Get the free kansas kw 3 - ksrevenue

Show details

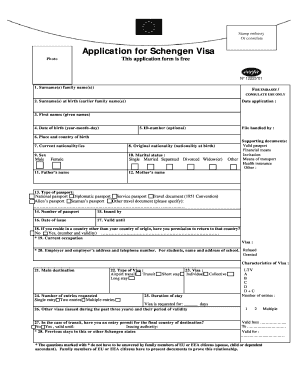

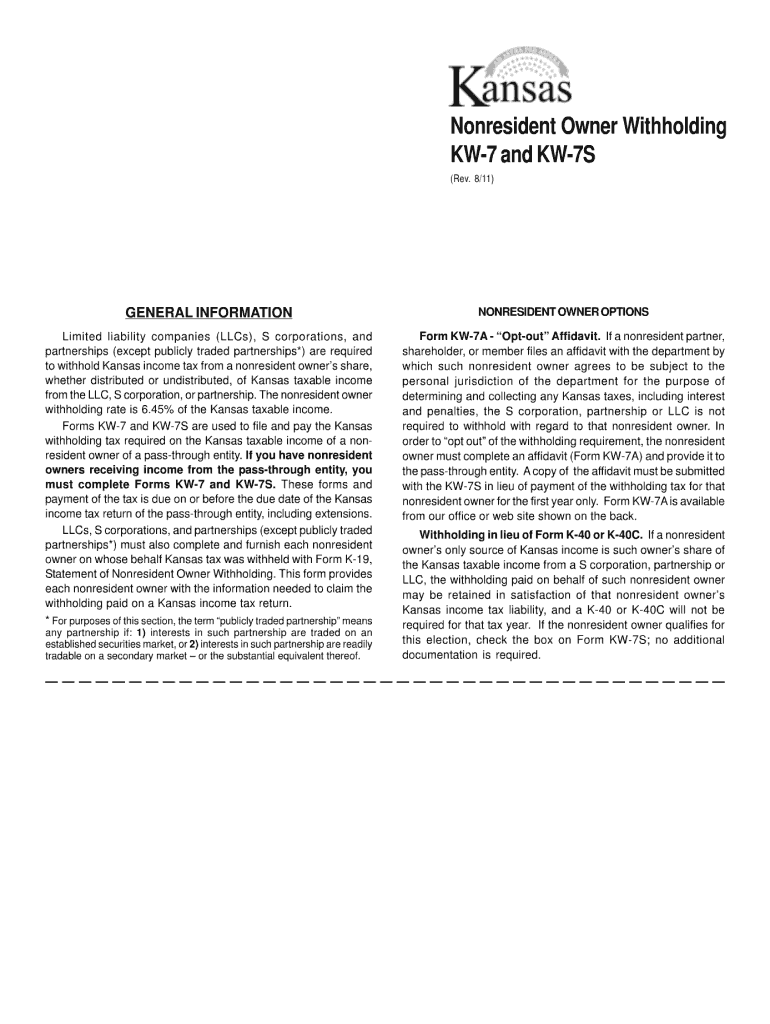

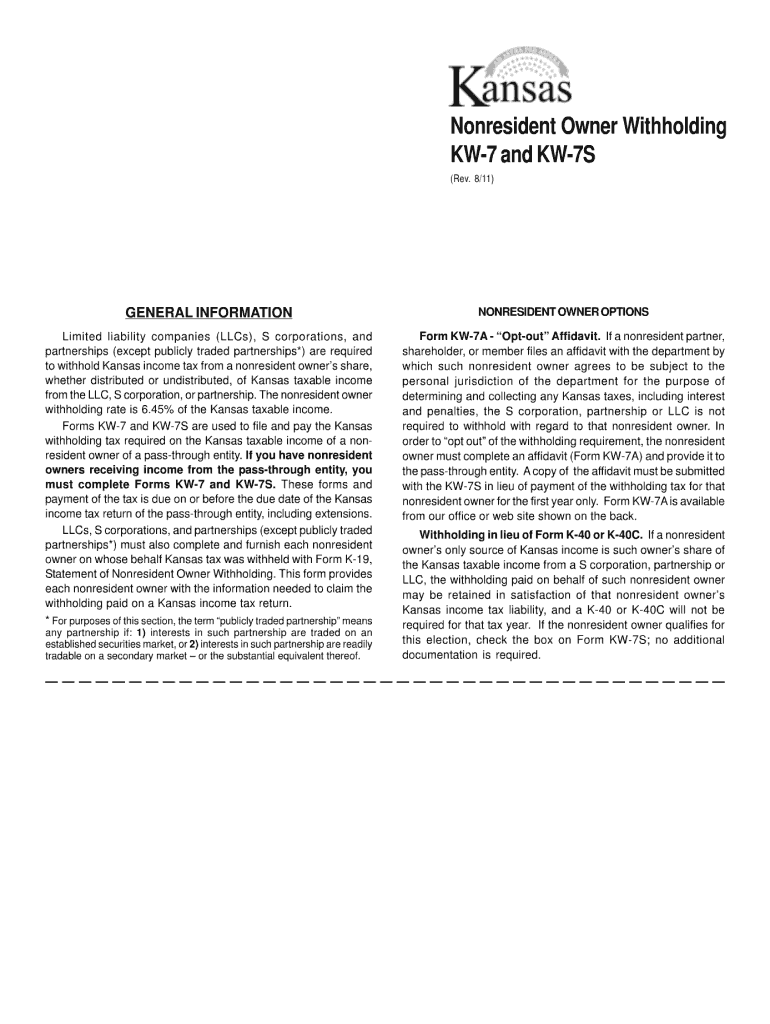

Nonresident Owner Withholding KW-7 and KW-7S (Rev. 8/11) GENERAL INFORMATION Limited liability companies (LCS), S corporations, and partnerships (except publicly traded partnerships*) are required

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign kansas kw 3

Edit your kansas kw 3 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your kansas kw 3 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit kansas kw 3 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit kansas kw 3. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out kansas kw 3

How to fill out Kansas kw 3:

01

Obtain the Kansas kw 3 form from the appropriate government agency or website.

02

Read the instructions carefully to understand the information required and any specific guidelines for filling out the form.

03

Provide your personal information accurately, including your name, address, social security number, and other requested details.

04

Complete the sections related to your income, deductions, and tax liability according to the provided instructions.

05

Double-check all the information filled in to ensure it is correct and accurate.

06

Sign and date the form where required.

07

Submit the filled-out Kansas kw 3 form to the designated authority by the specified deadline.

Who needs Kansas kw 3:

01

Individuals who are Kansas residents and earned income during the tax year.

02

Anyone who has a Kansas income tax liability or is eligible for a refund from Kansas state taxes.

03

Self-employed individuals, freelancers, and independent contractors who need to report their income and deductions to the Kansas state tax authorities.

Instructions and Help about kansas kw 3

Fill

form

: Try Risk Free

People Also Ask about

What is the state income tax withholding in Kansas?

State withholding is the money an employer withholds from each employee's wages to help pre-pay the state income tax of the employee. An employer must withhold Kansas tax if the employee is a resident of Kansas, performing services inside or outside of Kansas, or a nonresident of Kansas, performing services in Kansas.

Who is exempt from Kansas withholding?

To qualify for exempt status you must verify with the Department of Revenue that: 1) last year you had the right to a refund of all State taxes withheld because you had no tax liability; or, 2) this year you will receive a full refund of all State income tax withheld because you will have no tax liability.

What percentage of my paycheck should be withheld?

