Get the free SPRING 2012 PAYMENT PLAN AGREEMENT FORM - govst

Show details

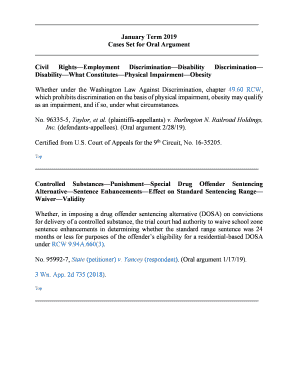

This document outlines the payment plan options for students at Governors State University regarding their semester balance, including due dates and installment percentages.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign spring 2012 payment plan

Edit your spring 2012 payment plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your spring 2012 payment plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit spring 2012 payment plan online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit spring 2012 payment plan. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out spring 2012 payment plan

How to fill out SPRING 2012 PAYMENT PLAN AGREEMENT FORM

01

Begin by downloading the SPRING 2012 PAYMENT PLAN AGREEMENT FORM from the appropriate website or office.

02

Fill in your personal information at the top of the form, including your name, student ID number, and contact information.

03

Specify the payment plan option you are choosing, ensuring you understand the terms and conditions associated with each option.

04

Indicate the total amount you will be paying and the payment schedule you are opting for.

05

Read through the agreement carefully to understand your responsibilities.

06

Sign and date the form at the bottom to acknowledge your agreement.

07

Submit the completed form to the designated office or email it to the appropriate contact.

Who needs SPRING 2012 PAYMENT PLAN AGREEMENT FORM?

01

Students who wish to manage their tuition payments over a period of time.

02

Individuals enrolled in classes for the Spring 2012 semester who do not want to pay their tuition in full upfront.

03

Students requiring financial assistance to manage their educational expenses.

Fill

form

: Try Risk Free

People Also Ask about

Will the IRS keep my refund if I have an installment agreement?

If the IRS approves an installment agreement, it will generally keep any tax refunds and apply them to your debt. If the IRS agrees to an installment agreement, it may still file a Notice of Federal Tax Lien.

How do I qualify for an IRS installment agreement?

Payment options include full payment or a long-term payment plan (installment agreement) (paying monthly). You may qualify to apply online, if: Long-term payment plan (installment agreement): You have filed all required returns and owe $25,000 or less in combined tax, penalties, and interest.

What is the IRS payment agreement form?

Use Form 9465 to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you).

How to write a written agreement for payment?

You can create a simple payment contract with these steps: Look for examples of payment agreement contracts online. Format your document. Write your title. Outline the parties involved in the agreement. Clearly write out the terms of the loan. Explain that the contract represents the entire agreement.

What is the IRS payment plan agreement form?

Use Form 9465 to request a monthly installment agreement (payment plan) if you can't pay the full amount you owe shown on your tax return (or on a notice we sent you). Most installment agreements meet our streamlined installment agreement criteria. See Streamlined installment agreement, later, for more information.

Is an IRS installment agreement worth it?

An installment plan allows you to pay your taxes over time while avoiding garnishments, levies or other collection actions. You'll still owe penalties and interest for paying your taxes late, but it can help make the payments more affordable.

What is the form for the monthly payment plan?

How can we help? Use IRS Form 9465 Installment Agreement Request to request a monthly installment plan if you can't pay your full tax due amount. The IRS encourages you to pay a portion of the amount you owe and then request an installment for the remaining balance.

How do I write a payment plan agreement?

A Payment Plan Agreement should include the following details: Names and contact information of both the creditor and debtor. Description of the debt being repaid. Total amount owed. Payment schedule, including due dates and amounts. Interest rate (if applicable) Consequences of late or missed payments.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is SPRING 2012 PAYMENT PLAN AGREEMENT FORM?

The SPRING 2012 PAYMENT PLAN AGREEMENT FORM is a document that outlines the terms and conditions of a payment plan available for expenses incurred during the Spring 2012 term, allowing individuals to manage their financial obligations effectively.

Who is required to file SPRING 2012 PAYMENT PLAN AGREEMENT FORM?

Students or individuals who wish to enter into a payment plan for their tuition or related fees for the Spring 2012 term are required to file the SPRING 2012 PAYMENT PLAN AGREEMENT FORM.

How to fill out SPRING 2012 PAYMENT PLAN AGREEMENT FORM?

To fill out the SPRING 2012 PAYMENT PLAN AGREEMENT FORM, individuals need to provide their personal information, including name, student ID, contact information, details of the payment plan options chosen, and any supporting documentation as specified in the form instructions.

What is the purpose of SPRING 2012 PAYMENT PLAN AGREEMENT FORM?

The purpose of the SPRING 2012 PAYMENT PLAN AGREEMENT FORM is to facilitate a structured payment arrangement that allows students to pay their tuition and fees for the Spring 2012 term over a specified period, thereby easing financial burdens.

What information must be reported on SPRING 2012 PAYMENT PLAN AGREEMENT FORM?

The SPRING 2012 PAYMENT PLAN AGREEMENT FORM must report information such as the individual's name, student ID, contact details, total amount due, payment plan option selected, payment schedule, and any additional terms and conditions related to the agreement.

Fill out your spring 2012 payment plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Spring 2012 Payment Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.