a name. Publications are regularly updated to keep up with changes in tax law.

What is the purpose of the IRS publication circular E?

Circular E is the Employer's Tax Guide published by the Internal Revenue Service (IRS). The publication provides guidance and instructions to employers about their federal tax responsibilities.

What are the best IRS publications?

Popular IRS publications include: Pub 1, Your Rights as a Taxpayer; Pub 15, Employer's Tax Guide; Pub 17, Your Federal Income Tax; and Pub 334, Tax Guide for Small Business.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Publication 598?

Publication 598 is a document provided by the IRS that outlines the rules and regulations for filing Form 990, which is used by tax-exempt organizations to provide information about their finances, operations, and compliance with federal requirements.

Who is required to file Publication 598?

Organizations that are tax-exempt under Section 501(c)(3) of the Internal Revenue Code and those that meet the filing thresholds set by the IRS are required to file Publication 598.

How to fill out Publication 598?

To fill out Publication 598, organizations must gather financial data, including income, expenses, assets, and liabilities. They should follow the instructions provided in the publication to accurately complete the form before submitting it to the IRS.

What is the purpose of Publication 598?

The purpose of Publication 598 is to provide guidance to tax-exempt organizations on how to comply with IRS filing requirements, ensuring they report their financial activities transparently and fulfill their legal obligations.

What information must be reported on Publication 598?

Publication 598 requires organizations to report information about their financial activities, governance, compliance with public support tests, and any significant changes or events that may affect their tax-exempt status.

Fill out your publication 598 - irs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Publication 598 - Irs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.