Key Takeaways. Employers should withhold half (7.65%) of the 15.3% owed in FICA (Social Security and Medicare) taxes from an employee's gross pay. FICA taxes come in addition to regular federal income taxes, which change depending on your income level. There are seven tax brackets in 2022 and 2023: 12%.

How do I show proof of Kansas withholding?

A completed withholding allowance certificate will let your employer know how much Kansas income tax should be withheld from your pay on income you earn from Kansas sources. Kansas Form K-4 to their employer on or before the date of employment.

What is a kw 3 form?

Annual Withholding Tax Return (KW-3), by the last day of January of the year following the taxable year. Form KW-3 must accompany. the Wage and Tax Statements (W-2) and/or any federal 1099 forms that have Kansas withholding. ( 1099s without. Kansas withholding should be mailed to the Department using federal Form 1096.

How much Kansas tax should be withheld from my paycheck?

Overview of Kansas Taxes Income tax rates in Kansas are 3.10%, 5.25% and 5.70%. There are no local income taxes on wages in the state, though if you have income from other sources, like interest or dividends, you might incur taxes at the local level.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute kansas kw 3 online?

pdfFiller has made it easy to fill out and sign kansas kw 3. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I create an eSignature for the kansas kw 3 in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your kansas kw 3 and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I complete kansas kw 3 on an Android device?

Complete your kansas kw 3 and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is kansas kw 3?

Kansas KW 3 is a form used by employers in Kansas to report their quarterly wage and tax information.

Who is required to file kansas kw 3?

All employers in Kansas who have employees earning wages subject to state unemployment insurance tax are required to file Kansas KW 3.

How to fill out kansas kw 3?

Kansas KW 3 can be filled out online or manually. Employers need to provide information such as their business details, total wages paid, and tax withholdings for the quarter.

What is the purpose of kansas kw 3?

The purpose of Kansas KW 3 is to report employer wage and tax information for each quarter, including the amount of taxable wages subject to state unemployment insurance tax.

What information must be reported on kansas kw 3?

Employers need to report their business details, including the name, address, and identification number. They also need to report the total wages paid, tax withholdings, and other relevant wage and tax information.

Fill out your kansas kw 3 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Kansas Kw 3 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.